Subsea processing moves forward with challenges in tow

Jon Fredrik Müller

Rystad Energy

Offshore developments are continually moving into deeper waters and the nature of the game is that the biggest potential targets get drilled first with the most commercial fields being developed. As the offshore fields mature, pressure differentials narrow and step outs from existing infrastructure increase with the newest technology being developed to tackle the challenges.

New technology has been implemented gradually both in greenfield developments and modifications of existing fields, but for many of the technologies that adaptation is still low. There are several key subsea technology developments in the works that could reduce future barriers for widespread use.

Subsea processing is the concept of gradually moving the entire topsides processing facilities to the seabed which would create better financial returns due to increased recovery. In some cases, subsea processing is a prerequisite for making marginal field developments economically viable. By moving the processing of the well flow from the topsides to the seabed, projects previously deemed non-commercial may become economically viable, while increasing the recovery rates on existing fields. Currently, Petrobras, Statoil and the majors, along with equipment manufacturers, are driving the developments behind subsea processing. While subsea processing encompasses a large array of technologies and systems, there are mainly four technologies that have been implemented by the industry so far: boosting, separation, water injection, and compression.

Subsea boosting

Subsea boosting is the application of subsea pumps to "boost" the pressure in the well stream. The main advantages of subsea boosting are accelerated production; increased production and recovery; development of low energy reservoirs; heavy oil fields; long tiebacks; and where pressure differentials pose a problem.

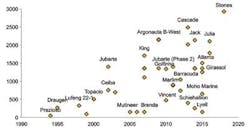

The first subsea booster pump was a twin-screw multi-phase pump developed by GE Oil & Gas, which was installed in Eni's Prezioso field in Italy in 1994. Since this first installation in water depths of 164 ft (50 m), the technology has reached deeper depths. For instance, the Cascade oil field in the Gulf of Mexico (GoM) is currently the deepest subsea boosting system installed, at a water depth close to 8,202 ft (2,500 m); and Shell is currently contemplating booster pumps at its Stones development in 9,514 ft (2,900 m). Although GE was first, it is OneSubsea (through Framo Engineering) that has become the market leader, capturing most of the market with their helico-axial pumps. Today, the booster technology is by far the most mature of the subsea processing technologies.

Booster pumps are mainly used in oil fields with low gas to oil ratios, both for heavier and lighter crudes. The key regions have been, and will continue to be, Brazil, the US Gulf of Mexico, the North Sea, and West Africa due to the water depths, reservoir characteristics and tieback distances.

Subsea separation

Subsea separation is the concept of separating gas/liquids or oil/water at the seabed. Such systems bring solutions to flow assurance challenges such as hydrates and slugging; enables viability of challenging reservoirs; prolongs economic lifetime of fields; debottlenecks flowlines, risers and topsides; and handles water and sand at the seabed, thereby reducing the potential costs associated with a topsides facility. Many of the installations have been in conjunction with booster pumps with subsea separation today, being a proven technology. While OneSubsea has taken the lion's share of the booster market, it is FMC Technologies that have become the market leader in the separation segment, being system provider for the majority of projects completed.

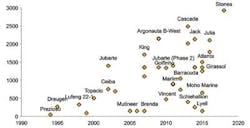

While experimentation on subsea separation systems occurred prior to the 2000s (Zakum 1965, Highlander 1985 and Argyll 1986), most people regard the Statoil Troll C pilot on water separation and injection in 2001 as the first modern subsea separation unit. The Troll system was installed in 1,115 ft (340 m) of water depth, 2 mi (3.5 km) from the platform. Today, it is Shell's Perdido field which is the deepest application of subsea separation at approximately 8,202 ft (2,500 m). Subsea separation systems have now been installed at 11 fields operated by Petrobras, Statoil, Shell, and Total. All the fields lay in Brazil, Norway, US GoM or Angola, and going forward, these areas, including the rest of the North Sea and West Africa, is seen as the primary markets for such systems.

Water injection

Subsea water injection is used to increase recovery, and thus, important for value creation. In conventional injection systems, water is normally required with the water treatment being performed topside. High pressure water pipelines to the wells are installed, which means higher development costs. With subsea water injection, the whole system is placed on the seafloor, only requiring power from the shore/host.

The main potential advantages of subsea water injection include the ability to avoid expensive high-pressure flowlines, potentially expensive topsides modifications, and enabling more flexible development solutions in terms of injection well placement and timing. The first system was installed at Columbia E in the UK part of the North Sea in 2007. Since then, similar systems have been installed on the Tyrihans field in Norway (2011) and at Albacora L'Este in Brazil (2013). However, costs remain high and need to decrease to see more widespread use of these systems.

Subsea compression

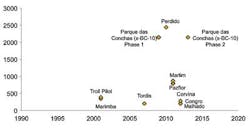

Subsea compression increases the pressure difference driving the gas through the flowline, and it effectively lowers the wellhead pressure, thus speeding up production and increasing recoverable reserves. The compressor can be placed close to the well, which increases and accelerates the production. Until recently, the solution has been to install gas compressors on an existing platform, or to build a new staffed compression platform. By taking the compression subsea, one can reduce the need for additional platforms. However, subsea compression systems are complex and require large gas resources to justify the investments.

Subsea compression is a technology under development and remains to be proven, although Statoil has qualified two different systems, Aasgard and Gullfaks Compression, which will be installed in the near future. In addition, the technology has been tested in an onshore pool on the Ormen Lange Pilot project, where Shell is the operator. However, in April 2014, Shell put the concept selection for Ormen Lange on hold, citing too high costs, and an option value in compression not being time critical. While the Ormen Lange and Aasgard fields will require separation of liquid from the well stream before compression, Gullfaks South will involve compression of wet gas without pre-separation. Aker Solutions is working on the Aasgard project, and they also had the Ormen Lange pilot, while OneSubsea recently delivered the system for Gullfaks South.

With the subsea processing technology moving forward, the number of platforms may be reduced in the future. Even with a full-fledged subsea factory, the distance to shore might be such that offshore export solutions are preferred and risers will still be needed.

Water pressure and the structural integrity of the risers have been an issue that flex pipe manufacturers have been working on for many years. By the end of the 2000s, flexible production risers were approved down to around 6,562 ft (2,000 m), however, there were rigid and hybrid solutions (riser towers/submerged bouys) capable of handling deeper waters. Currently, there are flexible production risers capable of withstanding 8,202 ft (2,500 m), and the qualification of equipment for deeper waters is likely to continue. Into the 2020s we might see water depths at around 9,843 ft (3,000 m), for example with the giant Libra development moving forward in Brazil. These depths are at the limits of what is possible today, but the hope is that emerging composite flexibles (more strength and less weight) will be qualified to handle water depths beyond 9,843 ft (3,000 m).

What does the future hold for subsea processing? Statoil is working on completing the subsea factory by 2020. Several of the building blocks needed are in place, however, this vision needs to be fine tuned to reach such an aggressive target. With the current downturn in the market, the mid- to late-2020s is probably a more realistic target before such a complete subsea facility is tested and in place. There are several challenges toward the full-fledged subsea factory.

Some of the obstacles needed to overcome are:

Power distribution. Large subsea fields with high power inputs, many components and long step-out distances means that subsea variable speed drives will be needed to convert, distribute and control the electricity. The subsea components run on high voltage alternated current, which has limits on transmission distance relative to power, meaning that high voltage direct current may be needed. Major electro and automation companies like ABB and Siemens are working on these aspects.

Control systems. Putting all the equipment subsea also increases the requirements for the control systems. There will be a need for increased bandwidth, real-time information on system performance, in addition to increased demands on safety functionality and regularity.

Oil storage. Not seen as a major technological challenge by the operators, but a component that needs to be tested and qualified. Kongsberg Oil & Gas has an ongoing development project for Statoil.

Monitoring. Knowing the state of the well stream will be crucial in terms of production monitoring and flow assurance. Improved reliability for subsea and multi-phase sensors will be key.

Subsea well intervention. Subsea processing fields bring challenges related to year-round well intervention and maintenance operations from ships in high waves, particularly the handling of large and heavy processing modules. The reduced accessibility of a subsea installation, compared to a topsides, brings additional requirements to the system uptime, maintenance on demand and a general optimization of the intervention frequencies. To handle the up to 400-ton modules at Aasgard, in waves of 15 ft (4.5 m), Technip is supplying Statoil with a new handling system to lower and raise modules over the side of the vessel.

Integration, reliability, and cost. Enabling and qualifying the integration, i.e. cooperation between all of the components, is a key challenge with standardization being a key topic. In addition, equipment needs to be more robust, have a proven high-reliability and a decrease in cost.

Considering the number of subsea fields (~1,500) compared to the number of subsea processing projects (boosting ~30; separation ~15; compression ~three), the current technology adoption is low. The main reasons for this are related to costs; uncertainty regarding reliability (proven on boosting and separation by now); and a general conservatism in the industry. These factors are likely to be spurred by the current cost-sensitive environment where low-risk solutions seem to be preferred. This downturn in the market might be a bump in the road in terms of realizing the subsea factory. However, looking toward the end of this decade and into the 2020s, offshore field developments are forecasted to be one of the most important sources for new liquids production. With shelf production maturing, and the most prospective areas in deeper depths, the need for these technologies will increase.