Write-down of Maria reserves an appraisal issue, consultant claims

Offshore staff

LONDON – Wintershall DEA’s Maria field in the Norwegian Sea has undergone a 71% downward revision to the 207 MMboe of reserves estimated at sanction following underperformance, according to consultant Westwood Energy.

The field came onstream a year ahead of schedule and close to $370 million under budget, but 50% of the $1.5 billion capital cost of the project has had to be written off so far, said Westwood analyst Joe Killen.

Benchmarking has revealed that Maria was under-appraised relative to its peers before the partners selected their development concept, and this is not an isolated case for projects offshore Norway, Killen added.

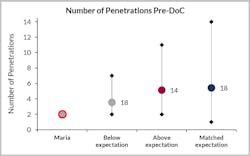

Appraisal analogue benchmarking using Westwood’s wildcat appraisal project database indicated that prior to the declaration of commerciality (DoC), the reservoir had an anomalously low number of penetrations, and this increased the likelihood of underperformance.

During production, unanticipated reservoir complexity resulted in a lack of connectivity between producers and injectors, and this appears to be the cause of the underperformance. The same issue was recognized in similar reservoirs in an adjacent field prior to the field investment decision, Killen claimed.

Analysis of Maria and nine further fields starting production shows that eight are non-performing, while four aside from Maria have all undergone downward reserves revisions of >50%.

Some companies appear to be taking these lessons onboard. Spirit Energy, which has a 20% stake in Maria, has reportedly delayed submitting a development plan for the Fogelberg discovery due to concerns over reservoir complexity.

05/10/2019