Expro supporting deepwater Mauritania P&A campaign

Pacific Drilling subsidiary, Pacific Santa Ana Ltd. has commissioned Expro to provide an Intervention Riser System (IRS). This will operate on Petronas’ Chinguetti field Phase II P&A program offshore Mauritania.

Under the $20-million contract, the IRS system and associated surface support equipment will be run from the drillship Pacific Santa Ana. The work should take 360 days to complete.

Worldwide Oilfield Machine will assist Expro through supplying the subsea well access system and technical support team.

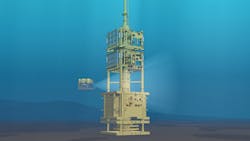

The IRS is designed to safely establish and maintain well access throughout riser to surface operations, replicating the function of the BOP and ensuring safe and reliable well control, connected directly to the production tree.

Full scope of the contract includes provision of the lubricator valve, surface flowhead, umbilicals, topsides control equipment and installation and workover control system package.

Brazil, Guyana boosting offshore drilling services revival

Drilling activity has picked up globally during the first half of 2019, according to Westwood Global Energy Group, helped by the Brent oil price remaining above $60/bbl since February.

Various large-scale offshore projects have passed final investment decisions, with significant drilling and well services (DWS) costs, such as Mero 2 off Brazil, North Field South Expansion off Qatar, and the Mozambique LNG project.

And several E&P companies have revealed ambitious, longer-term investment plans, which should further sustain the DWS market between now and 2023.

Overall, Westwood expects further modest improvement, with stronger growth rates in the coming years.

The 2Q 2019 edition of the company’s World Drilling & Well Services Expenditure Market Forecast predicts total expenditure over 2019-2023 of $1.3 trillion, 19% up on 2014-2018, with the US, China, and Russia accounting for 63% of the global DWS spend.

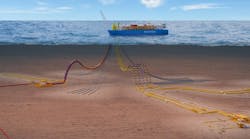

But Latin America too should grow strongly. Offshore, the emergence of Guyana and the development of various large discoveries in the Stabroek block should boost DWS spend significantly. During 2019-2023 Westwood expects more than 60 subsea wells to be drilled in the country.

At the same time, a resurgent Brazil will see more than 200 subsea wells drilled, making the region the largest for these type of wells which are typically high cost, particularly in the presalt region.

However, significant oversupply remains an issue for many DWS service lines and this, combined with strict capital discipline by operators, has held pricing down, Westwood said

Total adopts cementless completion technique for Moho wells

Welltec has run what it claims is a world-first cementless completion offshore Republic of Congo. It follows experience gained through the continuous deployment of the Welltec Annular Barrier (WAB) for Total in the Moho North Albian field.

The cementless completion featured the Welltec Annular Isolation (WAI) in open hole. This involves use of multiple metal expandable packers to provide long length, open hole zonal isolation to replace the functions of traditional cement.

According to the company, this leads to efficiency gains in the overall well construction process. The technique reduces the free annulus space between the liner/casing and the open hole, said to be beneficial in highly layered reservoirs of varying permeability where selective production, stimulation or water shut off are needed.

In addition, the simplified well completions operations are said to have eliminated the multiple operational risks associated with cementing in depleted and over-pressured reservoirs.

Ronan Bouget, drilling and completions manager of Total E&P Congo, said: “We were early adopters of Welltec’s WAB technology which has assisted in ensuring zonal isolation and annular sealing (liner to formation) during the development of our major oil project in the Republic of Congo.”

Bouget noted that the WAI was deployed “as part of the global efficiency drive to reduce drilling expenditure whilst maintaining the beneficial productivity index in this highly heterogenous carbonate field.”

The simplicity of the WAI, Bouget said, “enabled us to successfully deploy the technology the first time without operational issues. We delivered a step change improvement in our well construction record and plan to deploy the WAI in subsequent wells – especially those identified as high-risk.” •

.