Alistair Warwick

Atkins

Over the past decade, the industry has had great success pushing into the deepwater frontier through innovation. However, this success has come with a price. There have been numerous recent high-profile failures, which are estimated to have cost hundreds of millions of dollars of additional capex and lost revenue. While we continue to learn from these incidents, the technology boundary continues to be pushed and, in an environment where time truly is money, the potential for further failure is a major concern.

The effect of exploiting reserves in deepwater has been to change the risk and investment profile in which the upstream oil and gas industry has traditionally operated. Wells and facility costs are rising dramatically and the risk of underperformance is increasing. The industry has to deploy more sophisticated technologies, in particular in areas such as downhole completions, subsea hardware, and facilities able to operate in deepwater.

Increasingly, the commercial success of a new multi-billion dollar deepwater development can depend on the performance of a small number of new pieces of technology. Assuring the integrity of this technology, and the associated uncertainty introduced, constitutes a new challenge for an industry where the primary expertise has traditionally been in the management of geological uncertainty. A word commonly used by oil company executives these days is “risk,” and for them, the success of their organization can depend on its ability to manage the risk effectively.

Framing the challenge

The oil and gas industry has developed procedures to qualify new technology. Whether these are specific company processes or industry practices (e.g. DNV-RP-A203), the assumption is that robust application of these processes will ensure the successful deployment of the technology. However, the deepwater industry has examples where technology deployments have not met expectations. These have resulted in major schedule overruns, escalating capital costs and operational failures.

In many cases, a key factor appears to have been an inability to identify and characterize how the new technology would behave in operation. For example, while understanding of lateral pipeline buckling has greatly improved through research and development undertaken by individual projects and Joint Industry Projects [such as the Atkins-led SAFEBUCK], there have been situations where subsea pipeline integrity has been compromised by unanticipated behavior.

There have been numerous integrity-related issues associated with technology applied to mitigate flow assurance issues in deepwater, typically associated with hydrate formation. Thick-walled insulated flowlines/risers or pipe-in-pipe systems have been successful in mitigating hydrate formation, but there have also been failures associated with this technology including:

- Damage to insulation during the pipelay process

- Corrosion under insulation

- Lower than predicted fatigue lives of risers, associated with ineffective prediction of the behavior of insulated risers.

The behavior of deepwater moored facilities when exposed to hurricanes in the Gulf of Mexico has been another major focus area for the industry in the last decade. Hull design and mooring technology have been stretched to address increasing topsides payload and water depths. While the industry has invested significantly in this area, there have been failures that have resulted in significant damage and in extreme cases total loss of these facilities when exposed to hurricanes. In the majority of these cases, the root cause can be tracked back to a failure of an element of technology to behave as predicted during the design phase.

The primary concern with proven technology is that towards the end of its operational life the likelihood of a failure increases significantly. The concern with new technology is that an unexpected failure occurs early in field life, caused by a failure mechanism not understood or anticipated by the design, manufacturing, qualification, or testing processes employed. The phrase “you don’t know what you don’t know” is the simplest way to define the problem statement associated with deployment of new technology.

Success factors

However, while there have been many reported failures associated with the deployment of new technology, there have also been significant successes. The industry can learn as much from its successes as it can from its failures, and a review of several examples of successful deployment of new technology reveals a set of consistent and distinguishable factors.

This may seem obvious, however it is necessary to clearly define what constitutes new technology. As an industry we have been successful at pushing existing technology, sometimes referred to as stretching technology. When we “stretch” technology, we typically deliver more from a proven piece of technology by implementing a qualification process to increase the rating.

However, this introduces the risk that we have not fully understood the impact of the change with respect to the physical characteristics and limitations of the materials of construction. An example would be the use of elastomers for higher temperatures in subsea equipment, where qualification tests may be passed but operational reliability may have been compromised because the physics of how the seal operates may have subtly changed.

We must challenge ourselves to define what constitutes new technology to avoid the risk of mistakenly thinking we are taking a small step when in effect we are moving the operational envelope to a place where component characteristics will behave differently than we have historically predicted or seen before.

Engineering principles

Regulations, design codes and practices are the industry’s foundation. As engineers, we rely heavily on these to deliver robust fit for purpose designs, equipment and operations. In addition to relying on these foundations, when developing and deploying new technology it is fundamental that we have a full and deep understanding of the engineering principles that apply to the new technology.

The majority of regulations, codes, and standards are experience based – they typically lag the development of new technology in the industry, thus sole reliance on these is not sufficient. We must ensure that we develop a deep understanding of the engineering principles behind the technology development; only with this understanding will come the ability to identify the potential failures modes allowing them to be addressed and mitigated.

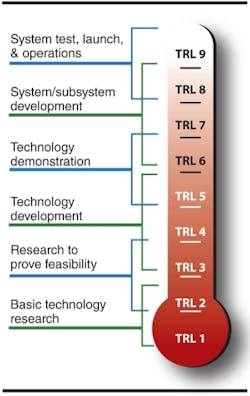

Establish technology readiness levels – are we being honest with ourselves? The space industry introduced the concept of technology readiness levels (TRL) a number of decades ago. Many parts of the oil and gas industry have embodied the concept and implemented TRL processes and management systems.

A challenge we face in the oil and gas industry is the expectation to drive maximum value from discovered reserves: a key factor in maximizing this value is shortening the time to recover the reserves. This places significant pressure to deliver to aggressive schedules. Employing an effective TRL program in a schedule-driven environment can be challenging. Ultimately, the success of that program depends on a robust assessment of the readiness of the technology to move to the next step. The successful deployment of new technology means the ability to stop and realistically evaluate the level of readiness at each stage of the delivery process. In some circumstances this will impact the overall schedule of a project which is a cost the industry must be willing to bear.

The processes employed to deliver a major deepwater development from the concept selection to the operations phase are established and well understood by the industry. These same processes cannot be used effectively, however, to deliver new technology. While it is essential that the development and deployment of the new technology is interlinked with the overall project delivery, it should be treated as a project in its own right. The definition of success, the processes and procedures employed, and even the engineering teams and supply chains, may all have to be different.

Role of suppliers

The oil and gas industry has one of the most efficient supply chains of any industry. This efficiency has been driven by the exploration and production companies over many years of effort to drive the maximum value at each stage of the chain. In addition to being efficient, the supply chain has to be effective at delivering the new technology in the coming decades. This will require further development of key aspects of the supply chain including:

- Collaborative relationships between parties throughout the supply chain

- Modifications to work processes that will foster the robust management of new technology deployment interfaces along the supply chain

- Contracting strategies that will encourage the development of new technology.

The offshore sector is adopting Technology Readiness Levels procedures first devised by the space industry.

Developing and deploying new technology introduces risks to the successful delivery of a project. While these risks can be mitigated, it is unlikely that they can be eliminated. As mentioned previously, the success of a multi-billion dollar deepwater development can depend on the performance of a small number of new, and largely unproven, pieces of technology, failure of any one of which could jeopardize the success of the overall project. An alternative plan for each element of new technology must therefore be developed to ensure there is an alternate development plan should it not be possible to deploy an individual element of technology. This will offer two main benefits:

- The discipline of generating a contingency plan will actually drive a deeper understanding of the key issues that could prevent successful deployment of a piece of new technology

- The ability to implement a contingency plan will ensure more robust decision making when an element of new technology stalls, i.e. having alternatives allow for better evaluation of the optimum way forward.

Innovating with integrity

The oil and gas industry must continue to innovate to provide the world with sustainable and affordable energy supplies in an environmentally sound manner. Innovation means the deployment of enabling technology to access the significant oil and gas reserves that still exist globally. History has demonstrated that deploying new technology in a dynamic and challenging environment, like the deepwater oil and gas industry, is not without risk. The industry must employ robust processes and practices, and instill a culture that will facilitate the successful deployment of new enabling technology.

For every step we move closer to deploying new technology we must be ready to step backwards to ensure its integrity in operation.

Our industry must rise to the challenge and demonstrate to the watching world that we can deliver an essential component of the energy needs of the future in a safe and environmentally sound manner.

More Offshore Issue Articles

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com