This will be deepwater’s decade

Editor's note: This article first appeared in the 2024 Offshore Business Strategies Special Report, which published within the May/June 2024 issue of Offshore magazine.

By Espen Erlingsen, Rystad Energy

The decade of the 2010s was tight oil’s decade, with this source of supply seeing considerable investment and production growth. This is now changing, and with tight oil investments flattening out and production growth falling, the offshore sector has emerged as the key new source of supply. Sanctioning activity reached historical high levels last year, and investment is increasing. This will result in strong deepwater production growth; the 2020s is on the way to becoming deepwater’s decade.

Total approved greenfield deepwater investment reached almost $60 billion last year, about 40% higher than 2022. Key countries in terms of approved projects last year were Guyana, Brazil and Norway, with Equinor and Exxon Mobil being the key operators. In fact, measured in US dollars, 2023 was the strongest year for deepwater project sanctions since 2013. This is even more impressive considering that the average development cost for new deepwater fields has fallen from about $14 per barrel of oil equivalent (boe) to about $8 per boe over the last 10 years. By reducing costs and becoming more efficient, deepwater projects have become a more profitable source of new production, resulting in higher sanctioning activity. Rystad Energy expects activity to reduce slightly this year before a potential new historical high in 2025, when growth will be driven by Guyana, Suriname, Brazil and Norway.

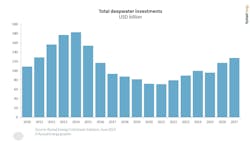

Increased approval activity also influences annual deepwater investment (see Figure 1 above). After more than seven years of consecutive decline in deepwater investment, spending started to increase in 2022. Deepwater investment grew about 13% last year, and this year’s growth is expected to be about 11%, making deepwater the fastest-growing supply segment in 2024. With growing approval activity toward 2025, deepwater investment is also forecast to increase; from 2023 to 2027, total spending is predicted to grow from about $90 billion to almost $130 billion, representing an increase of about 40%.

Higher deepwater activity and investment also influence deepwater production levels. In the past, a yearly growth rate of 400,000 barrels per day (bbl/d) was considered strong for deepwater projects, like what was seen in 2014 and 2015. In some challenging years, such as 2011 and 2020, production has declined about 500,000 bbl/d. For this year, Rystad predicts growth of about 750,000 bbl/d, which would make 2024 the best year on record in terms of growth. For the period from this year to 2030, Rystad foresees an average growth rate of about 550,000 bbl/d per year.

Historically, Brazil and the US Gulf of Mexico (GoM) have been the engines for deepwater growth. Last year these two countries alone contributed with almost 550,000 bbl/d of growth. Going forward, Brazil will remain a key country in terms of new volumes, making up about 50% of the yearly increase. The US GoM is predicted to go from a net growth region to a net declining region. The key reason for this change is the lack of new large undeveloped projects. New countries in terms of deepwater growth will be Guyana and Norway. Guyana is driven by the rapid development of fields within the prolific Exxon Mobil-operated Stabroek Block, while Norway is benefiting from the project approval wave in the wake of tax incentives brought in during 2020 amid the COVID-19 pandemic. By the end of this decade, new deepwater producers, such as Suriname and Namibia, are also expected to contribute to the growth.

The growth in deepwater production can also be benchmarked against other supply segments. By comparing the year-over-year net changes in non-OPEC oil supply by supply segment, Rystad clearly sees that, over the last 21 years, tight oil was the key source for non-OPEC growth, growing at an average yearly rate of 750,000 bbl/d for the period. This year, tight oil is expected to grow 600,000 bbl/d and is seen on a declining path for the rest of this decade. In that sense, 2024 represents a change, where deepwater growth is expected to surpass tight oil. Toward the end of this decade, deepwater production will be the key—if not the only—source for non-OPEC oil growth.

About the Author

Espen Erlingsen

Espen Erlingsen is head of upstream research with Rystad Energy. He is a partner and leader of the E&P team at Rystad Energy. His areas of expertise include company and acreage valuation, breakeven price analysis and international petroleum fiscal regimes. Before becoming a partner, Erlingsen was the lead NCS analyst at Rystad Energy.