Minimal facility production buoys could unlock 'stranded' North Sea resources

Jeremy Beckman

Editor, Europe

Britain needs to find new ways of harnessing its remaining offshore reserves, according to a recent UK government-commissioned report. Author Sir Ian Wood's recommendations included fostering new technologies to maximize recovery from UK North Sea fields and regional cooperation to allow more tiebacks of smaller discoveries to offshore infrastructure.

The report also noted that the average UK offshore discovery is now less than 25 MMboe, and that many of the undeveloped fields are marginal. There is no shortage of would-be developers of fields in this category. The main problem they face is raising capital because of the perceived risk (due to the region's high costs). Some current 40-MMbbl oil field projects in the North Sea based on FPSOs, the standard solution for stranded fields, carry a price tag of more than $2 billion.

One partnership has been working to develop economic solutions for marginal fields even in the 5-10 MMbbl range. This involves use of what they term "buoyant solutions" which can be unmanned, minimal facility production buoys or self-installing floating towers (SIFTs), both suited to rapid depletion of small fields and easily re-configured for service on others. Enegi Oil and ABTechnology, via their joint venture ABT Oil and Gas (ABTOG), are working on a first potential application on the 10-MMbbl Fyne field in the UK central North Sea, with plans to extend their program to the Irish sector and in the longer term to other parts of the world.

According to executive chairman Alan Minty, "this is not a venture recently set up to take advantage of the current interest in marginal fields, nor is it based on the idea that an economic and appropriate technology can be found to justify investing in a stranded or marginal field. The business model for ABTOG is based on using a real options approach where marginal fields with zero value are identified as candidates for development with an appropriate technology that re-values the field at a significantly higher price. ABTOG, by acquiring exclusive rights to these solutions, can then use the improved returns to make the project economically attractive and extract some of this value for itself alongside the existing licensees."

The basis for the concept was established more than 10 years ago when Minty was working on various development projects offshore eastern Canada, including Terra Nova and Hibernia. "One of my team [members] had the idea that the stranded gas fields lying between Newfoundland and Nova Scotia could be developed using gas-to-wire technology, with a cable run to deliver the power to the northeast US. It sounds far-fetched but this was at a time of severe power outages in the US.

"I didn't know much about marginal fields then and I am not sure that my colleague did either, but the idea of trying to find a way to 'recover lost reserves' intrigued me. I raised some money from Atlantic Canada Opportunities Agency (ACOA) in Newfoundland in order to test the economics using this technology; and the study report was subsequently reviewed by Lloyd's Register. The technology wasn't viable or sufficiently proprietary to justify undertaking further work, but the study showed clearly that if you could lower capital and operating expenditure you could have a huge resource, because there are so many stranded fields that are not being exploited."

In 2008, Minty co-founded Enegi in Manchester, UK, as an independent E&P company initially focused on an onshore "discovery" and a couple of offshore exploration licenses around Newfoundland's Port au Port Peninsula. Developing these proved more problematic than initially anticipated so Enegi's board decided that a better strategy might be to reduce risk concentration by building a portfolio of more highly appraised fields. "We devised a plan to find a way to acquire marginal field assets and proprietary but proven technology to generate the required economics. We secured exclusive rights on the unmanned production buoy and in 2011 Wood Group PSN agreed to become a strategic partner in the production buoy solution, following studies which determined that there were no major engineering barriers to prevent development of marginal fields using this concept."

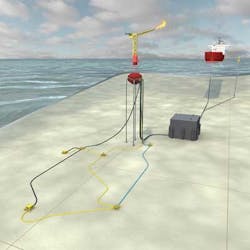

Minty describes the unmanned production buoy as "effectively a fifth-generation and unmanned FPSO operating within certain defined parameters." It is best suited to remote offshore oil fields in water depths to 600 m (1,968 ft), with production risers and flowlines linking the facility to subsea production and water injection wells. The buoy is a semi-submerged structure around 70 m (229 ft) high and up to 30 m (98.4 ft) in diameter, and is taut-moored to the seabed. There is a helideck and access tower above the water line for maintenance visits, and a submerged buoyancy chamber underneath housing process, power generation, and control equipment.

All functions that the buoy provides are performed using proven processes and technologies. A typical buoy might include a two-stage water/gas separation system, processing up to 20,000 b/d of liquids; an autonomous control and shutdown system; power generation equipment fuelled by associated gas, with excess gas flared; and facilities for remote intervention using microwave, radio, or satellite communication.

Processed crude is sent to a storage tank on the seafloor (with typical capacity between 100,000 and 300,000 bbl) and offloaded to shuttle tankers.

ABTOG estimates the typical cost of constructing and installing a buoy at $140 million. Following depletion of a field within four to five years there would be decommissioning costs, as with any project, but the buoy could be adapted relatively easily for re-use on another field. A buoy designed with a 25-year lifespan could potentially serve four different projects.

Each candidate field would be assessed for its oil volumes and varying fluid characteristics, with the process system designed accordingly. Depending on the number of wells drilled, the buoy could be economically configured to produce just 1,000 b/d, Minty claimed. In its present form the concept is focused on oil fields with limited quantities of associated gas. "Obviously we would try to use as much of the gas as possible from the outset. At this time we are not looking at pure gas fields, although there are a significant number of marginal gas fields worldwide."

ABTOG obtained its first licenses in the UK's 27th offshore licensing round. The applications focused on acreage containing discoveries or known prospects that would not be commercial using conventional solutions. Criteria included remoteness from infrastructure, and a physical environment appropriate for development using a production buoy. These licenses contain the Phoenix discovery and the Malvolio prospect, with combined resources estimated at 65 MMbbl. Azimuth agreed to farm in to the exploration areas of both blocks earning a 50% interest in these areas by assessing the hydrocarbon potential and funding associated geological, geophysical, and reservoir studies.

Last July a more immediate development opportunity arose when ABTOG concluded a farm-in deal with Antrim Energy to earn the right to a 50% interest in license P077, which contains the Fyne oil field and surrounding acreage. In exchange, ABTOG would fund the preparation of an amended field development plan for Fyne, with Wood Group PSN performing pre-front-end engineering and design and FEED studies.

Fyne was discovered by Mobil in 1986. Eventually Calgary-based Antrim Energy acquired the field and, following an appraisal campaign, farmed it out to Premier Oil. Various attempts at development foundered due to project economics. One of Antrim's previous concepts was to use the Sevan Marine-designed cylindrical FPSO tied in to two subsea production wells and one water injection well.

One of the main attractions for ABTOG was the fact that the field had been extensively appraised, with three wells testing at rates of up to 4,000 b/d of oil. This reduces the perceived production risks associated with a previously untried concept, Minty explained. The partners on Fyne aimed to submit the environmental statement to Britain's Department of Environment and Climate Change (DECC) by the end of March, to be followed by a field development plan submission late this summer.

Looking at the UK continental shelf from a wider perspective, Enegi has identified 88 undeveloped fields each with reserves of 15 MMboe or less, so there is scope for participation in other projects. The company claims the current studies have attracted widespread interest from operators in the region. Many of the potential developments could benefit from the UK government's small field tax allowance that provides an incentive to develop these smaller fields. Worldwide, ABTOG has identified more than 600 projects potentially suited to a production buoy, based on analysis of Infield Systems' global database. Criteria include reserves of less than 45 MMboe and water depths to 600 m (1,968 ft).

The first of these could be in the North Celtic Sea off southern Ireland. Last November, ABTOG struck a deal with Providence Resources and Lansdowne Oil & Gas. This gives the company the right to earn an interest of up to 50% in the Helvick and Dunmore discoveries in return for a three-stage work program, leading potentially to submission of field development plans based on an assessment of commerciality.

Helvick, an oil and gas field 36 km (22 mi) offshore in block 49/9, was discovered and appraised during the 1990s. As new operator, Providence drilled a fourth appraisal well in 2000 which flowed 5,200 b/d of oil. However, the field's reserves and remote location did not justify development. Eight years later Providence drilled an appraisal well on Dunmore, another 1980s oil discovery 20 km (12.4 mi) north of the Hook Head field. The well encountered a previously unknown oil-bearing carbonate interval. Here too reserves are modest, but along with Helvick, could form the basis for a small field development portfolio in the North Celtic Sea.

"Traditionally this industry has been very adverse to applying 'new' technology," Minty said. "But this isn't. It's an 'appropriate,' fit-for-purpose concept that uses existing technology to make marginal fields work…I can't see anything insurmountable in what we're doing."

Part of the attraction to the partnership and investors, he added, is that Wood Group PSN would act as duty holder, providing remotely controlled operations and maintenance of buoys and associated facilities. "They have a huge resource of engineers that could find ways to increase the level of remote control and operation of offshore infrastructure.

"One current focus is to make the system robust enough to minimize the need for intervention," he added. Another, addressed in the engineering studies for the Fyne development, was the installation method for the buoy – this could be performed using a relatively small vessel to reduce costs.

ABTOG has also signed another exclusive agreement with GMC to jointly develop applications for the latter's self-installing buoyant offshore platform concept, which is based on cell spar technology. GMC was part of the team that designed and built the buoyant tower for BPZ's Corvina field offshore Peru.

"If Sir Ian Wood's recommendations are implemented, there is the potential to deliver an additional 3-4 Bboe over the next 20 years worth around £200 billion [$334 billion] to the UK economy," Minty said. "Given that a large number of these fields are considered marginal, we are confident that ABT Oil & Gas could play a significant role in the North Sea's future."

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.