Deepwater Gulf of Mexico still offers tremendous resource potential

Infrastructure-led E&P keeps projects profitable, says Kosmos Energy official

As oil prices have recovered in recent years, offshore activity has ramped back up in several regions. But E&P activity in the US Gulf remains below pre-downturn levels.

Still, there is activity, and that activity is increasingly being driven by the independent and mid-sized operating companies. Many of these companies seized the opportunity offered by the downturn to enter the market through asset acquisitions, partnerships, joint ventures and mergers.

One key example of this trend was Kosmos Energy’s acquisition of Deep Gulf Energy, a deal that was completed in September 2018. The acquisition gave Kosmos Energy deepwater assets in the Gulf of Mexico, a region it had not previously operated in.

Recently, Offshore met with Richard Clark, Senior Vice President and head of Kosmos Energy’s Gulf of Mexico business unit. With more than 25 years of experience in the deepwater Gulf, Clark cofounded Deep Gulf Energy in 2004, and served as its President until its acquisition by Kosmos Energy.

Clark offered his views on the state of the E&P marketplace in the Gulf of Mexico; provided an update on Kosmos Energy’s drilling activities in the Gulf; and described how he sees field development programs taking shape in the Gulf going forward.

◆ ◆ ◆

Offshore: What is your view of the current state of the E&P market in the Gulf of Mexico?

Clark: We are excited about what we see in the Gulf of Mexico. There is a very large remaining resource in the deepwater and very little competition. Sixty percent of the companies that were active in the Gulf of Mexico 10 years ago are gone. Most went onshore. In the most recent lease sale only about 10% of the bids were competitive. The other 90% were single bids. The cost to drill and complete wells fell by about 65% after the downturn in 2014. Because of this, our breakeven oil price is near $30/bbl. Our economics are strong. The projected full cycle risked rate of return for our 2019/2020 exploration program is above 35%. These economics compete well with the onshore shale plays. The seismic data continues to improve which allows us to generate a lot of opportunities in our area of focus even though it has been actively explored for almost 30 years. There is a lot of existing infrastructure. Much of it is under-utilized with about 70% of the facilities producing at less than 50% capacity. This means there are many potential hosts for subsea tiebacks which is what we like to do. Kosmos recognized the current state of the Gulf of Mexico as a great opportunity and were looking to enter the basin when Deep Gulf Energy started its sales process.

Offshore: How has the acquisition of Deep Gulf Energy facilitated Kosmos Energy’s entrance into the Gulf of Mexico? Can you talk about your role in that effort?

Clark: Kosmos had no presence in the Gulf of Mexico before buying Deep Gulf, but several members of the leadership team were familiar with the basin. Kosmos was looking not only for good assets which Deep Gulf had, but they were looking for an operator with the ability to grow and significantly add scale. Deep Gulf fit this description. We were a strong, safe, low-cost operator. We had a G&G team with a good track record of generating prospects. We had spare operational capacity that we weren’t using because we were capital constrained. Our strategy of focusing on short cycle exploration projects fit perfectly with Kosmos’s existing strategy, so the combination made great business sense.

It is a huge undertaking to sell a company especially when you consider we were still running the company and had a very active drilling program going on at the same time. It was a team effort. I focused on the technical side of the effort and our CFO Jere Overdyke focused on the banking and commercial side.

Offshore: A number of the large and ‘major’ oil companies have either exited the Gulf or reduced their presence there. What opportunities is Kosmos Energy seeing in the Gulf, that perhaps other companies are missing?

Clark: New seismic data and reprocessing techniques are improving our ability to image under and around salt. If you look at the deepwater in the Gulf of Mexico over half of the area has a salt layer in the subsurface. Prior to the early 2000s, it was impossible to image beneath salt. Wide Azimuth data was developed specifically to improve our ability to image beneath salt. The majors used this technology in the Wilcox and the subsalt Miocene. They were looking for large targets which required new infrastructure. The time to production for these projects can be more than five years. As oil prices fell it became hard to justify these larger projects because of low returns. The independents were and are using this data to explore the younger section that majors haven’t really focused on. The reserves are smaller, in the 20-40 MMboe range, but since we are using existing infrastructure we are quick to production and our economics are very strong.

Offshore: Does being backed by private equity provide a competitive strength or offer differentiation in the market?

Clark: At Deep Gulf Energy, we had a very successful 13-year relationship with First Reserve. We had three ventures in that period. They were great partners. However, the challenge with private equity is the time horizon. Most private equity funds have a 10-year life. A portfolio company has five to seven years to return that money to the investors. You start a venture and each subsequent year your horizon shortens. With a short horizon it doesn’t make sense to buy new seismic or new leases. Being part of Kosmos, a public company, allows us to think longer term. We can have a more consistent and better resourced exploration effort which will produce better results.

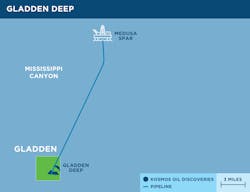

Offshore: Kosmos Energy has an active E&P campaign scheduled for the Gulf, including the Gladden Deep project and the Moneypenny, Oldfield, and Resolution prospects. Can you provide an update on these efforts?

Clark: Our exploration program got off to a good start. Gladden Deep was drilled in June and discovered what we believe is around 10 MMbbl. We had an existing subsea system right by the well location, which made it quick and inexpensive to first production. It came onstream earlier this month and is flowing at approximately 4,000 b/d of oil. It is not a big discovery, but the economics are strong with an IRR of better than 50% and finding and development cost of around $11.00/boe.

Moneypenny – an inexpensive deepening of an existing well – was spud in late October and was unsuccessful.

Resolution was a 100-200 MMboe prospect designed to test an amplitude-supported subsalt prospect in the under-explored western Garden Banks area. The well encountered reservoir quality sands; however, the primary exploration objective proved to be water bearing. The well has been plugged and abandoned and the well results are being integrated into the ongoing evaluation of the surrounding area.

Oldfield, which is about a 30 MMbbl prospect, was spud in December with results expected in the first quarter of 2020. It is near infrastructure where we are currently producing other subsea wells. If we are successful there, we should be able to get it into production fairly quickly.

In addition, Kosmos continues to high grade its multi-year infrastructure-led exploration prospect inventory in the Gulf of Mexico with a further three wells expected in 2020.

Offshore: Can you talk about the philosophy of Kosmos Energy’s “infrastructure-led exploration (ILX) program”?

Clark: The basic concept is we drill our wells near existing infrastructure owned by other companies. If we are successful, we make a deal with the platform owners where we pay a fee to produce across their platform. Since we are not paying to build our own platforms, our model is very capital efficient. Our costs are less than half of what would be required to develop a standalone project. Additionally, this allows us to get our projects onstream very quickly – usually in less than 18 months. The combination of low finding and development cost and short time to production drives strong economics. Typically, we are looking at high return projects with IRRs in the mid-thirties. We focus in large part on amplitude driven prospects with high success rates. Historically we have had a better than 60% success rate on exploration. We want to drill four to five prospects per year most of which will be the low risk opportunities in the range of 20-40 MMboe reserve potential. But we would like to drill at least one prospect a year with higher potential in the range of 100-200 MMboe, like Resolution. This will give our program predictable results from the low-risk projects and good upside potential from our larger shot.

Offshore: Will Kosmos Energy be advancing any new projects in the Gulf in the next few years that could involve a new production platform?

Clark: Most of the projects we do will not involve new production platforms. We will use existing infrastructure. We will drill some larger prospects, like Resolution, that could support a new facility. Should that be the case, we believe there are some low cost semisubmersible solutions that we can use and still generate very competitive returns.

Offshore: What types of field development systems do you see being deployed in the US Gulf of Mexico in the next five to 10 years? Are subsea tiebacks going to be the most common type of system deployed?

Clark: Subsea tiebacks will be the most common systems deployed by far because there is so much existing infrastructure. I think most of the future stand-alone developments will use semis as production vessels.

Offshore: One of the key challenges for Gulf of Mexico operators is competing with onshore production economically, in a price-per-barrel sense. But Gulf of Mexico operators are also finding that they must compete in a timeframe sense; i.e., they need to reduce the cycle time. Can you talk about gains that Kosmos Energy had made on these fronts?

Clark: One of the reasons we focus around infrastructure is that it allows us to get our projects onstream very quickly. Historically, we have averaged about 18 months from discovery to production. In some cases, we can be under a year. We are always looking for ways to shorten our cycle time. We inventory trees and other long lead time items to take them out of our critical path. We approach host platforms even before drilling our exploration wells so that we can select our host and establish commercial terms. Once we have a discovery this allows us to move fast.

Offshore: To what extent can one compare the deepwater Gulf to onshore shale? Won’t it always be true that deepwater development will take longer before first production, and therefore require more investment?

Clark: Our ILX activity in the Gulf of Mexico is economically competitive with the shale plays. Our breakeven price at a PV10 is $30.00/boe. Because of the production profiles from most deepwater reservoirs our projects can generate significant free cashflow where the shale plays can’t. They need to continually “feed the beast” by drilling wells every year to maintain production. We have cycle times of a year to 18 months. Very quick. This generates high IRRs and quick payouts. Roll it all together and I think we are very competitive with shale.

Offshore: There has been a lot of industry consolidation in the wake of the downturn, particularly in the oilfield service and supply sector. What trends do you see in the consolidation of the OFS market? Is it more beneficial for operators to deal with fewer contractors that can offer more products and services, under one ‘roof’, so to speak?

Clark: Consolidation in the oilfield service sector is driven by the low activity we have today. They have to right size their companies and their fleets to match that activity. Obviously, this results in fewer companies. What we want from service companies is best-in-class equipment and services and good prices. These are the dominant drivers. Bundling services for us is fine as long as there is good performance and no weak links. We are not looking for a one stop shop.

Offshore: The Gulf of Mexico rig count has fallen by more than 50% since 2014. To be sure, this is a manifestation of the downturn. But has rig count become less important as a metric, with the advent of new drilling technologies?

Clark: There have been a lot of efficiency gains in the deepwater driven by technology. We are drilling wells faster and our completions are better. We certainly haven’t doubled efficiency where one rig does what two did before, but we have made and continue to make improvements in this area.

Offshore: What is your view of the Gulf of Mexico E&P market going forward, in the near and long term?

Clark: Near term, I see a lot of opportunity with little competition. We are not seeing new companies entering the Gulf so I don’t think competition or activity is going to change much in the short term. I think we are at the bottom concerning service cost. Consolidations will firm up cost a little bit but until activity materially picks up, I don’t see a lot of cost escalation. In the longer term, I think seismic will continue to get better which will generate more exploration opportunities for many years to come in the Gulf with sustainable margins and returns. •

About the Author

Bruce Beaubouef

Managing Editor

Bruce Beaubouef is Managing Editor for Offshore magazine. In that capacity, he plans and oversees content for the magazine; writes features on technologies and trends for the magazine; writes news updates for the website; creates and moderates topical webinars; and creates videos that focus on offshore oil and gas and renewable energies. Beaubouef has been in the oil and gas trade media for 25 years, starting out as Editor of Hart’s Pipeline Digest in 1998. From there, he went on to serve as Associate Editor for Pipe Line and Gas Industry for Gulf Publishing for four years before rejoining Hart Publications as Editor of PipeLine and Gas Technology in 2003. He joined Offshore magazine as Managing Editor in 2010, at that time owned by PennWell Corp. Beaubouef earned his Ph.D. at the University of Houston in 1997, and his dissertation was published in book form by Texas A&M University Press in September 2007 as The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005.