US Gulf has 112 discoveries in water depths greater than 1,500 ft

The one constant during the 1998-1999 industry economic down turn was deep water action. When budget cuts were made, they were made from the shelf seaward. As a result, deepwater activity in the Gulf of Mexico in 1999 remained strong despite other areas feeling the weak market crunch.

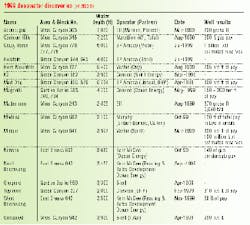

Seventeen discoveries were notched in the past year in water depths greater than 1,500 ft, which marks the greatest number of discoveries in any single year. The following shows the number of deepwater discoveries reported by year: 1999-17; 1998-10; 1997-16; 1996-8; 1995-5; 1994-4; 1993-3; 1992-0; 1991-4; 1990-1; and 1980 and previous-15.

From 1993, the deepwater discovery rate showed a steady increase until 1997 doubled the previous year's numbers, which was coin cidentally at the same time prices rebounded. However, as commodity prices dropped in 1998, deepwater activity followed. But, 1999 discoveries continued to climb despite a weak price scenario. This can be tied to the number of new deepwater units entering operations.

Operators have committed to long-term agreements with the drilling contractors, and as the rigs hit the water, both the contractor and the operator have been keen on putting them to work and paying off the large capital investment. So, as the deepwater fleet continues to expand well into the next few years, exploration activity (and results) will continue to rise.

Development

While discoveries were at record levels in the Gulf of Mexico, development activity remained slow. A number of discoveries were shelved and deemed non-commercial at the low prices. Others were pushed back indefinitely.

Two such casualties came from Texaco, which announced that the McKinley and Fuji prospects, while having good oil shows, were not of the commercial quantity for the company to develop. These were not reported as being the result of low oil prices, but rather because the size did not warrant further Texaco investment. However, these could feasibly be picked up by a smaller company that will not require the field size that Texaco does to turn a profit.

With prices rebounding and a strong first quarter expected, it would not be unreasonable to expect some operators to re-evaluate some of these projects and begin looking at new development schemes.

Another key factor causing low development activity, and a factor that will extend well into 2000, are the mega-mergers. Major producers such as BP Amoco, ExxonMobil, and TotalFinaElf are still trying to iron out the details of their new combined companies. This has resulted in a slowdown while decisions are being made on what assets to keep and what to let go. Activity from these players is expected to remain low for a while longer until these issues are decided.

This does translate to a chance for increased activity from the independents. When the mega-merged super majors begin dropping some of these properties, the independents are likely to snatch several of them up. And with the independents' notorious ability to act quickly, activity may pick up considerably.

In fact several of the discoveries in 1999 were made by the independents. Vastar recorded two, Kerr-McGee discovered three, and Murphy and Marathon each had one.

Production

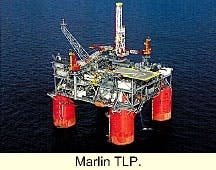

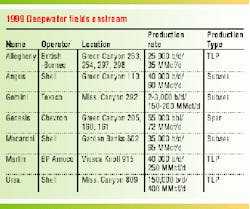

Twenty-seven of the 112 discoveries in deepwater are in production. In 1999, seven fields came onstream. Included in 1999 were some very big names - BP Amoco's Marlin Field, Texaco's Gemini Field, Chevron's Genesis, and Shell brought Macaroni and Ursa onstream.

This year 14 fields are planned to come on stream. Included are some major projects such as Exxon's Diana/Hoover, Texaco's Petronius, EEX's Llano, and Shell's Europa.

Deepwater survey

Of the 112 discoveries made in Gulf of Mexico water depths greater than 1,500 ft, 92 have been given prospect names, and the remaining 20 have yet to be named. A total of 83 are in planning stages, which for lack of a better term, means simply that it is not onstream yet.

It could mean that the operator is either still considering producing the discovery or is about to bring the field onstream. A total of 27 are in production and two of the discoveries, Fuji and McKinley, were recently determined by operator Texaco as not viable.

Offshore Magazine's US Gulf Deepwater Survey lists each field by name, location (block number), water depth, operator (partner), stage of development, and production type, year of discovery, year of first production, estimated or proven reserves in millions of bbl oil equivalent (BOE), and peak/test production (oil/gas). A dash indicates that the information was unavailable at press time.

Each listing has a number that corresponds to the accompanying map. Numbers on the map in red indicate that the field is in production; numbers in yellow indicate the field is in the planning stage. Fields beyond the 1,500 ft contour are listed on a separate chart.

Click here to view the Deepwater Discoveries in the US Gulf of Mexico (>1500 ft).

This survey is in PDF format and will open in a new window