Northwest Europe’s high impact exploration wells delivering mixed results

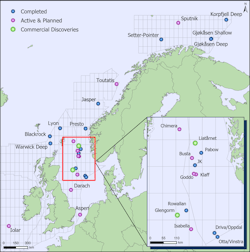

At the end of 2018, Westwood highlighted how northwest Europe was set to be one of the most active regions globally for high impact (pre-drill resources >100 MMboe or 1 tcf) exploration drilling in 2019. Fifteen such wells were completed in the UK and Norway in the first half of 2019, however these failed to result in any commercial discoveries. Since then, the Liatårnet well in Norway was announced as making an oil discovery with resources of 80-200 MMboe, while in the UK the one high impact discovery that has been made to date this year, Glengorm, had pre-drill resources of <100 MMboe and was therefore not considered high impact pre-drill.

At the time of writing, four high impact exploration wells were active in northwest Europe, with two in Norway and one each in the UK and Ireland. A further five high impact exploration wells are planned in the UK and Norway in the second half of this year. While all wells considered high impact prior to drilling have yet to deliver a commercial success this year, there remains potential for the discovery of material volumes with c. 1.4 Bboe prospective resources being targeted across these nine remaining wells.

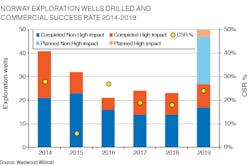

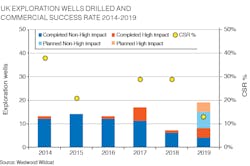

In addition to the 15 high impact wells, there have been 18 non-high impact exploration wells completed so far in 2019. Four wells, including Glengorm, have been drilled in the UK and 14 in Norway, from which six commercial discoveries have been made. In total, the 32 exploration wells completed to date in the UK and Norway have delivered commercial success rates (CSR) of 12.5% and 21%, respectively.

Norway

In Norway, high impact exploration has tended to be focused in the Barents Sea. There have been 28 high impact prospects tested there without commercial success since the last commercial discovery at Alta in 2014, more than half of the Norway total. The CSR is the lowest of the Norwegian basins despite a high technical success rate (TSR) due to the high minimum economic field size required. To date in 2019, four high impact wells were completed in the Barents Sea, with Equinor-operated wells at Gjøkåsen Shallow, Gjøkåsen Deep and Korpfjell Deep, and the Lundin-operated Setter-Pointer well. At the time of writing Equinor’s Sputnik well was active.

Just one high impact exploration well has been completed in the Norwegian Sea in 2019, with Total’s Jasper well making a non-commercial Middle Jurassic gas discovery. Wintershall Dea is planning a frontier well in 4Q 2019 on the Lower Jurassic Toutatis prospect with pre-drill resources of 165 MMboe. The nearest field to the prospect lies c. 150 km (93 mi) away.

The North Sea has seen five high impact wells completed to date this year. To the far south of the region MOL tested multiple objectives in its Driva/Oppdal and Otta/Vinstra wells, but both came up dry. Equinor’s JK exploration well was drilled on the Utsira High, targeting mid-case resources of c. 260 MMboe in the Lower Jurassic to the north of the Johan Sverdrup field on the Utsira High but was also abandoned dry. Aker BP drilled its Pabow well in the Stord basin immediately north of the Utsira High with a Lower Jurassic target that in the event of success would have de-risked adjacent prospectivity. However, this failed due to a lack of charge. A high impact discovery at Liatårnet was announced on July 12, with resources of 80-200 MMboe (midpoint 140 MMboe), although this well was yet to be completed at the time of writing so it is not in the statistics. Two high impact wells at Klaff and Goddo on the Utsira High are currently active.

Westwood understands two high impact exploration wells are planned to be drilled in Norway in H2 2019, which in addition to the three active wells, are targeting combined total pre-drill resources of c. 650 MMboe. This gives a total of 20 high impact exploration wells expected to be drilled in 2019.

UK

Exploration in the UK is more mature than Norway and fewer high impact exploration wells are drilled, with just 12 (17% of all wells) since 2014 compared to 63 (39% of all wells) in Norway.

Three of the high impact exploration wells that were completed in H1 2019 are located west of Shetland, including two that targeted Tertiary prospectivity at Blackrock and Lyon. These were drilled with the potential to provide critical mass for the development of adjacent discoveries, including Rosebank and Cambo around Blackrock, and Tobermory, Bunnehaven, and Cragganmore around Lyon. Warwick was drilled to test a southwesterly extension of the Rona Ridge basement play and, if successful, provide additional volumes for the nearby Lancaster development, where the early production system was brought onstream in June. Although the well encountered oil, it did not flow at commercial rates and was P&A’d.

Unusually there are three high risk/high impact wells planned in the southern North Sea, including two in 2019. Also surprising is that three supermajors are participating in two of these wells. Eni and Total are drilling a frontier Lower Carboniferous carbonate play test at Aspen, expected to spud in 3Q 2019, and Shell has entered Cluff’s frontier Zechstein reef play ahead of a potential well in 2020. Meanwhile ONE Dyas, Neptune, and Spirit are currently drilling the multi-target frontier Darach prospect targeting a Lower Carboniferous clastic play. The prominence of larger companies in these high impact wells suggests they see material follow up in the event of success.

The high-pressure/high-temperature (HP/HT) Central Graben area has seen increased activity of late, including CNOOC’s high impact Upper Jurassic Glengorm discovery. This is the only high impact discovery in NW Europe in H1 2019 and the largest in the UK North Sea since Culzean in 2008. Culzean was brought onstream in June. Eni’s high impact Rowallan exploration well was abandoned as a dry hole in May, and Total is planning to drill its Isabella exploration well in H2 2019 where pre-drill resources are estimated at c. 140 MMboe. A HP/HT exploration well on the cross median line is also planned for 2020 on the high impact Edinburgh prospect.

A key well to watch for H2 2019 is Cairn’s 160-MMboe Chimera prospect in the northern North Sea which is targeting oil in the Tertiary, north of its Kraken development on the East Shetland Platform. While large commercial discoveries in the Tertiary of the northern North Sea are proven at Kraken and Mariner, the last Tertiary discovery >100 MMboe in this region was in 1987.

Current forecasts to year-end suggest the UK will see a total of eight high impact exploration wells drilled, including the four completed in H1 2019. The four that are expected to complete in H2 2019, including the active Darach exploration well, have total pre-drill prospective resources of c. 470 MMboe.

Ireland

Exploration drilling activity offshore Ireland is infrequent, with the last exploration wells being Druid/Drombeg (dry) in 2017, Midleton (dry) in 2015, and Dunquin North (shows) in 2013. CNOOC’s Iolar well, spudded at the end of May 2019, is a frontier play test in the Middle/Upper Jurassic in the Porcupine basin. The north of the Porcupine basin has only seen a few technical discoveries and Iolar, if successful, will open a new basin that could be transformative to the region. However, the well is very high risk.

Conclusion

With 15 high impact exploration wells having failed, hopes are pinned on the remaining nine to deliver new material volumes and break the trend of falling success rates. The well to watch is Iolar offshore Ireland, which if successful could spark a surge of new exploration investment in the Porcupine basin. In the UK, the switch in 2019 from low-risk, near-field drilling to riskier, high-impact exploration has resulted in the decline of commercial success rates to levels not seen since prior to the oil price crash, as companies seek material volume rather than near-field value. For Norway, its commercial success rate has been boosted by small North Sea discoveries, but in the Barents Sea the question is how much longer can exploration continue without commercial success.

Without further success in 2019 from the high impact program, enthusiasm could wane in subsequent years. Glengorm does show that high impact discoveries can be made in the region, and not necessarily by drilling high impact prospects. •