Evolving business models, concepts will drive offshore recovery

J. David Anderson, PE, CFA •Mick Pickup, PhD

Barclays

The market downturn of the past two years has had a profound impact across all aspects of the oilfield services and equipment sector, but the deepest and longest lasting impact will ultimately be felt offshore. The decline in onshore US activity was most severe, but that market is also the most cyclical, having been through this as recently as 2009. On the other hand, offshore development had never really seen a downturn since the deepwater era began in 2006; the industry was building capacity non-stop in rigs, subsea equipment, and vessels until peaking in 2014. Since then, the offshore industry has been in freefall. While the North American and Eastern Hemisphere land markets have turned the corner, the Barclays 2017 E&P Spending Survey shows offshore spending down another 20-25% this year as international oil companies (IOC), continue to withhold spending. However, with recent IOC data points showing a number of offshore projects now economic at levels below $50/bbl, Barclays is increasingly optimistic for an offshore rebound in 2018.

This downturn has been extremely painful for the offshore industry, but ultimately, it will prove to be cathartic with leaner cost structures, flatter organizations, and more efficient designs that will structurally lower the cost of development. Three prevailing themes dominate Barclays’ thoughts of a recovery.

The first is a movement toward smaller projects, and a smaller pie as well. A reduction in workforces and asset bases is leading to a smaller, nimbler industry. The recent Wood Mackenzie survey shows 128 subsea tree orders in 2017 versus 83 in 2016, of which 42 are expected to be one- to five-tree awards. This is a far cry from the 550 peak in 2013. Though it is possible to see some larger awards (i.e. 10 or more subsea tree projects) in 2H 17, Barclays believes the era of mega-projects is over, as operators are now considering more phased-in developments to capture first oil earlier and minimize project risk.

Secondly, customers are increasingly focused on speed to market. Regardless of whether or not the next cycle is defined by shorter cycles that leave oil prices range-bound between around $50 and $70/bbl or by the emergence of a material global oil supply gap which sends oil prices skyrocketing, operators see speed to market as crucial to making decisions, requiring standardization of equipment, modular designs, and integrated packages for equipment and installation. A great deal of progress has been made on this front over the past several years as lead times on subsea packages have fallen from 24 months down to 12-16 months, in concert with a remarkable reduction of around 50% in subsea systems costs.

Finally, offshore development costs are now structurally lower, with many projects now effectively competing with shale. To cite some examples of this, the Johan Sverdrup development offshore Norway is being quoted at $26/bbl breakeven; Royal Dutch Shell recently stated that its deepwater portfolio is now breakeven in the range of $35-45/bbl (vs. $60-70/bbl in 2014); and the total estimated cost of BP’s Mad Dog Phase 2 development in the Gulf of Mexico has been revised down by more than 50% from $20 billion to $9 billion.

Barclays thinks about offshore development costs in four roughly equal quadrants (of course, every project is different) comprised of offshore rig costs; spread costs (or other services including materials, labor, etc.); subsea costs; and FPSO costs, with three of the four likely to be structurally lower in the coming cycle - with spread costs being the exception. Offshore rig costs have declined precipitously and will likely remain at breakeven levels for rig contractors for at least the next several years (we forecast a contracted floater rig count of 120 at YE 2017 vs. industry capacity of around 320); FPSOs are becoming more standardized and modular; industry subsea tree capacity is more than 800 trees (even higher when factoring in shorter cycle times).

New models

A crisis can create opportunities for those who adapt. Downturns have historically led to a change in the corporate landscape of the oil service industry, either through distressed situations or amalgamation. European service investors recall the seismic shifts that occurred at the start of the last decade following the 1998 downturn, when the subsea construction companies seen today were formed through a series of acquisitions. Already this downturn has led to the creation of OneSubsea, the merger of Technip and FMC Technologies, and the announced combination of GE Oil & Gas and Baker Hughes, each with a unique approach to navigating the coming upcycle. The announced mergers sit on top of a series of alliances (Saipem/Aker Solutions; Baker Hughes/Aker Solutions; OneSubsea/Subsea 7/Helix) with the current landscape jostling for position at the start line, almost trying the influence the direction of travel. For now, there is no clear answer as to which model will win out: Each offer savings and unique benefits, however, the answer could very well be the commercial models that offer the greatest flexibility to allow whatever the client feels is necessary.

TechnipFMC.A result of the recent merger between Technip and FMC Technologies, combining the premier players in subsea equipment, SURF, and topsides engineering. The TechnipFMC offering focuses on the wellhead-to-topside portion of an offshore development. Overall project costs can be lowered by as much as 30% through standardization of equipment, connections, and installation. Services is FMC’s fastest growing business, which is just starting to ramp up as the industry’s largest installed base (2,500 trees) goes through the intervention/workover phase.

OneSubsea.Schlumberger’s acquisition of Cameron International married a leading subsea equipment supplier with Schlumberger’s unmatched reservoir expertise and technology pedigree to create what is called a pore-to-process approach. This wellhead-to-subsurface focus has a greater emphasis on increasing reservoir recovery (and hence project net present value, or NPV) by using SLB’s reservoir and well construction knowledge to optimize well placement and design with the subsea infrastructure. OneSubsea views tiebacks and brownfield as the biggest near- to medium-term opportunity, well positioned with the largest installed base of subsea pumps, new intervention technology, and an alliance with Helix.

GE Oil & Gas/Baker Hughes.It is no longer just a two-horse race between TechnipFMC and OneSubsea with the new Baker Hughes as a wildcard. Baker’s drilling and reservoir expertise will build on GE’s broader view of offshore that extends into pipelines, power systems, and turbomachinery. Overall, the new Baker Hughes offshore offering feels closer to OneSubsea than TechnipFMC, though we would expect a greater focus on projects that extend toward midstream and downstream based on product mix.

Halliburton.Halliburton has not traditionally been a player in subsea, but is evolving into more of a solutions provider across the various offshore phases. In drilling, new automated cementing skids take people off the rig, and cementing technologies reduce time to drill. In completions, the ESTMZ multi-zone packer tool is now well proven, with Chevron citing an 18-day improvement in rig time on the first five wells of a recent project. In subsea, Halliburton actuator technology appears to be a final piece to electric subsea trees.

National Oilwell Varco.NOV has a number of products and solutions to cut down the time to first oil, through both enhanced reservoir recovery and early production facilities, such as the HoneyBee FPSO concept. This is designed to be a “bridge” solution for longer-term offshore production facilities, allowing operators to bring on production a year or two earlier from a larger field, or it could be used to produce a series of marginal fields.

SBM Offshore.As one of the largest lessors of FPSOs, SBM Offshore management has noted for years that the biggest impact on NPV in oil projects is delays to start-up. With its new Fast4Ward design, SBM Offshore can reduce the delivery time of an FPSO by six-12 months from the typical schedule of around 40 months. Indeed, SBM Offshore is already in the process of selecting yards to ensure that it has a head start on the basic components of new units as and when they are required.

The offshore cost curve is moving structurally lower. The two-year duration of the downturn resulted in a massive unwind of oilfield service inflation that has meaningfully reduced the cost to drill and complete wells. But while Barclays expects the majority of an estimated 40% reduction in onshore US well costs to return from service pricing, supply chain inflation, and inverse high-grading, offshore is a different story. A combination of an acceptance of standardization, technological leaps in flow assurance, untapped offshore intervention, and phased-in developments has structurally lowered the offshore cost curve.

Standardization is real

An ongoing theme among equipment suppliers during the downturn, standardization is viewed as the key enabler in bringing down development costs and getting projects to final investment decision. Without a doubt, standardization reduces costs and cuts project complexity along with reducing manufacture time and improving safety. Perhaps the best analogy is buying a new car where the base model is pre-defined and pre-engineered but the buyer can select which options are wanted, and how much more it will cost.

Subsea trees.Perhaps the most obvious example, subsea trees were ground zero for the offshore standardization movement, which can now be delivered in 10 months from 24 months previously, and now at 50% of the cost. TechnipFMC noted that new orders (though there are not many) have all the bells and whistles removed and many are now “off the shelf.” Schlumberger is taking this a step further with its HyFleX Subsea Tree System, combining the benefits of a vertical tree (flexibility allows for easier intervention) at the cost of a horizontal tree (typically 30-40% less than a vertical).

Standardized fittings and connections.A logical extension of the equipment and E&C mergers and alliances is to standardize all the connections between subsea infrastructure, flowlines, and SURF equipment, in fact, it was a core rationale behind the FMC Technologies/Technip merger.

FPSO standardization.One of the biggest sources of cost overrun and delays has been the construction and delivery of the FPSO. Going forward, FPSO hulls will be standard - after all, it is only a moored workspace and storage unit. The key is to introduce standardization in topsides processing, which has typically been a bespoke design using the specific characteristics of a field, but could be better addressed through modular equipment. In SBM Offshore’s Fast4ward design, it offers a standardized hull combined with topsides modules which can be chosen from a catalogue.

Metallurgic standardization.Standardizing equipment across an operator is one thing, but to standardize across multiple operators is another challenge. Safety tolerances narrowed and specifications increased, particularly in metallurgy, where operators typically have unique, specific guidelines. TechnipFMC is trying to solve this in its 20,000 psi workgroup consortium, which includes Anadarko, BP, ConocoPhillips, and Shell, which have agreed on a standard metallurgy (albeit a very high standard). Nevertheless, it is a step in the right direction.

Flow assurance

In order to increase an operator’s project NPV, the re-use of existing infrastructure represents a cost efficient method to bringing on new supplies. These tiebacks typically involve a small number of trees and a flowline to existing infrastructure and have a time-to-market considerably shorter than a greenfield project. TechnipFMC believes the entire subsea tieback can be standardized, leading to a 50% reduction in delivery times. The success (or limitation) on subsea tiebacks have often been the ability to move hydrocarbons in the deepwater, both out of the reservoir and back to infrastructure, more broadly known as flow assurance.

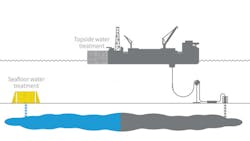

Successful tiebacks are all about flow assurance, which has long been a challenge in deepwater. Fluid streams leave the wellbore at elevated temperatures and are subjected to rapid cooling in the flowline. As such the higher molecular weight components of crude can start to crash out and hydrates can form to restrict flow with trenching, electrical trace heating, chemical injection and insulation all used to ensure flow. But the biggest need for operators has been the ability to bring more energy to the subsea system to not only move hydrocarbons over longer distances, but to extract more out of the reservoir itself. As the distance of tiebacks to existing infrastructure gets longer, more energy needs to be added to the system by way of boosting (for oil) or compression for gas by removing back pressure on the reservoir and enabling higher flow rates.

Subsea boosting.The concept of subsea boosting is to use pumps to relieve the backpressure on reservoirs, allowing flow to be maintained (or increased) as the reservoir pressure declines over time. Put another way, in order to produce, reservoir pressure needs to overcome the weight of the column of fluids in the well (oil, gas, water), which can be more than 30,000 ft deep. By using pumps to alleviate this backpressure, the reservoir has less force to overcome and can produce more at a lower reservoir pressure. OneSubsea is the dominant market leader in subsea boosting, with an installed base of over 90 Framo units installed across 30 offshore projects. Each system is unique and was generally in the $250-300 million total project cost range, many of which relying on multi-phase systems to accommodate a wider range of flow variables (light oil, heavy oil, gas, water). OneSubsea’s newer systems are designed as lower cost alternatives to enable better tieback economics using single pump systems, reducing the project cost down to around $100 million with Subsea 7 as its installation partner. TechnipFMC now has a toehold in this highly underutilized market for boosting technology having recently commercialized its pump, winning two awards in early 2016.

Seawater injection systems.Instead of “pulling” oil out of a reservoir, a new take on an old concept is to increase recovery by “pushing” on the reservoir by injecting seawater. After drilling injection wells along the perimeter of an offshore field, self-contained units installed to pump seawater into the injection wells allow operators to “sweep out” the hydrocarbons in a reservoir with monitoring through process and control systems. The Seabox concept is one of several forays by National Oilwell Varco into the subsea market (first prototype to be installed in 2017), offering which also include subsea storage for processed water, tiein structures, and a more robust SURF offering.

Electric subsea systems.Although the base technology has been around since 2008, electric trees have never gained traction since being used in a Dutch North Sea pilot program for Total, but momentum has picked up again following a technological breakthrough. OneSubsea (Cameron) has been at the forefront of designing electric subsea systems, but it was Halliburton’s electrical safety actuation valve that appears to be the final piece to creating a reliable system.

Subsea compression.The Gullfaks field in the Norwegian North Sea (Statoil) represents a technological leap forward in increasing gas recovery rates. Similar to boosting on oil fields, compression adds energy to the wellstream when reservoir pressure falls below a critical level. Using wet gas compression technology designed and built by OneSubsea, production has increased between 40-100% with Statoil estimating the recovery rate of the reservoir will increase from 62% to 74%.

Intervention potential

Currently, there are approximately 7,000 subsea trees installed globally, yet only a fraction have been worked over in the past decade. With intervention requiring a deepwater rig, the economics simply did not make sense as day rates skyrocketed during the 2007-2014 deepwater boom. According to TechnipFMC, offshore wells typically require a workover on average every seven years, which would imply an inventory of approximately 3,000 trees based on that math.

The fastest growing business within TechnipFMC is Offshore Services, where the company is adding layers of revenue streams driven primary by intervention. Services is more than just installation work on orders as the mix is quickly shifting toward intervention work with a focus on recurring revenue streams. The company has the largest installed base of subsea trees, with 2,300 trees globally. The subsea tree itself is designed for the life of the field and failure is extremely rare, but every well needs to be worked over at some point and when it is intervened, the tree is brought in for maintenance.

Another service revenue stream TechnipFMC is targeting is an Open Water Intervention Riser System (OWIRS), which is a large, complex pressure control device that is placed on the wellhead once the subsea tree is removed, considered one of the most cost effective ways to enter a well for light workovers. Once the OWIRS is lowered to the seabed by a rig or vessel, coiled tubing or wireline is run through the unit, controlled by an intervention workover control system (IWOCS). Historically, the OWIRS system has been owned and maintained by the operator, with about 30 units believed to be in the market, and TechnipFMC is operating several of these units for customers. But the bigger opportunity is for the company to take this off the hands of the majors, put it on its balance sheet, and then perform the work on service contracts.

In 2015, a Subsea Services Alliance between OneSubsea and Helix was formed to develop technologies and deliver services to optimize the cost and efficiency of subsea well intervention systems, which is now starting to bear fruit. Not only is Helix the only other service company with an OWIRS unit, but equipment has been designed to be utilized by vessels, not rigs, including a new piece of equipment called a Riserless Open-water Abandonment Module (ROAM) that is currently being developed. The ROAM system is designed to support open water well abandonment operations, providing well control from a well intervention vessel that allows tubing to be pulled safely from a well at a substantially lower cost than rig-based solutions. This technology is targeting a large, untapped market with an inventory of as many as 1,600 wells globally for plugging and abandonment.

Phased developments

One of the bigger industry shifts is the desire from oil companies to get to early first oil, not early full capacity on new developments. Perhaps the Mad Dog Phase 2 project is the ultimate example, once designed to be future proof and now, on its fourth iteration, likely to be built for a phase one development with the potential to tie-in future phases. As such first oil is quickened, NPV’s are improved and future expansions are set should they be required. With a more standardized and adapted approach to developments, many aspects will become more modular.

National Oilwell Varco’s HoneyBee FPSO concept is aimed at smaller marginal fields (stranded assets) that can be used in multiple deployments or to achieve early production on larger developments. NOV is the lead of an industrial alliance with GE Oil & Gas to build smaller FPSOs with a capacity of 20-40,000 b/d with processing capability in a plug-and-play modular design that can be customized depending on the parameters of the field. Between NOV, GE, and Fjords (NOV’s recent acquisition), this alliance can provide the entire topsides kit. While the overall cost was not disclosed, the concept is to approach the operator with a design that is 70% standardized (hulls are 25% cheaper to build), topsides processing for as little as 30-60% of the cost of typical FPSO facilities, and construction within three years. With lower cost and quicker delivery, the HoneyBee is ideal for multiple deployments on stranded assets, but could also allow operators the ability to produce from a larger development more quickly by deploying the HoneyBee initially. Not only will this bring forward NPV for the operator, but also allows for more comprehensive well testing while a larger, bespoke FPSO is being built.

SBM Offshore’s Fast4ward concept is a similar concept, but on a larger scale. It is targeting its more normal project size, 150,000 b/d or more, and has standard modules already designed to form the basis of a plug-and-play topsides, with conceptually standardized modules tailored to suit the required crude specifications, yet delivered six-12 months earlier than standard FPSOs. Both solutions have the same goal. They enable fields to be exploited quicker, enable easier construction, with repetition breeding familiarity within a fabricator and with it better deliverability and safety.

The concept of lighter and modular also fits into the subsea sector. OneSubsea has already reduced manufacturing times and costs on its standard trees, but with its new HyFLeX trees (previously discussed) it can offer the cost competitiveness of horizontal trees, with the intervention capabilities of vertical. Similarly, TechnipFMC champions its new manifold, which can be built internally, is 50% lighter, has a significantly reduced lead time, and can be connected in series, should bigger capacity be needed.

The authors

J. David Anderson is the senior North America Oilfield Services and Equipment Analyst at Barclays Capital. Prior to Barclays, he spent five years at J.P. Morgan in a similar capacity, preceded by 10 years at UBS. He earned a B.S. in electrical engineering at Lehigh University, a M.S. in ocean engineering at the University of Connecticut, and a M.E. in civil engineering at Stevens Institute of Technology. Prior to a career in finance, Anderson was a registered professional engineer specializing in the design of ports and harbors, offshore mooring systems, and underwater inspection as an engineer-diver. Anderson is also a CFA charterholder.

Dr. Mick Pickup is the senior European Oilfield Services Analyst at Barclays Capital. Prior to Barclays, he was at Lehman Brothers beginning in 2000, which he joined after a brief time at Commerzbank. Prior to 2000, Pickup worked in a consultancy role as a senior analyst for Evaluate Energy. He earned a B.A. from Oxford University and a Ph.D. in Chemistry from UCL.