Well numbers and demand for drilling tools down, report suggests

Offshore staff

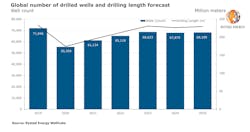

OSLO, Norway – Analysis by Rystad Energy suggests around 55,350 wells will be drilled this year, the lowest since the beginning of the century.

This would represent a 23% fall decline from last year’s tally of 71,946 wells.

Next year, well numbers should recover slightly to just above 61,000 as governments ease COVID-19 related travel restrictions, boosting oil demand and prices. Thereafter, well numbers look set to climb to just above 65,000 in 2022, remaining below 69,000 until the end of 2025.

Of this year’s anticipated wells, 2,238 are offshore. Prior to COVID-19 Rystad had foreseen 2,896 offshore wells.

Energy services analyst Reza Hasaan Kazmi said: “Both new wells and drilling lengths will be pared down as E&Ps scale down investments, affecting the entire supply chain associated with these services. This includes drilling tools, which will decline by 35% in 2020 compared to 2019.”

The latter includes BOPs, downhole drilling tools, drill bits, drill pipe, jars, drill collars and others except downhole pumps used for artificial lift.

Drilling length also looks set to ‘shrink’ by 25% this year before picking up again in 2021.

Demand for purchases of offshore and onshore drilling tools will drop from $16 billion in 2019 to $10 billion in 2020, Rystad forecasts, with the most pronounced declines in North America, Africa, and Russia.

But as the majors resume offshore development projects in Africa, demand for drilling tools (especially for drilling risers) will likely rise. In the short term, Brazil, Australia, and China should offer 20-40% growth prospects for offshore while the UK, Guyana, and Mexico also look promising in the medium to long term.

Norway should top the list for offshore drilling tools expenditure.

07/15/2020