Offshore Leadership Forum addresses capex challenges

Industry executives discuss transformative ideas, solutions

Sarah Parker Musarra

Editor

Bruce Beaubouef

Managing Editor

Editor’s note:The Offshore Leadership Forum followed the Chatham House Rule. Therefore, all guest speaker names, company affiliations, and project details have been withheld.

Offshore magazine and consulting firm Independent Project Analysis (IPA) recently presented the Offshore Leadership Forum. The inaugural event, entitled “Improving and Sustaining the Capital Efficiency of Major Projects,” was held in December in Houston.

As the oil and gas industry looks to recover from the downturn, the forum was developed to provide a recurring platform for senior leadership to exchange ideas and best practices. The next session is currently under development to be held later this year.

Some of the key items addressed by the line-up of senior executives included a frank assessment of the current market; several proposed methods to dramatically reduce project capex; ways in which the industry could evolve; the changing roles of the supply chain, contractors, and operators; as well as specific initiatives and lessons learned from other industries that could help its recovery.

Along with being a co-presenter, IPA was also the event host sponsor. Wood Group was the session and coffee break sponsor. Stafford Menard, vice president of Deepwater Development for Audubon Engineering Solutions, the event’s lunch sponsor, presented on the company’s smaller, standardized floating production systems offering (For further reading, refer to the September 2016 issue ofOffshore) during the mid-day meal.

The day kicked off with a closed-session roundtable discussion between the high-ranking executives, with the panel of 16 participants representing nine different operating companies. The second component of the forum comprised presentations from senior oil and gas executives.

Following the roundtable discussion,Offshore Chief Editor and Conferences Director David Paganie spoke briefly to welcome the audience on behalf of the event’s partners. He explained the purpose and intent behind the inaugural Offshore Leadership Forum and its theme before introducing IPA Founder and President Edward Merrow. “We are seeking transformative ideas and solutions for the oil and gas industry,” Paganie told those in attendance.

To begin the day’s presentations, Merrow, who has more than 35 years of experience in analyzing capital projects, described what he believes to be the industry’s new reality.

Companies initially reacted to the oil price crisis by slashing costs, first through workforce reductions, and then through other avenues including re-organizations, forced supply chain reductions, and travel bans. However, Merrow explained, the primary objective was no longer one of reducing budgets.

“We cannot ‘cut to prosperity’ and we need to understand that,” he said, later adding, “Most of us probably could or should be running leaner than we were in the 2006-2013 period, but that will not restore the industry’s economic health. It cannot possibly.”

Beyond ‘lower for longer’

Although running a leaner operation is justifiable, instead of further cuts, companies should face the possibility of a “lower forever” scenario, rather than “lower for longer.” Those companies learning to survive on the current prices will be the ones to survive, Merrow explained to the audience.

“The new reality is that we are not earning the kind of returns we need to be healthy industrial companies, on the owners’ or suppliers’ side,” he said. “Industrial companies need to earn about 12-15% real return on capital employed to be considered healthy.” Most E&P companies today are far below that level, he added.

Evidencing this “lower forever” scenario is that consumption levels in the Organization for Economic Cooperation and Development’s (OECD) 34 member countries are trending downward.

In addition, IPA found that there was very little demand bounce even when oil prices declined in the OECD. While it found that higher demand in the developing world, Merrow said that it would likely be only temporary, “given the problems the world has with carbon.”

Companies that can learn to operate on today’s oil prices will be the ones to survive, Merrow observed. He noted that the World Bank predicted a rebound in 2022, albeit only to $60/bbl, with even the Organization of the Petroleum Exporting Countries acknowledging that the long-term outlook is not good for consumption and prices.

He informed the audience that globalization has introduced more problems to the supply chain than anticipated, with markets softening overall by about 15-20%, he said. Some areas, like rig rates, suffered more than others, including subsea; IPA also found there had been very little decline in effective engineering costs. Although rates have stabilized or in some cases declined, productivity is falling. Engineers and contractors reported to the organization that they have been taking on work below their fully-burdened cost, a practice that Merrow said cannot continue because it is obviously not sustainable.

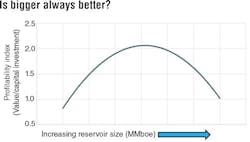

“To get to a 15% internal rate of return, capex needs to basically be cut in half from the average cost from the 2008-2014 period,” he emphasized. “We cannot get this from the supply chain.”

Facing facts

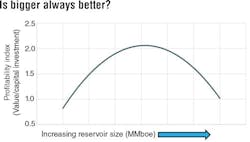

The industry will need to accept several sobering truths to achieve such levels of cost reduction. In examining recently completed projects with a year or more of operational history, IPA found an apparent optimism bias toward reservoir performance. In its latest sample, half of the projects were outside of the supposed P10-P90 range, with most on the low side, operating on the P70, Merrow said. With the planned production plateau at 70%, industry builds on average more than 40% too much capacity - overspending by a fair amount.

In order to carve out large amounts of capex, production intensity should be lowered to extend the production profile.

“The rate at which we draw down reservoirs needs to change,” Merrow said. “Rapid draw-downs … simply cannot be sustained at $50/bbl. We probably need to leave more of the higher-cost barrels in the ground.”

Another fact the industry will need to accept is that it is a low-margin commodity industry, as it was in the 1990s. Furthermore, Merrow posited that it will need to begin behaving like one by focusing on areas like the total cost of ownership, rather than just the initial costs.

He continued by mentioning several areas that should be of critical focus, and these would be echoed throughout the day by the other presenters: Chiefly, equipment should be fit-for-purpose, operationally safe and reliable, and not fit-for-kings. Simple and reliable solutions should be favored over the best possible ones.

To help with this shift, the oil and gas industry could benefit by looking to other low-margin businesses, like the chemical industry, Merrow said, which focuses on very good production attainment averages. These levels typically average in the mid-90s in chemical, versus the less-than-70 scenario seen in oil and gas. In addition, chemical facilities are designed to run with high up-time for 20 years, versus the eight years familiar to E&Ps.

Automation in the mining industry could also serve as an example to the oil and gas industry, which trails the former by about 10-15 years. The example of a mine in Western Australia was given: Fully-automated, it is managed remotely hundreds of miles away, in Perth. Beyond automation, the Internet of Things (IoT) could be employed to greater use in the oil and gas industry, as it allows full control with improved uptime and lower operating costs, Merrow said.

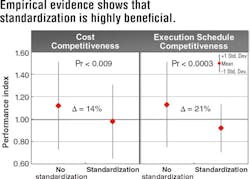

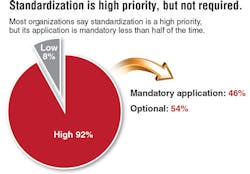

The example of standardization was used to illustrate how slow the industry is to change. Reflecting on how long the concept had been discussed, Merrow then carefully emphasized how important it is for the industry to move past talking about change to enacting wide-scale change.

“This is a difficult period of adjustment,” Merrow said. “But, we must go through it relatively quickly or we might not make it through at all. There’s more urgency about change now than ever before.”

Closing the forum’s first presentation of the day, the IPA founder reiterated the importance of change, and of transforming the industry’s mentality. This was not only the best time to do so; it is necessary.

“Now is the time to get things accomplished and not just talked about,” he said.

Capturing future opportunities

An executive from a major international E&P company discussed its strategy to reduce costs and boost efficiency that began several years ago, when the price of an oil barrel was still firmly in the triple digits. This early adoption, the speaker said, “positioned us well,” seeing the company through the crisis and allowing it to capture value when the upturn occurs.

“We had to embrace change at the grassroots-level,” the speaker said, crediting the company’s “relentless pursuit of excellence in all areas of operation.”

As a result of this program, the company dramatically lowered its per-barrel breakeven cost. Achieving a difference of around $30 in about three years, it handily beat its targeted price by $10, the speaker explained. In addition, the company reduced its facility costs by 15% as well.

To illustrate the effectiveness of the company’s strategy, the speaker shared a pair of international case studies. The first covered a project located off South America that saw a $25 reduction in its per-barrel breakeven cost in just two years.

The speaker explained that the company optimized areas such as its drilling operations, well design, and project support; and reduced costs everywhere it could, especially management costs.

Importantly, it rolled out a new execution model, one modeled after operations in the Gulf of Mexico.

“We utilized our existing relationships with contractors, relying on them to define the path forward,” the speaker explained. “It is no longer ‘operator vs. contractor.’”

Shifting the focus on the contractors to manage their respective areas of expertise allowed the company to maintain very lean management teams. This was a key area of cost reduction that in turn proved to be a key area of success in the first case study.

Additionally, the Gulf of Mexico model meant that everything was engineered as fit-for-purpose, with adjustments made only as needed.

According to the speaker, the company also carefully examined its own standards, as well as international standards, scrutinizing them strictly before deciding if they were to be applied to the project. Local construction teams were used, and the often-costlier international standards were “followed but minimized,” the speaker explained.

The second case study shared during this presentation described a project offshore Europe. Once again, the speaker explained, the company shaved costs by amending its execution strategy. The strategy was simplified, to echo a theme present in the previous case study; and the result was a $35/bbl reduction in breakeven cost - and a capex reduction of nearly 50%.

“[The company] went back to basics,” the speaker continued. “We took a fundamental look at how we do things.”

The speaker emphasized how critical standardization and simplification is to the industry, calling it one of the building blocks of the future competitiveness of the industry. The speaker also pointed to other industries that made better use of automation, and concluded that as other industries had entered their “next-generations,” it was time for the “next-generation oil and gas industry.”

“There’s been very little change over 20 years,” the speaker exclaimed. “Let’s be leaders. Let’s be bold and deliver on this.”

Another key focus, or building block, was the modernization of the industry through the adoption of what the speaker called “transformative technologies,” including more widespread use of tools such as the IoT and harnessing the power of data.

The executive suggested that the industry needed to move quickly in embracing change. “We see incremental changes in oil and gas,” the speaker said, emphasizing the importance of learning from other industries. “Incremental changes are fine, but we need fast and transformational change.”

In closing, the speaker described another building block for the industry’s future competitiveness: inter-company collaboration.

“Our industry is not set up for collaboration,” the speaker said. “It is difficult to get two companies to agree on plans, but think of what we could achieve if we worked together.”

‘Standardize and simplify’

Another speaker with a major oil company agreed with the point that digitalization and standardization could be seen as part of the transitional steps necessary to move the industry into becoming more modernized.

The speaker then introduced the need for a change in current practices by introducing some startling statistics.

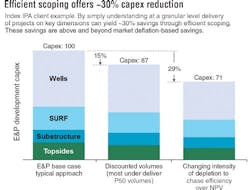

“Relative to the early 2000s, capital project costs have escalated two to three times on a like-for-like basis. More than 70% of this is not the result of cost escalation due to oil price,” the speaker said. Instead, recent data showed the escalation to be due to inefficient practices.

The speaker added: “Suppliers say that operators are not consistent. We have allowed the supply chain to evolve to deliver customized products. They have done so because that is what [suppliers] perceive we want. We need to break this barrier.”

Continuing, the speaker referred to a 2016 industry survey that investigated barriers to cost-sustainability in the oil-price-dependent oil and gas industry.

The survey pointed to a lack of structural changes and a short-term outlook as major hindrances to sustainable cost-reduction. For example, current efforts to reduce costs have been procurement-driven, in pursuit of unit cost reduction, or through thousands of employee lay-offs.

However, there have been no structural changes made to the way the industry operates.

Also noted was the unsustainability of the losses taken by the service companies. Once the market recovers, the service providers will move to regain margins, the speaker warned.

The speaker also pointed to the absence of a long-term, collaborative approach within the industry, which leads to an “us vs. them” mentality and discourages risk-sharing. In addition, the continued aversion to standardization leads to custom equipment made for every customer.

“The current system is probably the most inefficient,” the speaker concluded.

To overcome some of these barriers, the speaker’s company looked beyond itself for solutions. It developed a system in collaboration with contractors and suppliers to standardize and simplify equipment and package requirements. The focus was on creating and efficient and highly repeatable procurement process. This system made sizeable reductions in the mountains of documentation driven by specific project requirements and produced results and efficiencies on both sides - supplier and buyer.

In one example given, 10 documents came to suffice, where there had been more than 60 before. Having worked on this process, two major industrial technology producers for the oil and gas and other industries were quoted in the presentation as now having a defined, standard product or package to offer other operators. The speaker noted that both suppliers had previously touted their respective abilities to design and make anything to spec, which illustrated the shift in approach.

Another success shared based on the company’s approach of choosing supplier-led solutions was based on the fabrication of a major piece of subsea production equipment. By using in-stock components, relying on a structural frame design from a previous project, and by employing risk-based engineering judgement, the equipment came in under budget and with a reduced delivery time.

Perhaps most impressively, the piece took about 30-40% of the original capex and allowed tiebacks that were previously impossible. The supplier-led solutions approach is now deployed on all of the company’s subsea systems.

The speaker called the approach a “massive enabler for how we do business.”

“You have to meet in the middle to understand the supplier and operators’ respective risks,” the speaker said.

Winding down the presentation, the speaker shared a number of reflections with the crowd, telling them to always listen to suppliers, using risk as a common language to broker trade-offs.

The audience was imparted to examine the standardization of not only products, but the process of how things were done, which is where a lot of expenditure can be spared.

Deepwater future

An executive with another major international operating company noted that there are about 350 Bboe - roughly 8% of the world’s total hydrocarbon resources - located in deepwater fields, according to several industry estimates. Only 15% of these deepwater resources have been developed to date. “There’s still a lot out there,” the speaker noted. “Too many companies have put too much of a stake in deepwater for them not to pursue it.”

But the low oil prices of the past two years have led companies to shelve a number of long-planned projects. Concept design has a lot to do with this, the speaker commented. “We will continue to struggle with standalone projects at $50/bbl,” the speaker noted. The industry needs to move to lower-cost concept designs, such as long-distance subsea tiebacks.

And, new technologies will be the primary means of moving forward. “Research and development is the only way to a sustainable deepwater industry in a $50/bbl environment,” the speaker observed. “Gone are the days of the elephants. Today’s fields are smaller, more remote, and complex.”

There have been a number of initiatives launched by industry to address these challenges in recent years, the speaker noted. These have been aimed at reducing complexity, and promoting standardization and industrialization. “But will these efforts get us there?” the speaker asked. “No. We find that innovative technical solutions are the only way.”

The question of rising costs is a critical one, the speaker said. Costs more than doubled in the decade preceding the oil price drop; and in the five years preceding the oil price decrease, costs continued to climb.

For most major operating companies, even when oil prices were $100/bbl, return on investment was low and unsustainable. These costs increases were not solely caused by inflation, the speaker observed. “It was also due to excessive complexity, and varying specifications,” which in turn led to lower levels of “industrialization and competition.”

Operating companies should always keep in mind, the speaker commented, that “deepwater needs to remain competitive with onshore shale development.”

To remain competitive, the speaker offered a number of broad recommendations. “The industry needs to simplify and reduce complexity,” the speaker observed, “and there needs to be an acceptance of ‘good enough’ designs.”

Other recommendations followed. These included a need to simplify specifications; a need to align on technical specifications; and a need to standardize on modules. Industry-wide adoption of these methods and practices could lead to a 25-30% reduction in lead time and cost.

In fact, the speaker observed that the industry has already made significant strides in cost reduction, with a 30% cost reduction over the past two years. This decrease has largely been driven by the vendors, suppliers, and contractors in the wake of falling oil prices. “Contractors are willing to make these discounts now,” the speaker recognized, “but what about later when demand increases?

But this level of cost reduction is not sufficient to justify deepwater development, the speaker noted, “and further reductions are needed.” The industry needs 50% cost reduction for deepwater to remain competitive with onshore shale production. This reduction would rollback costs to 2014 levels before the oil price decline. And new technology development, the speaker reminded the audience, “is essential in driving this cost reduction, and in making deepwater development viable.”

The speaker cited several cost reduction fronts that could help make deepwater development viable going forward. These include:

- Reduction in the cost of pipelines (single line, lower laying cost, composite pipe materials, subsea HIPPS)

- Reduction in flow assurance cost (greater use of low-dose hydrate inhibitors, better remediation technologies, more reliable prediction tools with lower contingency)

- Reliable and lower cost subsea processing

- Lower-cost subsea power/control systems (all electric, DC power, subsea chemicals storage)

- Lower-cost inspection, maintenance, and repair systems (higher reliability, intelligent condition monitoring, using resident AUVs instead of ROVs)

- Industry-accepted qualification criteria for new technologies

- Industry-wide collaboration involving all stakeholders/players in qualifying new technologies to control cost.

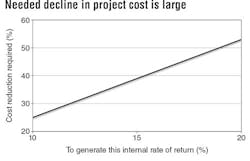

The speaker cited a realistic hypothetical example to offer details on the ways in which deepwater project costs could be reduced. The speaker explained how the operator of a deepwater production facility could reduce its capex significantly by taking some of its topsides equipment and placing it on the seabed.

In this detailed example, the speaker showed that the operator could reduce capex on this project by nearly 40% if they took their chemical storage units, and seawater treatment and injection equipment off the topsides, and placed them subsea.

In the example, the operator also placed a 14-in. wet insulated pipe and an all-electric controls system on the seabed. The power generation and subsea controls modules remained on the topsides. “It is this type of technology that will save our industry, if we do it in a collaborative way,” the speaker said.

Macro perspective

The panel also offered a macroeconomic perspective on today’s offshore marketplace. The speaker emphasized that even with the current market downturn, the fundamentals favor oil and gas in the near and long term. “The new reality is that global GDP growth will continue to drive demand for oil,” the speaker observed. It was predicted that global GDP will continue to grow at moderate pace in 2017.

But, there are some risks, the speaker noted, including tightening fiscal policy in the US; and the economic slowdown in China and the OECD countries. Still, the speaker exhorted attendees to remain focused on the fundamentals. And those fundamentals, the speaker said, should continue to push future growth in worldwide energy demand. Even in a market flush with excess inventory, the speaker noted that worldwide oil demand was up again in 2016 at 1.3 MMb/d, and has been projected at 1.2 MMb/d for 2017.

And the long-term future is even brighter for the energy industry, the speaker said. Worldwide energy demand is expected to grow by almost 40% by 2030. “There will be demand for energy products,” the speaker said. “We need to think about these fundamentals when developing our strategies.”

Where will that growth come from? Not from the US, the speaker noted. “It will be from non-OECD nations such as Africa, India, and China.”

And operators should remember that there is always a 4-6% natural decline in production that needs to be accounted for. “We will need significant new production just to keep production flat overall,” the speaker observed. “Quite frankly we will need it all, every form of energy.”

The speaker acknowledged that there will be several uncertainties going forward. The political and regulatory impact of climate change will be a major topic going forward; and evolving automobile battery technology and geopolitical uncertainty will also continue to drive change. “Politics are as important as production,” the speaker said. Several political environmental issues have halted production in recent years, including the Keystone pipeline; the effects of seismic technology on marine mammals; methane emissions; and the Oklahoma earthquakes.

And, offshore operators cannot forget what they are competing with. “Today’s reality is that the offshore market is in direct competition with onshore development, and offshore is at a disadvantage due to cost and cycle time,” the speaker said. However, some operators are active on both fronts.

The cost structure of deepwater projects must allow for economic development at $50/bbl, or even less, to adjust for risk, the speaker said. “Offshore - especially deepwater - is disadvantaged.” Subsurface complexity and uncertainty is increasing, and “the pool of skilled labor may erode quicker than we think.”

On the positive side, the offshore marketplace is on the leading edge of technology. “It’s up to us. How will we choose to respond?” the speaker asked. “Our choices will decide the future of offshore…the opportunity is there.”

One of those choices will be technological versus behavioral transformation: “which change do we pursue?” the speaker asked. “There is no magic bullet.” Success will come through a series of things, the speaker predicted: supply chain efficiencies, design standardization, innovative field developments, and the terms of commercial agreements in the international arena.

Recent trends are encouraging, the speaker said, noting that costs have come down over the past two years. Drilling rig rates are at “rock bottom,” and drilling days per well have improved. Supply chain costs are down, and production rates and efficiencies have increased with improvements in completion technologies and multiphase pumping. “Supply chain costs are going down, productivity is rising, and assets are coming onto the market,” the speaker observed.

“The big bite is from drilling rig rates,” the speaker said. These rates are down significantly, but the problem is that they can just as easily go back up. “Rig contractors are accepting and pursuing breakeven contracts, but that can’t last forever,” the speaker acknowledged. “Eventually the drillers will need to make money.”

Regulatory costs can also have a profound impact, the speaker noted. With the pending increase in abandonment costs, the new federal regulation could lead to an “oligopoly” in the Gulf, and “the pool of operators could shrink.”

The speaker also warned against the creation of silos that prevent integration - subsurface, drilling, completions, subsea facilities, surface facilities - “but this is the one thing that we can control.” Greater integration and connection of these activities could also help reduce costs, the speaker argued.

Looking at the international market, the speaker took some time to compare the regulatory regimes of various offshore producing provinces. Even at 48% government take in the Gulf of Mexico, the speaker noted, “things are tougher elsewhere.” Other nations are requiring 60-80% of the take.

At the same time, falling oil prices have hit host governments hard, particularly those in developing countries. Many of these, the speaker noted, are now suffering from budget deficits, currency devaluations, import/export imbalances, no new reserves being discovered, and civil unrest - with Venezuela a prime example. “These nations are now starting to see that they are in competition for capital from the oil companies.”

One way forward here is for international oil companies to seek “fiscal flexibility” - the ability to modify existing terms to move things forward, then adjust the terms when circumstances change. The speaker recognized that this type of idea is “easy to propose” but often goes nowhere. In most cases, the speaker observed, “the conversation just dies.” State oil companies are often very opaque, the speaker noted, and there is often intra-governmental conflict that prevents progress on these fronts. “Until the pain of doing nothing exceeds the pain of change, nothing will change.”

There will be challenges in the days ahead, the speaker allowed. A move toward industry-wide standardization will be the biggest challenge. But the speaker was pessimistic on the feasibility of implementing this type of initiative. “While we arm-wave about ‘standardization’ and ‘alliances,’ the reality is that every company has its standards which are entrenched in culture, processes, and people.” Competition between operators and between service companies constrains both concepts, the speaker explained. “Intra-company dynamics are often at odds, let alone between companies; and competition is another problem,” the speaker said. “It’s doubtful that we can pull it off.” Instead, the industry should focus on other ways to reduce costs.

“Even if we grind costs down and negotiate improved terms - have we learned our lesson?” the speaker asked. “Or will we simply repeat the sins of the past?” Speed kills, the speaker observed. “There is often too much pressure to go too fast. In this type of situation, strong leadership is vital.”