Deltic assesses North Sea drilling options

Offshore staff

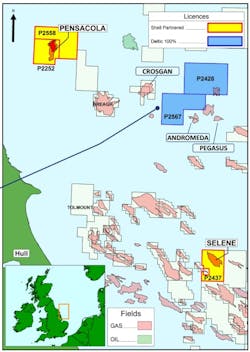

At the P2437 license in the southern gas basin, which Shell operates under a 50:50 venture with Deltic, preparations continue to support drilling operations for the Selene prospect, which the company believes is one of the largest unappraised gas structures in the basin with prospective P50 resources of 318 bcf.

Although rig schedules remain to be finalized, the partnership is working toward a spud date in summer 2024.

A geotechnical survey is planned for later this year, and following completion of the well design process, procurement has started for long-lead items including casing. Deltic estimates the cost of the well in the range $30 million to 40 million.

With drilling costs rising since the farm-out to Shell in 2019, the company has started a farm-out process to limit its capital exposure to the Selene well.

The same partnership is advancing the appraisal program for their Pensacola gas and oil discovery in license P2552, targeting an appraisal well in fourth-quarter 2024. In parallel, various studies will help optimize the development planning; Deltic is again reviewing its options, which may involve monetization and/or a farm down of part of its equity interest.

In the UK central North Sea, the company has a 100% interest in P2542 containing the 24.5-MMboe Syros prospect to the west of the Montrose-Arbroath production platforms and close to other fields producing from the same Fulmar sandstones thought to be present within the Syros rotated fault block.

Although the search continues to bring in a partner to drill Syros, interest has declined since the UK Government imposed further windfall taxes on the industry last November.

08.22.2023