Asia-Pacific, Australasia lagging in returns from deepwater wells

Deepwater exploration remains patchy throughout Pacific Rim waters, but the exact cause is difficult to identify. A new report from analysts Wood Mackenzie cites numerous factors, including modest fiscal incentives and moderate oil yield to date, compared with deepwater drilling results elsewhere, and gas-prone plays that are too remote from established markets.

Despite these shortcomings, certain companies are stepping up their efforts in the more prospective areas. Unocal has had successes in Indonesia, as has Shell with its recent Malam-paya project. In February, a BHP Billiton-led group was awarded Brunei's first deepwater license, Block J, covering an area of 5,000 sq km.

Slow acceleration

Wood Mackenzie defines "deepwater" in the Pacific as beyond 400 m. The first such wells in South East Asia were drilled in the North West Palawan Basin and the Andaman Sea in the 1980s. In the '90s, the scope broadened to include Brunei, East Java, Sarawak, and China's Pearl River Mouth Basin, with wells in 1,000 m of water or deeper by mid-decade. However, Unocal is the only operator to date to have drilled in water depths beyond 1,500 m.

The highest success rate has been offshore The Philippines, where Malampaya and Camago were recently brought onstream. Offshore Indonesia, a total of 1,500 MMBOE may have been discovered in the deepwater, but only two fields can be considered commercial, Unocal's Merah Besar and West Seno in the Makassar Straits. The same operator's more recent Ranggas discovery needs further appraisal before commerciality can be established.

Ranggas is mainly an oilfield, while the others are chiefly gas. Wood Mackenzie views sweeping development of the gas reserves as unlikely in the short term, given the much lower costs associated with shallow water gas off East Kalimantan. On the other hand, Pertamina may try to encourage further "gas banking" arrangements on the lines of West Seno to promote sales of gas associated with deepwater oil developments. The emerging infrastructure could, in turn, promote tiebacks of isolated gas structures.

Offshore Sabah in Malaysia, Shell had deepwater successes with Kamunsu East-1 (gas) and Kamunsu East Upthrown-1 (oil and gas). Shell reportedly plans two further wells on the acreage this year.

Across Australasia, the analysts have identified 45 deepwater exploration wells since 1980, yielding a total of 1,739 MMBOE. Most of these wells were drilled off North West Australia, with the highest concentration in the Gorgon area in the Carnarvon Basin, where five gas-condensate fields have been discovered. Six wells were completed west of Gorgon between mid-1999 and early 2001, in water depths ranging from 1,000-1,500 m. The Gorgon Field alone is thought to contain 12 tcf recoverable, but development remains some way off, due to lack of markets both in Australia and Southeast Asia. Also, the expanding North West Shelf LNG project is too strong a competitor.

In the Bass Strait off Southeast Australia, there has been one commercial gas find ranked as deepwater, Blackback/Terakihi, where small quantities of associated gas have been produced with oil through three subsea wells tied back to the Mackerel A platform. In the Timor Gap, the "deepwater" Corallina oilfield was discovered in 1996 and subsequently tied back to the shallow water Laminaria FPSO. A more substantial find in 1999 was Woodside's Enfield, where reserves are rated at 60 MMbbl-plus. Woodside may opt for a joint development of Enfield and the nearby Laverda Field via a leased FPSO. The only apparently large gas-condensate find in the Timor Sea is Inpex's Abadi. Appraisal drilling is planned.

Cost comparison

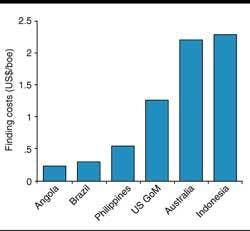

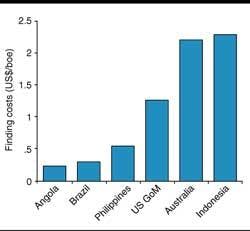

According to Wood Mackenzie, only The Philippines benchmarks well against Angola, Brazil, and the US in terms of commercial reserves through the drill bit. It rates 87.5% of Australia's deepwater reserves as technical rather than commercial, most of these being gas.

Australia's finding costs are high at $2.21/BOE, due to the low level of commercial reserves resulting from exploration wells drilled. This compares with rates of less than $0.50/BOE off both Angola and Brazil. The average cost of a deepwater exploration well off Australia is estimated at $11.5 million.

Southeast Asia's deepwater wells typically cost $20 million, the exception being Indonesia's Kutei Basin, where the norm is less than $5 million/well. Finding costs are higher offshore Indonesia than off Australia, but the former's lease signature costs are well below those in the prolific Atlantic provinces. For Indonesia's latest license round, last December, the Dongala block attracted signature payment bids of over $4,500/sq km. According to Wood Mackenzie, that compares with an average signature payment of $5,000/sq km in Brazil, $18,000/sq km in Angola and $49,000/sq km in the US Gulf of Mexico. Australasia has no signature payment obligations, but neither does it offer fiscal incentives for deepwater drilling – unlike Indonesia, Malaysia, and The Philippines.

Generally, however, the production sharing contract system in most Southeast Asian nations offers little incentive to producers to explore frontier provinces. Indonesia did consider introducing a new concession system, but this did not make it into the recent Oil and Gas Bill. Indonesia has awarded four new deepwater licenses, two going to Malaysian-owned companies, one to Amerada Hess/Petronas, and the other to TotalFinaElf/Inpex. The latter are reportedly chasing gas. Deepwater drilling may pick up most strongly off Malaysia, with Shell and Murphy lining up programs on Blocks SB G and SK E and Blocks SB K and SB H. In the longer term, China's Pearl River Mouth Basin may also attract attention.

Australia has made large deepwater blocks available in the Carnarvon Basin and in the Gippsland Basin, adjacent to Bass Strait permits. Frontier acreage was also offered last year in South Australia's deepwater Duntroon Basin and Tasmania's Sorrell Basin. A Woodside-led consortium was awarded deepwater acreage in the unexplored Great Australian Bight. Wood Mackenzie foresees the southeast as having greater potential for deepwater activity, particularly as this is the one part of the country currently craving gas.