Emergency preparedness study seeks to quantify best practices

Florent Andrillon

Christopher Miller

Capgemini Consulting

The oil and gas industry invests significant financial and human capital resources in the prevention of injury, casualty, and disaster. After prevention, preparation for emergency response is the next most important consideration so any negative consequences can be mitigated effectively.

Following the Macondo incident, US regulatory authorities shut down drilling in the Gulf of Mexico until the industry could demonstrate its ability to contain a deepwater blowout. The industry leaders – Anadarko, Apache, BHP Billiton, BP, Chevron, Conoco-Phillips, ExxonMobil, Hess, Shell, and Statoil – formed the Marine Well Containment Company (MWCC) Its mission is to be continually ready to respond to a well control incident in the game and to advance associated capabilities to keep pace with its members' needs.

Based on its work with MWCC, Capgemini Consulting conducted an Emergency Preparedness & Response (EP&R) survey across 20 oil and gas producers and 10 oil field services companies with participation representing roughly 10%-15% of the world's daily oil and gas production.

The survey was conducted to codify and quantify best practices, while at the same time summarizing where companies should focus financial resources in EP&R. It provided a view into the industry's evolving emergency response capabilities, assessing priorities, performance gaps, and the development of capabilities.

The results indicated that respondents have started to create a holistic, integrated approach to EP&R. For example, while equipment tests and drills had historically been conducted at an asset-level, companies shifted towards creating globally standardized emergency management systems. Since the survey was published, leading oil and gas companies have made substantial investments in innovative equipment and technologies. However, as the fifth anniversary of the Macondo incident nears, there are significant gaps in approaching EP&R capabilities on a holistic basis including organization, people, and process elements.

Historical improvements

According to the International Oil & Gas Producers Association (OGP) the reasons for fatal incidents include: inadequate risk assessment, supervision, work standards and procedures; improper decisions; unintentional violation of regulations; and inadequate training or lack of competency across workers. Besides this, as many as one-third of these fatalities are caused by vehicle or air transport incidents. In addition to the casualties, the industry faces several major gas leaks and spills each year.

Common survey findings

Capgemini Consulting's EP&R survey revealed nine major performance areas that could be improved, but five in particular stood out as critically important to each respondent:

EP&R tests, drills, and performance measurement. Organizations tend to demonstrate varied execution of EP&R testing and performance measurement in an effort to meet regulator mandated requirements. While most tests and drills are currently conducted at the asset level, there was a clear trend in the survey towards globally consistent EP&R capabilities; tests and drills are moving beyond an asset-level focus. One of the greatest challenges highlighted by the companies was ensuring adherence to quality standards, and meeting the capability requirements of JV partners.

Information sharing. Although most organizations recognized the need to document best practices, few had a formalized process for doing so. Around 23% of organizations surveyed did not have any formalized process to facilitate the sharing of lessons learned and best practice knowledge. The other organizations presented disparate approaches for sharing EP&R best practices, ranging from technical support, drills and training exercises, to knowledge sharing sessions. There is also an evolving capability maturity with the use of digital information sharing tools. Some organizations are using surveillance tools and specialized software for EP&R support. One example of these capabilities is the geographic information system (GIS) teams in response to emergencies such as gas explosions, oil spills, and in-response management.

Training and competency assurance. Most respondents indicated that their employee training and competency plans were designed to meet, but not exceed regulatory and compliance standards for, workforce competency. Leading practices observed include: cross training and the swapping of roles during exercises and drills to ensure a degree of robustness in the response plan. EP&R is as a driver of better industry collaboration. Organizations are realizing the potential implications of not effectively responding to catastrophic incidents. These organizations also feel that EP&R can be a path that drives industry collaboration.

Continuous improvement. Around 90% of the companies surveyed responded "no" when asked if EP&R applies only to catastrophic situations. Instead, EP&R applies to all kinds of incidents, which were categorized by their severity on a "tiered" system. Also, EP&R plans were mostly asset specific, with guidelines provided from corporate management. Unless a low probability risk has high consequence impacts, organizations may not conduct drills and exercises for less-than-likely risk scenarios.

Contractor identification and selection. Most organizations recognize the potential resource needs (and challenges) of supporting a sustained, large-scale response effort. In fact, more than 50% of organizations surveyed indicated that they hire external resources as part of their EP&R department. The top areas where survey respondents leveraged third-party service providers are EP&R documentation and planning, as well as the usage of specialized equipment. Around 65% of companies surveyed did not maintain a dedicated full-time staff (more than 10 people) working as part of an EP&R team. In lieu of dedicated staff, individuals across the organization were tagged with EP&R responsibilities in addition to their primary job duties. As a result, most EP&R activities were not budgeted as part of a larger cost center preventing a company's ability to focus on planning for larger EP&R system upgrades, tests, and drills. In the case of smaller organizations, the EP&R function was typically outsourced to a third-party vendor.

Other EP&R performance improvement areas identified by the survey included: Asset Tracking and Condition Monitoring; Demobilization Planning; Maintenance of Equipment Readiness; and Equipment Deployment Operation and Monitoring.

EP&R progress

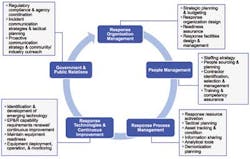

Overall, the survey results indicated that leading oil and gas companies lacked a holistic, enterprise-wide view on EP&R. Capgemini used the results to design an approach to analyze, prioritize, and subsequently fix the key issues faced by oil and gas companies in EP&R. This approach consists of five core elements: Response Organization Management, People Management, Response Process Management, Response Technologies & Continuous Improvement, and Government & Public Relations.

Since the EP&R survey was published, significant advancements have been made in Emergency Response Equipment & Technology. In addition to the contributions made to industry consortiums such as MWCC, offshore operators such as Shell, BP, and others have made investments in advancing the capabilities of EP&R equipment. Innovations in BOP and capping stack technology continue to be a focus on equipment capability development. For example, there are nearly 20 capping stacks currently available for deployment around the world, six of which are located in the deepwater GoM region.

There have also been significant developments in information sharing and data standardization. In particular, companies are working through common operating picture (COP) projects – largely focused on technology and data standardization.

Remaining gaps

While companies continue to invest in BOP improvements, containment technology, and data standardization, many are not taking a comprehensive, holistic approach to advancing all the key elements of the EP&R capability. Rather than institutionalize emergency response as a core organizational process, companies continue to view EP&R as a part-time support function. Organizations must work proactively to close the gaps instead of waiting to react to the next emergency situation. Companies should take EP&R beyond equipment and data standardization improvements, and include a holistic approach that also addresses the human and organizational elements.