DEEPWATER ECONOMICS: Productivity shortfall puts deepwater exploration gains in perspective

Jeremy Beckman

Editor, Europe

Deepwater exploration is becoming more reliable, with increasingly spectacular results - but development/production costs are harder to control. This was a concern voiced by speakers from BP, Shell, and Petrobras at The Institute of Petroleum's recent Deepwater Exploration and Production Conference in London. Improving productivity from fewer wells was another recurring theme.

Various speakers issued global deepwater discovery estimates. In his keynote address, Ian Vann, BP's Technology Vice-President, said that 45 billion boe had been found by the end of 2000, of which 70% was oil. Thirty geological basins around the world had undergone deep-water drilling, with one-third of those tested proving commercial. The industry was currently drilling 120 deepwater exploration wells per year, he said, adding that success rates were "significantly better than in any other exploration play in the world today." They have also provided 30% of all oil discovered over the past couple of years.

To date, deepwater finds in the Gulf of Mexico have been more plentiful than elsewhere - 40% of the global total - but they also tend to be smaller, with the aggregate volume currently put at 11 billion boe, similar to the totals off West Africa and Brazil. In the Mediterranean, Northwest Europe, and the Asia-Pacific region, the success rate has been 1:4 wells drilled compared with 1:3 in the Gulf of Mexico and the Campos Basin, and 1:2 off West Africa. Results in these smaller, northerly and easterly provinces suggest that they are overwhelmingly gas prone, Vann added.

He also claimed in his paper that the 45 billion BOE figure probably represents less than half the eventual discovered resource. He pointed out that Roncador, Brazil's deepest producing field, was only discovered after 200 exploratory wells in the Campos Basin and more than a decade after its second-largest field, Marlim. The gap between finding Mars and Crazy Horse in the Gulf of Mexico was more than 10 years, during which 250 exploratory deepwater wells were drilled.

Vann pointed out, however, that the real challenge was not exploration success, but economic field development. There had been an "explosion" of innovative development and production technologies, but no single concept had emerged as the "winner." Nor should the industry expect such a solution to emerge in future, he added, given that all concepts are compromises, which have to address economic objectives as well as field characteristics.

Drilling provides the biggest scope for change, he said, as this consumes typically half of deepwater development costs. But extending shallow water technology to the limit will not provide the next generation of solutions, he claimed in his paper. Somehow, productivity has to be increased radically to 30-40 days per 10,000 ft rather than the industry norm of 100 days, he stated. Once deepwater wells are onstream, they need to be far more productive to compensate for the high costs of the production facilities. Among the more promising technologies Vann identified in this regard were expandable tubulars to reduce casing string numbers and dual-gradient drilling.

Where reservoir energy is low due to shallow depth of reservoirs (as off West Africa), Vann cited the need for large seabed multiphase booster pumps and wellhead water separation systems to reduce back-pressure. Another primary concern was system flow integration - wax and hydrates should be dealt with by adding chemicals to the flow, rather than the traditional mechanical engineering approach of "developing ever more expensive insulation systems." Insulation can commonly add more than 20% to subsea costs, he pointed out. Once flow assurance breakthroughs have been established, the industry can think in terms of greater numbers of tiebacks stretching 80 km or beyond, with fewer large standalone developments.

Ultimately, his paper concluded, a new type of deepwater development will evolve, with fewer wells, and much of the processing activity being remote, and with huge amounts of real-time data collected by autonomous robotic devices and intelligent control systems. Producing deepwater fields could be unmanned, controlled from safe, comfortable offices in Houston, Luanda, or Aberdeen.

Into the unknown

Jose Miranda Formigli, Assistant Manager for the Marlim Field, told the conference that Petrobras had five rigs exploring in water depths greater than 1,500 meters. One recently set a new water depth drilling record, and the company's target was to extend its capability to 2-3,000 meters.

Deepwater continues to provide a greater percentage of Petrobras' overall production, currently contributing 65% of a rate just above 1.5 MM b/d. The company's target is 1.85 MM b/d by 2005, with deep and ultra-deepwater fields contributing nearly 75%. To date, it has installed 386 subsea trees, with a further 120 planned in 2001-02. More than 2,220 km of flexible flowlines are in place, with a further 957 km planned in the same period, while the figures for umbilicals are 1,394 km in place with 584 km to come. Due to the high operating efficiency of current systems in service, Petrobras plans to install a further five deepwater production systems over the next three years.

Looking ahead, Petrobras has commissioned a new generation of horizontal subsea trees for operations in 2,500 meters of water. These are being designed to withstand installation loads and to allow completion with a 7-in. production string, to optimize well production. Petrobras has also looked at power interconnections between FPSOs stationed in waters up to 2,000 meters deep. Previously, there were no submarine electrical cables that could withstand the dynamic requirements for a configuration at this depth, but the world's first was developed and installed last September between the P-36 and the P-47 storage unit on Roncador.

PROCAP 3000, the technology program for water depths of 3,000 meters, is being applied to the next production phases on Marlim Sul, Roncador, Marlim Leste, and Albacora Leste, all of which feature differing fluid characteristics and reservoirs. The initial budget, through 2004, is estimated at $130 million. Among the 19 systemic projects under review, Petrobras is working on:

- Use of extended reach wells from tension leg platforms to reduce costs and increase productivity.

- Intelligent completions - a project has been formulated to test this technology in a long tieback deepwater situation (offset > 10 km).

- Underbalanced/lightweight drilling. Off-shore, underbalanced wells are currently feasible only from fixed platforms, but Petrobras is targeting an application from a floater. The key challenge is to handle hydrocarbons safely in the drilling riser.

- Gas-lift is needed for more than 47% of Petrobras' current production. Improving performance further will in turn raise productivity. To this end, Petrobras is investigating new methodologies and software for gas-lift design and analysis.

- Subsea multiphase pumping - a prototype deepwater system, will shortly be installed on Marlim in 660 meters of water. This was a collaborative project also involving Westinghouse, Leistritz, Kvaerner, Tronic and Pirelli.

- Locating and removing wax and hydrate plugs from blocked flowlines - a specially developed tractor for this purpose will be tested.

- An 18 3/4-in. wellhead system will be developed for operation in 3,000 meters of water, capable of resisting high bending moments and accommodating increased numbers of casing strings.

- Flexible pipes - the Midwater Transfer System involves connecting a floating production unit with a dry completion unit, such as a TLP or a deep draft caisson vessel (DDCV), on the same field. Its main advantage would be to avoid hydrate and wax formation due to the higher temperatures and lower pressures encountered in mid-depth waters. It would also remove the need for ultra-deepwater risers for both production systems.

Shell's targets

Dean Malouta, Technology Manager for Shell Deepwater Services in Houston, spoke of Shells' experiences in the Gulf of Mexico. The company's discovered volumes from deepwater wells exceeded expectations by 35%, he said. Shell had also been involved in 38 of the Gulf's 79 confirmed deepwater finds. However, he claimed that companies were becoming more selective in the deepwater leases they chose to maintain because of rising lease costs.

Cycle times from lease acquisition to first production have been cut to 4-5 years, compared with 12 years in 1983. "Two to three years may be the future limit. We are improving our TLP hub cost by having templates that are workable in different places." Another Shell target, driven by the ban on flaring offshore, is to develop systems that can handle any kind of gas produced - "right from the wellhead to the shore, where it can be dealt with."

Dr. Matthias Bichsel, Director of Deepwater Services at Shell International Exploration and Production, said new modeling techniques were improving reserve estimates on deepwater fields. One new approach developed in-house by Shell and applied to Bonga, off Nigeria, led to the field being upgraded from 700 million bbl of oil to over 1 billion bbl. The company modeled 120 reservoir "situations" for Bonga before deciding on appropriate numbers of producer wells, water injectors and the size of the surface facilities.

Reserves need to be substantial, because as Bichsel pointed out, current rates for 5th generation rigs in the Atlantic are $150,000/day and up. However, use of monobore technology could allow 2nd or 3rd generation rigs to drill these wells at half the cost, he suggested. Shell itself had employed expandable tubulars to access ultra-deepwater plays in the Gulf of Mexico. "One of our recent wells wouldn't have reached T/D without two sets of expandable tubulars" (supplied through Shell's joint venture with Halliburton). "The step to the true monobore well is just around the corner."

Bichsel cited subsea pumping as another important enabling technology in ultra-deepwater. There are three different industry projects, one of which Shell signed on for the Gulf of Mexico. Another exciting prospect, he said, was the move towards production through casing.

For Shell's current Na Kika project, a sled has been developed to allow remotely operated vehicle (ROV) installations and inspections in 7,000 ft of water. Shell was also aiming to increase tiebacks in the Gulf to 100 miles - currently, the longest deepwater tieback in that area is 20 miles. Finally, Bichsel said that Shell had cut integration testing time for trees down from 60 days on Mensa to five days for Europa, its latest project - "two to three is our future target."

Willem Brandt, Director of Business Develop-ment at Transocean Sedco Forex, spoke briefly of his company's work on dual-gradient drilling, as part of the DeepVision venture with Baker Hughes, BP, and Chevron. "Our concept is based around a riser filled with seawater," he said. The Phase 1 feasibility study had been completed, and phase 3 was now under way. "By mid-year, we will have a flow loop of different components set up, followed by six months of day/night tests. By 2003, we plan to have a system operational on an offshore well."

Shetland lessons

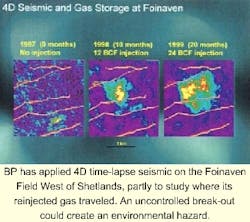

BP's West of Shetland projects (Foinaven and Schiehallion) are hardly "deep" by today's standards, in a water depth of just 500 meters. But they did serve as a stepping-stone for the company in the mid-'90s in deepwater learning terms, said BP's Martyn Smyth. These fields with their two FPSOs can produce 275,000 b/d on a good day, he said, via six drill centers and 50 subsea wells. Until now, the produced gas has been reinjected, but a new project is under way to pump volumes via a new long-distance pipeline east to the northern North Sea, where it will be used for miscible injection to enhance production from BP's Magnus oilfield. The pipelay and facilities upgrade program will require a workforce in the area this year of more than 700.

Oil spill incidents on Foinaven and Schiehallion had been "moderate," Smyth said, but quantities leaked had been low. These have come mainly from hydraulic fluids, and not as a result of offshore loadings to shuttle tankers. However, the turbulent weather in this area affects operations in other ways. Helicopter flights have had to be cancelled, leading to extended offshore stays - "so it can be a very stressful environment," Smyth admitted.

All 50 subsea wells were remotely connected using the D-Mac system. "All the technology was essentially new, and we only had one chance to deploy this equipment - so it had to be right the first time. We're now putting in jumper connections and extension manifolds - all this again has to be done remotely." Metallurgy is another issue, due to the combination of ocean currents and salty waters. Cracks did appear, for instance, on a Foinaven manifold. BP has recently been studying how damage occurs to the flowline risers, and how to fix this.

This year, Smyth added, BP will probably undertake intervention for the first time in the wells. "We're seeing a bit of sand production in a couple of them - we've been doing a lot of work on sand detection. However, the only fatigue-induced failures we've experienced to date have been on the anchored down umbilicals. One anchor failed, so the tethering had to be replaced last summer."

The big challenge in the future in this region will be flow assurance issues relating to long distance subsea tiebacks, Smyth said - unless BP chooses to form a third hub on its undeveloped Suilven Field. "A big influence in this regard will be our first well this year off the Faroe Islands. The industry now has the confidence to develop something in the Faroes, based on work by BP west of Shetland."