Offshore Leadership Forum kicks off efforts to move industry toward long-term health

Geoff Emeigh

IPA, Inc.

At industry conferences and in private conversations, oil and gas company leaders have expressed frustration about the industry’s struggles to find simpler and sustainable ways to do projects and deliver returns. Across the industry, there is a shared view that companies must pursue new ways of thinking about E&P asset investments.

Concerned about where the E&P industry is headed, many industry executives have expressed a shared vision of generating sustainable changes to the way E&P projects are conceptualized, developed, and executed. Responding to this call, Independent Project Analysis (IPA), Inc., andOffshore magazine have teamed up to sponsor the Offshore Leadership Forum. The forum’s inaugural meeting took place on Dec. 6, 2016, in Houston.

The Offshore Leadership Forum will meet regularly to review the ideas that were discussed at previous meetings and brainstorm new approaches to reshaping the industry. The next meeting is slated to take place later in 2017. At each meeting, the forum’s sponsors will bring E&P capital project data, proprietary research, and the latest industry reporting and intelligence to the table to spark debate among the industry leaders in attendance. In a shared work setting, executives are expected to test and evaluate their assumptions about proposed solutions and asset development practices based on data-driven research findings, and generate actionable ideas that can be “project-tested.”

IPA Oil and Gas Practice Director Neeraj Nandurdikar said the expectation is for the industry’s senior corporate executives to challenge their standard way of doing projects. Left in the wake of the latest industry downturn - one that saw oil prices plummet and capex budgets slashed - is a decimated upstream capital projects market. For years to come, oil prices will likely be in the $45-60/bbl range. However at times prices will be volatile, Nandurdikar said. “This means that for some companies the market will make it difficult to deliver and sustain profitable E&P assets unless they make fundamental changes to their approach. For other companies, it will be difficult to stay in business.”

Take the issue of supply chain savings, for instance. In recent months, E&P operators have reported that project costs are declining 30 to 50%, suggesting that service providers, suppliers, and vendors are adjusting prices to market conditions. However, there are grumblings among engineering firms and contractors that the rates they have been offering are below their fully burdened costs. In other words, these lower supply chain rates are unsustainable. Operators cannot expect to bank these savings on future projects. Supply chain prices may, in fact, begin to go up again soon. And the more whipsaw that our behavior generates, the more long-term damage we inflict on the supply chain. E&P operator executives must look for other ways to rein in project costs.

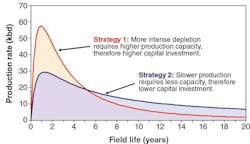

IPA data and research presented for consideration by executives attending the forum in December added depth to the discussion of what changes leaders must weigh. In particular, with oil prices and market conditions as they are, many companies may be better off pursuing projects with lower production intensity to extend their production profile, so as to significantly reduce capital intensity. This strategy stands in stark contrast to the preference of owners to extract as many barrels as possible from the ground immediately after first oil. IPA’s work with clients in a variety of hydrocarbon projects has shown quantitatively that a sustainable approach might actually be to phase developments rather than develop all P50 volume as a single development.

Another opportunity to find savings is to evaluate the flow of information across functions. Facilities continue to be overdesigned. Subsurface teams often prepare high reservoir estimates; then facilities engineers build in added capacity. Project scopes get bloated. This can be fixed by improving interactions among various functions as work products are being created.

In addition, while the industry has been quick to change and adapt on the technical side of projects, change has been slow to arrive on the organizational and collaboration front. For example, research using IPA’s Upstream Database support the benefits of standardization, but few owner companies have embraced the asset development approach and instead have developed unique designs for projects with similar scopes. Citing potential cost reductions through new technology advancements, many executives at the December event agreed that innovative solutions, technology, and effective ways to collaborate across the entire supply chain are key to sustainability with oil prices around $50/bbl.

Other forward-looking changes likely to be tackled by executives participating in the joint IPA-Offshore leadership forum involve the future capability of project organizations to design and execute increasingly complex projects, ideally with an eye toward cost competitiveness and effectiveness. For instance, IPA Founder and President Edward Merrow has commented that while some of the reflexive cost-cutting measures operators made during the downturn were justifiable, it makes no sense to reduce training funds as experienced engineers and project professionals are walking out the door. Among the more important steps the industry must consider is the recruitment and development of millennial workers, since it will be a challenge to get these workers to believe in the oil and gas industry as a full-time, life-long career.

E&P project leadership is another area that could drive significant industry changes moving ahead. The successful development of major upstream projects is largely dependent on good project leadership. However, new IPA research into E&P leadership traits indicates that many E&P owners may be overlooking the significance of getting the leadership selection right from the start. In fact, the research identifies specific traits that are empirically linked to better project results, but are often not even considered in the typical project manager selection process.