UK the current focus for high-impact drilling in NW Europe

Offshore staff

LONDON – Exploration and appraisal drilling offshore the UK has delivered positive early results this year, according to Westwood Global Energy Group.

Following disappointing returns last year—one commercial discovery and the lowest added commercial volumes since 2014—there have been two finds already in 2023, both operated by Shell: Pensacola (gas) in the southern UK North Sea and Orlov (oil) in the central North Sea, close to the Nelson platform.

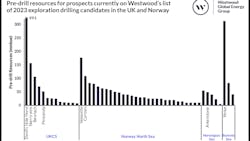

According to Emma Cruickshank, head of NW Europe at Westwood, UK drillers this year may be targeting 13 prospects with combined potential resources of about 1.5 Bboe, along with five appraisal wells.

Despite a lack of success in recent years in high-impact UK offshore drilling, there could be at least three wells in this category in 2023: North Sea Natural Resources’ Devil’s Hole Horst and Parkmead’s Skerryvore (both in the central UK sector) and TotalEnergies’ Benriach west of Shetland.

While exploration activity was stronger across the Norwegian Continental Shelf last year, only nine commercial discoveries resulted from the 28 wells completed, Cruickshank said, and all the finds were below 40 MMboe.

This year the focus will likely be on near-field exploration. Westwood counts 38 prospects targeting about 2 Bboe of unrisked resources and seven appraisal wells chasing about 1 Bboe, with five high-impact wells planned.

In the Barents Sea, Vår Energi and Aker BP appear to be the sole players planning exploration wells in the sector this year.

UK production should climb slightly this year to 1.5 MMboe/d, supported by startup of the Neptune-operated Seagull Field HP/HT tieback to bp’s ETAP complex in the central UK North Sea, and Shell’s Penguins redevelopment in the northern North Sea.

Infill drilling at Clair Ridge, Cygnus and Golden Eagle should provide uplifts to hub production. Cruickshank warned, however, that capital investment assumptions could change as operators revise their budgets in reaction to the UK’s energy profits levy.

Most activities are likely to focus on low-risk investments with fast-track returns, as opposed to longer-term investments exposed to fiscal and political instability. And the focus on containing emissions to comply with regulations is making capital access more challenging.

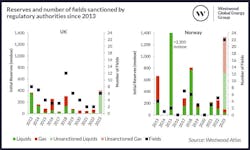

However, the North Sea Transition Authority should still sanction six new UK field developments this year, the largest being Equinor’s deepwater Rosebank oil project west of Shetland.

In Norway, Westwood expects production to reach 4.25 MMboe/d, mostly driven by additions from the recently onstream Johan Sverdrup Phase 2 in the North Sea.

Following a large number of PDO submissions last year for 22 fields, 2023 should be a record-breaker in terms of newly sanctioned projects. The fields hold combined reserves of 1.23 BBoe.

02.22.2023