DRILLING RIG ECONOMICS: Top five drilling contractors emerge from long history of change

After decades of struggling to maintain global mobile drilling unit fleets amidst "feast and famine" utilization conditions, five drilling contractors have emerged with control of most of all offshore mobile drilling assets (see historical chronology following). The five also built and acquired in the past decade nearly 100% of deepwater drilling capability.

Since the industry collapse and emergence of low oil prices in the late 1980s, analysts and investors have pressured offshore drilling contractors to merge, but high indebtedness and difficulty in disposing of stacked and aging assets made such business condensation difficult. Only in recent years has the merging process proceeded in earnest.

The spreadsheet accompanying this article shows the acquisitions and mergers among drilling contractors and service companies that have taken place over the past 50 years. The spreadsheet also shows how the top five drilling contractors formed and grew over the years.

Despite the difficulty in transferring hard iron assets over the years, the one constant over the 50-year period is change. The consolidation taking place among drilling contractors is not unlike that taking place among operators, manufacturers, and service companies in the upstream petroleum industry.

Contractor changes

Two of the five major drilling contractors can trace their origin back to as far as the1920s. Two of the contractors trace their origin back to the 1950s, and one contractor (Pride) originated as late as 1968. Four of the five major drilling contractors have built their operations by acquisitions or mergers. Global Marine built their company solely by constructing their own rig fleet.

Offshore Data Services' Mobile Rig Register (6th Editon - 2000) lists 94 different offshore rig owner groups of various types. However, some of the 94 companies are involved in various partnerships with other rig owners. Since the 6th Edition was published, R&B Falcon and Deepwater Drilling LLC have been acquired by Transocean Sedco Forex, resulting in a total of 84 different worldwide drilling contractors.

At the writing of this feature, Pride International is proceeding with a merger with Marine Drilling Com-pany, further reducing the total to 83 drilling contractors. That merger for Pride will add 15 jackup drillng units and two deepwater semisubmersible rigs. As a share of the total global drilling fleet, the Pride-Marine combination will become the second largest offshore drilling contractor, with 77 total rigs, behind only Transocean Sedco Forex, with 129 rigs.

Deepwater capability

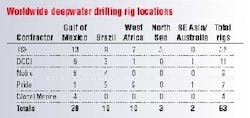

An accompany table indicates the number of deepwater drilling units capable of drilling in over 3,500 ft water depth by present area of operation.

The number of deepwater drilling units (>3500 ft water depth) has increased from a total of 61 drillships and semisubmersibles in 1998 to 83 in 2001 (36 %). Drillship units have increased by 30%, from 20 in 1998 to 26 in 2001. Semisubmersible units have increased by 39%, from 41 in 1998 to 57 in 2001.

Fourteen different drilling contractors owned the 61 deepwater drilling rigs that were featured in Offshore's 1998 Deepwater Drilling Rig Poster. In 2001, the number of drilling contractors had increased to 16, however, there are five new drilling contractors. In order to achieve the net gain of two drilling contractors, other contractors have since acquired three of the 1998 contractors.

In 1998, the largest five drilling contractors owned 70% of the 61 offshore drilling rigs, or 43 units. In 2001, those same contractors now own 76% of the 83 units, or 63 units (a comparative look at the five largest deepwater drilling contractors is shown in an accompanying chart).

The comparison shows that Transocean Sedco Forex more than tripled their number of deepwater drilling units with their acquisition of Sedco Forex, RB Falcon, and Deepwater Drilling LLC. Similarly, Pride International had no deepwater drilling rigs operating in 1998, and today has five operating rigs, that will become seven rigs following the acquisition of Marine Drilling Company.

The current worldwide utilization rate for deepwater drilling rigs is 84% with the breakdown as follows: drillships at 85%, and semisubmersible rigs at 82%. Drillships with water depth capabilities exceeding 5,000 ft water depth have 100% utilization. Semisubmersible rigs have a utilization of 68% for 2nd generation, 90% for 3rd generation units, 100% for 4th generation units, and 86% for fifth generation units.

The apparent demand for deepwater drilling units continues to rise, although the 1998/1999 wave of newbuild construction has subsided. Drilling contractors today seem more content to purchase deepwater rigs, and furthering shareholder values by acquiring competitors, in lieu of building new units.