UK grappling with implications of lower oil price

Offshore staff

OSLO, Norway – If Brent drops to $20/bbl, 30,000 boe/d of UK offshore production would not cover marginal costs, according to Rystad Energy.

Theoretically, the production facilities could be at risk of an early shut-in, although this might not actually happen, the consultant said.

This is because most operators will want to keep facilities running even at a loss and claw back the profit back once oil prices recover. The assumption is that it is more economic to maintain the facility at a loss than to shut it down and attempt a later re-start.

However, a lower oil price would have more impact on discoveries and companies’ ability to proceed with final investment decisions (FIDs) for new projects.

At $30/bbl, only 34% of unsanctioned UK offshore volumes are commercial, the consultant claimed while at $20/bbl, none are financially viable.

“As a result,” said Sonya Boodoo, vice president of Upstream Research, “we expect sanctioning activity to be low in the current price environment, not only because of the breakeven price of the projects but also because operators will tend to be cautious over the scale and pace of future capital spending commitments.”

Last year UK offshore exploration rose from previous lows in 2018. Operators had indicated that activity would fall back again this year, and it now looks as if exploration activity will likely be deferred where possible, although the impact will be felt more in 2021 as most of this year’s scheduled wells already have contracted rigs.

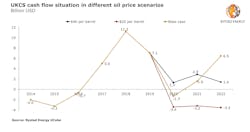

As for cash flow, under an average oil price of $34/bbl in 2020 and $44 in 2021, Rystad expects most UK upstream activity to be cash-negative in 2020 with free cash flow at -$1.3 billion.

If the oil price falls to around $20/bbl, the situation will be more severe with cash flow at about -$3.4 billion. And if the present situation shows no sign of improvement, UK operators and their partners of all sizes will be forced to make deeper cuts to those already implemented.

“UK players already stretched their limits and accumulated losses in the previous market downturn, so they now have very limited opportunity to absorb further reductions,” Boodoo said, adding that “a favorable tax regime and competitive operational costs for producing assets will sustain short-term production.”

04/20/2020