Offshore at 60: Arctic dreams and cold truths-full

Joseph A. Pratt

University of Houston

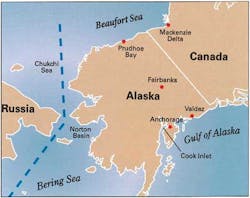

The Cook Inlet is not "offshore" in the open waters of the ocean; nor is it above the Arctic Circle, which is some 500 mi (805 km) to the north. But operations there in the 1960s foreshadowed the difficulties the industry would face in the 1980s as it searched for oil offshore in Arctic waters, where it found lower temperatures, higher winds, and thicker ice than in the Cook Inlet. In the brief boom offshore northern Alaska and Canada in the 1980s, oil companies also found that they could not yet operate profitably in the Arctic. Their experience is of interest today as many of the same companies contemplate offshore work in much wider arctic areas.

Now, as in earlier Arctic ventures, ice remains the key barrier to success. The Cook Inlet was a particularly hard teacher on the subject of ice. Ice floes there move back and forth with tidal variations as high as 30-35 ft (9-10.5 m). Early studies concluded that lateral wind, current, and ice forces on a typical four-legged, self-contained platform in the Cook Inlet were three to four times as great as wind and wave forces on platforms in the Gulf of Mexico.

The new Cook Inlet platforms had to withstand twice the thrust of the Saturn V rocket used in the Apollo moon shots. They cost several times more than traditional Gulf of Mexico platforms, and their weight tested the limits of existing barges used to transport and install jackets. Considering high costs, the challenge of extreme ice movement, the distance from established equipment and supply companies, and the severe cold and harsh winds in the Cook Inlet, it is not surprising that in the 1960s,Offshore concluded that operating conditions there were "worse than any spot on the globe."

Jacket designers attacked the ice floes with two major weapons: very conservative design loading that far exceeded real forces measured on the jackets and new designs to deflect ice. One innovation was the "large-legged" jacket with four legs up to 28 ft (8.5 m) in diameter built from low-temperature steel with no diagonal supports in areas subject to ice forces. These were quite heavy jackets for shallow water, but they stood up to the extreme ice movements in the Cook Inlet.

Another innovate design was the "monopod," a one-of-a-kind 130-ft (39.5-m) tall structure that stood on a single leg about 28.5 ft in diameter. Built for a 60-ft (18-m) water depth with an additional 30 ft to account for tidal variations, the monopod rested on large pontoons that spread the forces exerted by ice. This unique and strange-looking structure sparked great interest in the industry. Although it performed acceptably in depths up to 100 ft (30.5 m) in a harsh, ice-filled environment, it received mixed reviews. Its design lowered costs; one leg used significantly less steel than four smaller legs. But those who worked on the monopod recalled that it was not "real comfortable," and it did not pass the "toilet test." Large chunks of ice that came to rest against the leg and the pontoons jerked the platform as they broke free, giving a "good splash" to those sitting on the toilet. One engineer involved in the project concluded: "It has managed to survive, so I guess it wasn't too bad." In the absence of experience with heavy ice floes and of the powerful computers that came later, that was the best result that could be expected.

Too heavy to be transported on existing barges, these jackets were self-floating structures built in fabrication yards in Washington state and Texas and floated to the Cook Inlet, where the flooding of two of the four large-diameter legs eased them to the bottom. In some cases specially fabricated, detachable flotation devices helped reduce the exposure to ice of the permanent structure during installation. If something went wrong, however, help was far away in repair yards in the lower 48.

This became abundantly clear during the installation of a large Mobil Oil platform by Brown & Root. When the detachable flotation tank released prematurely, the jacket broke loose from cables that held it to the derrick barge and was carried away by strong currents. It moved up and down the inlet for a week as Brown & Root scoured the western US for barges large enough to regain control of the partially flooded structure.

To help corral it, the company placed an employee onboard. As he rode up and down the inlet, he kept an air compressor going and checked the pressure in the legs. "It was a lonely job," he recalled, "because you could have fallen off in that cold, swift water up there." Local newspaper accounts reported the ordeal with cartoons depicting Texas cowboys trying to rope the jacket. Company engineers could only point to an underlying truth: "People tended to underestimate the dangers of these new areas because everything was extrapolated from such a nice calm place as the Gulf of Mexico." Although the industry did find and produce commercial amounts of oil from the Cook Inlet, its early encounter with severe ice foretold difficulties to come.

As development there went forward, several companies studied conditions above the Arctic Circle in the Canadian sector of the Beaufort Sea. Interviews of those involved tell the story of the early struggles to understand the demands of E & P in the Arctic at a time when commercial production from the region remained a distant dream.

Conditions were extraordinarily demanding, even in comparison with those in the Cook Inlet and the North Sea. Knowledge of ice was scarce, and hazards from moving ice remained "the controlling factor in all Beaufort Sea operations." Extreme cold for much of the year meant that Arctic ice posed more complex problems than the ice floes in the Cook Inlet. Researchers classified different types of ice found as operations moved northward and as the weather changed during the year. They made progress in understanding the forces exerted by ice in various situations.

Although many acknowledged the potential of the region, few willing players were ready to accept the risks and costs of exploring for oil in this imposing climate.

As knowledge of Arctic ice grew, four basic approaches for drilling and production emerged. Gravel islands proved effective in shallow water. As with everything in the remote regions above the Arctic Circle, however, equipment and material to construct these islands were expensive. For deeper water, ice islands could be constructed by using powerful nozzles to spray water high up into the frigid air to create giant blocks of ice capable of supporting drilling activity for several months.

Gradually, large drillships with reinforced hulls came into use in deeper water. They had the mobility and strength to extend the drilling season, which was no small matter when the window for work might be as short as three to four months a year. After early exploratory drilling suggested that oil and gas would be found, designers tackled the even more demanding job of creating production platforms capable of year-around operations. Equipment placed on the ocean floor under the ice made this possible. Trial and error with new technologies suited for the Arctic gradually produced greater understanding of what could go wrong, but the price of knowledge was high.

Permafrost, ground permanently frozen from long exposure to intense cold, presented demanding new problems in the Arctic. On land, protection of permafrost demanded new construction techniques, notably the building of long segments of the Trans-Alaska Pipeline (TAPS) above ground to avoid damaging the permafrost, which could have been thawed by hot oil flowing through an underground pipeline.

Offshore, different problems had to be solved with what came to be called "relic permafrost," that is, once frozen ground gradually being thawed by warmer temperatures near the ocean floor. The degradation of relic permafrost was hastened by the heat generated by drilling operations and by the circulation of warm drilling mud. Under certain conditions, this caused the walls of the drill hole to disintegrate and collapse. This problem could be lessened through the use of "permafrost cement" developed at Prudhoe Bay to anchor steel casings to the walls of the drilled hole. Refrigeration to cool drilling mud also helped slow the degradation of relic permafrost. Another innovation that improved drilling in this environment was the introduction of "Big Bits" as large as 25 ft (7.6 m) in diameter.

Costs were high in every aspect of Arctic operations. High wages and the need for enclosed work spaces raised labor costs. The transport of supplies and equipment from distant locations and delays from abrupt changes in the weather and from regulatory constraints raised operational costs. Given the expense of new technologies to combat ice, this was a very expensive new frontier. Companies needed oil prices to stay high over decades to justify the billions of dollars of investments needed to develop commercial supplies of arctic oil.

The harsh conditions in this remote region raised two problems of particular concern to planners and investors. The first was the cost of transporting oil or gas from the region to distant markets. The construction of TAPS in the 1970s confirmed that the financial and environmental costs of moving oil and gas from the North Slope to markets would be quite high. Despite a cost of about $8 billion, TAPS could be justified by the fact that Prudhoe Bay had 10-14 Bbbl of recoverable oil reserves, making it the largest oil field ever discovered in the United States. Only very large fields could justify such investments.

The opening of TAPS in 1977 gave those searching for oil offshore northern Alaska and Canada one option for transporting the oil they hoped to produce. Depending on where they discovered oil, however, these companies might be forced to build their own expensive and technically challenging pipelines to connect with TAPS. If they could not gain access to TAPS, they had few alternative means of transport. Proposed ideas included moving oil to market under the ice in a fleet of nuclear-powered submarine tankers, using very long unit trains with tanker cars, and using oil tankers with reinforced hulls to move through a new Northwest Passage kept open with giant icebreakers. All of these options had been discussed and dismissed as impractical or uneconomic before the building of TAPS.

An even more difficult reality faced those who discovered natural gas fields in the Arctic. An estimated 35 tcf (1 tcm) of associated natural gas deposits found at Prudhoe Bay in the 1970s remain there today. Proposals to construct gas pipelines from the North Slope through southern Canada into the US sprung up when natural gas prices rose, with price tags ranging from $30 billion to $65 billion. Yet no gas pipeline has been built. High costs combined with fluctuating prices for natural gas have undermined these ventures. The very high costs of transport facilities from the Arctic makes the break-even point for the "commercial production" of Arctic natural gas even higher than that of oil.

Now, as in the late 20th century, environmental protection remains the second great uncertainty facing Arctic exploration and production. We know that oil in water is not the same as oil in ice. But more information is needed on how to attack the problems presented by a major oil spill in ice-filled waters. More basic infrastructure to respond to oil spills is still needed to bridge the long distances from the location of onshore response facilities to spills or accidents in remote undeveloped sections of the Arctic. TheExxon Valdez oil spill in 1989 took place in the less fragile, less ice-filled waters of southern Alaska, yet the cleanup was difficult and significant damage occurred. Spills in remote sections of the Arctic could be orders of magnitude more difficult to address than those in warmer waters.

Such issues moved to the background after 1977, when TAPS began shipping oil and oil production offshore began in Canada's Beaufort Sea. In the next five years, a variety of factors encouraged the onset of an Arctic oil boom. The price of oil remained at what were then historic highs from 1978 to 1983; surely, a new era of high and rising oil prices had arrived. Exuberance for developing Alaskan oil grew particularly high, since domestic reserves might reduce imports of OPEC oil. In the context of the time, this was not necessarily "irrational exuberance," at least as long as oil prices remained high.

This Arctic boom and bust of the 1980s followed patterns from previous oil booms. As the oil industry searched for new reserves of non-OPEC oil, Alaska loomed large. Business and government spokesmen oversold the Arctic's potential production and downplayed potential difficulties. A National Petroleum Council report in 1981 estimated that Alaska had perhaps 45 Bbbl of undiscovered oil. The report included a letter from the Secretary of Energy stating that "the Alaskan province and Arctic area Outer continental shelf appear to be the frontier regions with the highest potential for significant oil and gas resource development." A high level Exxon executive added, "The Arctic is the future of the oil industry." John Swearingen, the CEO of Amoco, proclaimed that "the Gulf of Alaska will make the North Sea look like a kiddie pool." In such an atmosphere, the herd instinct common during booms kicked in, and the industry jumped into Alaska with both feet.

Much higher than expected bids on promising leases at federal government lease sales in 1982 and 1983 indicated that the rush was on. In January 1983, a feature article inBusiness Week entitled "The Great Arctic Energy Rush" left no doubt. The article used a variety of sources to estimate that Arctic regions (onshore and offshore) around the world held "as much as 170 Bbbl of oil and 1,800 tcf (51 bcm) of natural gas "in proved and potentially recoverable reserves." As with Arctic estimates before and since, these numbers were projections based on limited data about offshore basins, most of which had yet to be explored. As with the earlier NPC report, the article made little mention of the impact declines in oil and natural gas prices might have on commercial production.

As numerous major companies invested heavily to drill exploratory wells offshore Alaska,Business Week reported a "government estimate" that the cost of future Alaskan development would be $100 billion, plus some $10 billion in lease bids. In an extreme case that became a symbol of Arctic enthusiasm, a consortium of 11 major North American and European oil companies headed by Sohio bid a total of $1.5 billion for the right to explore the Mukluk structure, a very promising prospect in the Beaufort Sea. Such bids fed the frenzy. With oil prices high, seemingly excellent prospects to drill, and experts agreeing that the Arctic was the next big thing, 1983 had the makings of a banner year for Arctic exploration.

Things changed quickly. First, Sohio reported that wells drilled at Mukluk had come up dry. A spokesman for the company maintained his sense of perspective by explaining that good seismic data had shown a structure resembling that at nearby Prudhoe Bay, but "we were simply 30 million years too late." Better to laugh than to cry. Apparently in geological time oil once held in the structure had drained to other locations.

Dry holes in promising structures are common in oil history, but because of the extravagantly high expectations offshore Alaska and the size and reputations of the members of the Mukluk consortium, this one sent a shock wave throughout the global oil fraternity.

Another unexpected development followed: the steady decline of oil prices from 1983—1986. As prices went from unrealistically high to unbelievably low, it was clear that the party was over in Alaska, as well as in other regions where the assumption of high and rising oil prices had spurred investments that could no longer be justified when prices plunged.

Shell and Amoco held on throughout the decade, even drilling very challenging exploratory wells in the Chukchi Sea. It was clear, however, that they could not produce oil from the Chukchi Sea at prevailing low oil prices, and in 1989, they withdrew from offshore Alaska. Each lost heavily in money and time that could have been spent in other places. One prominent Amoco executive provided a succinct evaluation of his company's fling in the Arctic: "We failed miserably." The company's CEO provided a more optimistic, public relations-friendly perspective: "We perceive the Beaufort Sea offshore Canada as a near-term opportunity to develop a position in an area that could become increasingly important when oil prices return to more realistic levels."

Has that time come in 2014? A new Arctic rush has gained momentum in the recent past, with projections of giant reserves to be found under Arctic ice around the globe. A much quoted report in 2008 by the U.S. Geological Survey (USGS) encouraged the boom with estimates that Arctic regions around the world held as much as 170 Bbbl of oil and 1,800 tcf of natural gas in"undiscovered technically recoverable" conventional oil and gas (about 22% of estimated undiscovered conventional reserves). Unfortunately for future Artic development, the report concludes that as much as 78% of this reserve base is natural gas, which will have to compete with supplies of relatively inexpensive unconventional shale gas. Costs of development of offshore Arctic oil and gas are projected as 1.5 to 2 times higher than similar oil and as projects undertaken in Texas. Financial risks will be increased by unpredictable impacts of weather and regulations, with a high risk of delays and cost over-runs in the Arctic.

As in the early 1980s, there is much confidence today that oil prices have reached a permanent new plateau at a level high enough to support Arctic development. Such confidence can be fragile, and it often has been misplaced at the onset of a perceived boom. In the last decade, the shale gas boom abruptly shattered confidence in high natural gas prices. Technological advances and increased scientific knowledge gained from research and experience over the last 30 years encourage optimism that the industry is much better prepared to deal with Arctic conditions that it was in the past. But the growing knowledge of the potential environmental impacts of spills in Arctic waters has not yet been matched by investments in the infrastructure needed to respond effectively to accidents and disasters in the harsh conditions of the vast and remote Arctic. Surely it would make sense to address this problem as systematically as possible before, rather than after, a major oil spill.

Finally, recent events in Ukraine and elsewhere wave warning flags of new challenges reminiscent of the Cold War, when geopolitics shaped the terms of access to much oil and gas in many regions of the world. It is too early to predict how current global tensions will be resolved, but it is not too early to acknowledge that geopolitical risks are the risks over which companies have the least control.

The risks in developing oil and gas offshore in the Arctic are high given the uncertainties about future energy prices, continued access to promising offshore prospects in Arctic regions, and the capacity to limit environmental damages. With so much change afoot in global energy markets and so much uncertainty about future global responses to climate change, committing vast financial and technical resources to offshore regions in the Arctic that have not yet produced substantial amounts of oil will require considerable capital, confidence, and courage. History counsels caution.

Acknowledgment

The author notes: "I have made extensive use of the Arctic Technology Preservation Project at the University of Calgary, whose interviews became the primary source for the book Breaking Ice with Finesse: Oil & Gas Exploration in the Canadian Arctic (Arctic Institute of North America, 1997). I also have drawn heavily from Tyler Priest, The Offshore Imperative (College Station, Texas: Texas A & M University Press, 2007), and from Ty's comments on the article."

The author

Joseph A. Pratt is NEH-Cullen Professor of History and Business at the University of Houston's main campus. Dr. Pratt is a leading historian of the petroleum industry, and has been a consultant for the PBS mini-series on the oil industry, The Prize, and for the American Experience documentary on the Trans-Alaskan Pipeline. He has conducted several hundred interviews of offshore engineers and executives for the Offshore Energy Center's Hall of Fame oral history project. For a fully referenced version of this article, contact him at[email protected].