Drilling & Production

NOV sells two 20K BOP stacks to Transocean

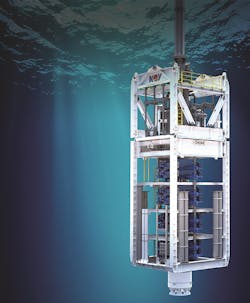

National Oilwell Varco Inc. has sold two 20,000-psi (20K) BOP stacks to Transocean.

This, the company said, makes it the first oilfield equipment manufacturer to successfully design, engineer, and sell such a package.

According to NOV, the 20K BOP stack is designed to optimize uptime and reduce unplanned stack pulls. It is also designed for use with extremely high-pressure reservoirs and can be used in ultra-deepwater.

Joe Rovig, President, NOV Rig Technologies, said: “This is a historic moment for the offshore oil and gas industry. The introduction of NOV’s 20K BOP marks a new era in the exploration and development of high-pressure formations...”

The sale of this equipment and technology package is the culmination of five years of work by NOV Rig Technologies. The initial deployment is expected in 2021 on a 20K well in the Gulf of Mexico.

Norway’s drilling future may hinge on high-impact wells

Norway’s exploration performance has declined markedly over the past five years, according to consultant Westwood, as the quality of the prospect portfolio has deteriorated.

Results from high-impact drilling planned over the remainder of this year could prove critical to the country’s ability to sustain exploration into the future.

Westwood’s Norway Exploration Performance 2014-2018 report concluded that activity levels and returns were down markedly compared to the previous five years.

The number of exploration wells completed fell by around a quarter, and discovered commercial volumes were down by more than 50%, even taking into account volumes from Johan Sverdrup in the North Sea.

Commercial success rates (CSR) fell from 30% to 20%, but technical success rates (TSR) only dropped slightly from 52% to 49%. According to Emma Cruickshank, Head of Northwest Europe at Westwood, this reflects the lesser quality of the pool of prospects being drilled as the proven plays continue to mature.

Norway’s annual exploration well count in Norway has remained steady at 21-22/yr since 2016, down from 39 in 2014. Over the past five years, the industry spent $7.3 billion drilling 138 wells to find 1.2 Bboe of commercial oil and gas with an average discovery size of 44 MMboe and a pre-tax drilling finding cost of $6.1/boe.

Fewer than half of the discoveries were deemed commercial, and of the 27 finds that were commercial on the shelf during the last five years, only three were greater than 100 MMboe.

The northern North Sea Middle Jurassic play was the most prolific in terms of discovered commercial hydrocarbons and CSR, but the average discovery size was small.

The Barents Sea is not delivering the returns expected. While the TSR is high, Cruickshank said, the CSR is the lowest of the Norwegian basins due to the high minimum threshold for an economic field size. However, interest in the region remains high because of the potential prizes on offer.

This year, Westwood foresees 15 high impact wells, up 67% from 2018. Results so far have been disappointing, although several significant wells are yet to spud.

Oversupply still prevails in oilfield service sector

Oilfield service companies are starting to increase prices for products and services, according to consultant Rystad Energy.

“Oil and gas investments are on the rise, and so too is the pricing power of service companies,” said Audun Martinsen, head of oilfield service research.

“After losing pricing power in 2015 and 2016, oilfield service companies have since regained some of the lost ground, thanks first and foremost to industry consolidation among players that has concentrated the market over the past couple of years.

“Pricing power is likely to be further strengthened within the service industry, as orders are anticipated to rise across the supply chain, coupled with capacity adjustments intend to avoid oversupply in 2019 and 2020.”

Many oil and gas companies scaled back their investments in 2015 as oil prices fell, and the smaller players were forced to cut costs.

“This trend continued in 2016,” Martinsen said, “but in 2017 and 2018 more E&Ps could finally finance their ambitious operations growth through improved operational cash flow, leaving market concentration levels in 2018 on par with those seen back in 2014.”

Rystad’s analysis suggests that the Big Four of Schlumberger, Halliburton, BHGE, and TechnipFMC, and the next 10 largest service companies, started to lose market share to smaller players in late 2015.

But market concentration was re-established in 2017 and 2018 following various major M&A deals in the industry.

“Even though the oilfield service market has become more concentrated at the same time as the buyer side has become more fragmented, there are also other factors which impact pricing power,” Martinsen said.

“Some segments, despite being more concentrated, are still heavily challenged by oversupply, forcing companies to adjust their capacity before prices improves.” •