Kuwait leads offshore drilling successes in 2024

By Jeremy Beckman, Editor-Europe

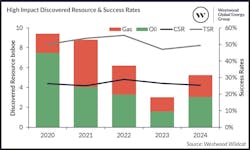

Seventy-five high-impact exploration wells were completed globally last year, according to Westwood Global Energy Group, with 19 of the wells delivering potentially commercial discoveries.

Reserves added totalled 5.2 Bboe.

Speaking at the company’s recent State of Exploration 2025 webinar, Andrew Jackson, senior analyst at Westwood, said the largest offshore find was Kuwait Oil’s Al-Nokhata, east of the island of Failaka, containing an estimated 1.5 Bboe.

Kuwait Oil made a further offshore oil discovery in the Al-Julaiah prospect.

Other standout discoveries last year included Petronas’ Fuseaia in the Upper Cretaceous offshore Suriname. Petronas is looking to drill more wells in the area later this year to prove up further reserves for a development.

TotalEnergies opened a new exploration play at Dalia Deep on the Dalia Field offshore Angola, Jackson added, while Eni and Repsol found 300 MMboe to 400 MMboe drilling the Yopaat prospect in a mature Miocene play in the Sureste Basin offshore Mexico.

Elsewhere, CNOOC had multiple successes around the Huizhou area of the eastern China Sea, a run which continued this March with the Huizhou 19-6 oilfield discovery in the deeper Paleogene Enoing and Wenchang formations. In the Andaman Sea off Indonesia, Mubadala drilled the Tangkulo discovery in the emerging Oligocene play.

Offshore northwest Europe, results were more modest, with the largest find in 2024 being DNV’s 40-MMbbl Palaeocene Falstaff.

There were disappointments with the remaining 56 high-impact wells drilled, notably in the deepwater outboard offshore Guyana and Brazil, Jackson said.

The offshore Suriname-Guyana basin appears to be running out of steam, with only 400 MMbbl additional reserves proven last year. This is partly down due to reduced exploration drilling in the Upper Cretaceous offshore Guyana, a play which may have reached maturity.

Different geologies and the impacts of M&A

Since 2010, Jackson added, 43 new oil plays had been discovered globally, but only 11 of these were more than 1 Bboe in scale. Until recently, it looked like the deepwater Orange Basin offshore Namibia might not compete with the Suriname-Guyana basin due to questions concerning commerciality of Shell’s discoveries in PEL 39.

That may change with the industry now targeting different geological settings offshore Namibia to open new plays.

Jamie Collard, research manager global E&A at Westwood, said NOCs dominated high-impact drilling last year, in large part due to having access to areas that are not opened to others. CNOOC was the most active NOC, participating in 45 wells.

Of the majors, Shell and Exxon Mobil were the most active high-impact drillers. Shell tested the most plays (32) in different geologies. Geographically, TotalEnergies led the way drilling high-impact wells in 19 countries.

It should also be noted, Collard said, that the number of companies participating in high-impact exploration has dropped by half since 2014—mainly because the industry itself has halved in size over the same period following mergers or acquisitions.

2025 year-to-date activity

Gareth Hector, group head of marketing at Westwood, said the 32 high-impact exploration wells drilled so far in 2025 had yielded 1.5 Bboe from eight potentially commercial discoveries.

Among the standouts have been Galp’s three ultradeepwater finds around the Mopane area in the Orange Basin, followed soon afterward by Rhino Resources’ light oil Capricornus 1-X discovery in Block 2914 in the Lower Cretaceous in the same basin.

TPAO has proven an extension of the deepwater Sakarya gas play in the Black Sea offshore Turkey with its 75-Bcm Göktepe discovery, which it could develop via the floating production platform lined up for the next phase of development at Sakarya. And Petrobras found oil in a large presalt structure on the Aram Block in the Santos Basin offshore Brazil.

Early in the year, Murphy made a promising oil find with its Hai Su Vang-1X exploration well in the Cuu Long Basin offshore Vietnam. And bp discovered oil in the Far South prospect in the Miocene salt play, a potential subsea tieback to nearby infrastructure (the Constellation Field is 4 km away).

Looking ahead

Hector said he expected 70 to 80 high-impact wells to be completed by the end of this year, with Africa and South America likely to be the busiest regions.

Outside the Atlantic Margin, he added, key wells to watch include OMV’s Vinekh-1 in Block 122 in the Bulgarina sector of the Black Sea, and TotalEnergies/Petronas’ deepwater Mailu well offshore Papua New Guinea.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.