Reviewing rig construction cost factors

Mark J. Kaiser

Brian F. Snyder

Center for Energy Studies, Louisiana State University

Many factors influence rig construction cost. Market conditions, design type and class, construction shipyard, and rig specifications are the primary factors. Contract type, shipyard productivity, and scale economies also influence cost, but are either unobservable or more difficult to ascertain the nature of their impact. The goal here is to describe the primary factors that impact rig construction costs.

Market conditions

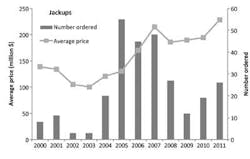

Prices are determined by the demand for rig construction services and the number of shipyards capable of supplying these services. Drilling contractors demand newbuild rigs when day rates and utilization rates make investment criteria positive. But only a small number of shipyards around the world are capable of building rigs; and during periods of high demand, the supply of rig construction services saturates the market, leading to backlogs and price increases.

From 2000 to 2011, for both jackups and floaters, there was little activity early in the decade and prices were low. The number of jackups ordered during this time numbered less than 10 per year. For floaters, there were three orders in 2001 and two orders in 2002. As orders increased in the middle part of the decade, prices rose. Following the 2008 recession, orders declined markedly, but prices only declined marginally, reflecting long backlogs and the expectation that a decline in orders would be short lived.

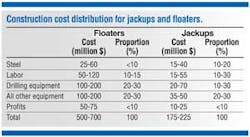

Material prices

Building a rig requires steel, labor, drilling, and other equipment. The manner in which cost is distributed across these categories determines the variation in construction cost by rig class, complexity, and time. Shipyard location plays a key role. In China, labor costs are low and are likely to represent a small proportion (on the order of 10%) of total cost. By contrast, US labor costs are high and may account for as much as 30% of total costs. Steel costs are highly variable over time, and when prices are high, the percentage values will tend to reside at the upper end of their ranges.

Steel is the main component of rigs, and material prices impact newbuild costs. On a proportional basis, jackup steel is usually a larger component of cost (10 to 20%) than in floaters (<10%). Steel prices are specified on a per ton basis and vary regionally with steel quality and shapes. Rigs are constructed using a variety of steel strengths, and no single steel price reflects costs for all rigs. However, the vast majority of rigs are built in Asia, and the Asian steel price index is a reasonable proxy for the rig construction market. Both rig prices and the steel index grew over the course of the decade at approximately the same rate, and are correlated. The steel price index explains 70% of the variation in average jackup rig prices. No significant relationship is observed between floater prices and steel prices.

Equipment prices

Engines, cranes, generators, drilling equipment, and dynamic positioning systems are significant components of rig cost. These are all third-party materials purchased by the rig builder and assembled onsite or at another location. The drilling equipment package is the largest equipment expenditure, and typically costs $20 to $70 million for jackups and $100 to $200 million for floaters (or on the order of 10 to 30% of total costs). Non-drilling related equipment range over similar cost intervals; and together, drilling and other equipment typically range from 30 to 60% for jackups and floaters.

Drilling and equipment costs are influenced by steel prices to the extent that the majority of the equipment is made from steel, but more importantly, are influenced by demand from the oil and gas and commercial shipping industries. Labor cost is also a high component in equipment manufacturing costs.

The oil and gas field machinery equipment index can be used to proxy the costs of the drilling equipment installed on MODUs; the finished goods index proxies the overall rate of inflation experienced by manufacturers. While both indices are based on US products, the oil equipment index is applicable to global MODU prices because much of the drilling equipment installed on MODUs is sourced from the US. Throughout the 1990s, the oil and gas index grew gradually and in line with the finished goods index, but in the mid-2000s the oil and gas index increased rapidly, outpacing the overall rate of inflation, suggesting that the increase in rig prices is due in part to an increase in the costs of drilling equipment.

The steel price index was a poor predictor of floater costs while the equipment index explained 82% of the variation in prices, suggesting that equipment costs are a larger factor in overall prices than steel costs for floaters. The equipment and steel indices are themselves strongly correlated, and are likely to be influenced by many of the same global factors. However, their influence on rig cost is largely independent, since each index impacts a separate shipyard budget category.

Exchange rates

Contracts for rig construction are denominated in US dollars, but costs at international shipyards may be in US dollars, euros, Chinese yuan, South Korean won, or Singaporean dollars. For example, labor and steel costs at a South Korean shipyard may be in South Korean won while drilling equipment costs may be in US dollars. For the rig builder, as the value of the US dollar rises, the value of a contract increases. From the perspective of a rig buyer, a strong US dollar lowers newbuild costs at international shipyards. Thus, when the dollar declines relative to a local currency, an increase in costs is expected.

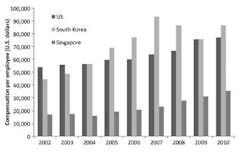

Labor

Labor costs and productivity are important drivers of shipyard costs. The costs of shipbuilding labor in the US and Korea are roughly similar, and about three times the labor costs of Singaporean yards. South Korea compensates for relatively high labor costs with advantages in productivity over Singaporean and US yards.

Over the past decade, both labor costs and productivity have increased in Singaporean and South Korean yards; the combination of these two factors will determine the contribution of labor to total costs. In the US, each dollar spent on labor generates approximately three dollars of revenue, consistent with labor costs accounting for approximately one third of total costs. In Singapore and South Korea, each dollar spent on labor generates approximately seven to ten dollars of revenue, suggesting labor costs make up on the order of 10 to 15% of total costs for rigs built internationally.

Design class

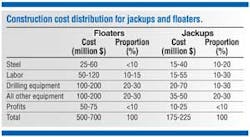

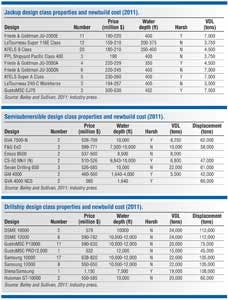

Newbuild jackup designs range from $159 to $530 million for water depths between 200 to 492 ft and variable deck load (VDL) capability of 3,750 to 7,000 tons. The KFELS B Class, Letourneau 116E, and F&G JU-2000E are the most common designs. In general, there is relatively little variation in cost between rigs of the same design, but some designs exhibit more variation in water depth capacity and price than others. The Letourneau Super 116E class is especially variable, because several rigs are being built for the Persian Gulf market where water depth capability is not at a premium.

Semisubmersible newbuilds range from $460 to $771 million for water depth capacity ranging from 1,640 to 10,000 ft and VDLs between 5,000 and 22,000 tons. Operating displacement varies between 42,000 and 62,000 tons. There is more variation in costs between rigs of the same design than for jackups, and this may reflect increased customization. Most of the units are sixth generation ultra-deepwater rigs; however, the GM 4000 is designed for drilling in mid-water regions or well workovers in ultra-deepwater, while the GVA 4000 NCS is intended for harsh environment drilling in mid-water. Both of these rigs were designed to provide lower capital and operating costs in regions in which the capabilities of ultra-deepwater rigs were not required.

Drillship newbuilds range from $550 million to $1.2 billion for VDLs ranging from 15,000 and 24,000 tons and displacements between 45,000 to 112,000 tons, in part reflecting differences in oil storage capabilities. The Samsung 10000 and 12000 and the Gusto P10000 are the most common designs and can store small amounts of oil (approximately 140,000 bbl) during early production, while the Gusto PRD12000 and Huisman designs exclude oil storage to reduce ship size, and operating and capital costs. Stena and Keppel have developed a drillship to drill slimmer, less expensive wells, but to date, these smaller designs have not been as popular as the larger designs.

Rig specifications

Rig designs vary in drilling capabilities, VDL capacity, maximum water depths, and environmental criteria. As vessel specifications increase, costs rise for all other factors held constant. Some of the key criteria are outlined below.

Structural weight. Weight is associated with rig capabilities. Larger rigs have greater variable loads, can support more powerful drilling equipment, and can operate in more severe conditions. Weight is an important factor in design and is linked to fabrication costs; as more steel is added, material costs and fabrication expenses increase. However, complex tradeoffs are involved with weight management, and because so many interdependent factors are involved, it is difficult to quantify the effects of weight on cost.

Water depth. For jackups, water depth is a primary determinant of cost. The legs of a jackup are made of expensive high-grade steel, and as water depth capacity and environmental criteria increase, so do the costs of construction. Wind and wave forces act in proportion to leg length, and above a certain threshold, a rig cannot be extended to deeper water by simply extending its legs. Instead, a new and larger rig design is required.

Source: Data from RigLogix, 2011; Steel Business Briefing 2011.

For drillships and semisubmersibles, water depth capability is not as strongly correlated with costs, because the rigs are floating units; and with the exception of the drilling risers and anchor handling systems, do not have elements that pass through the water column. Increased water depth is associated with increased costs for risers, riser tensioners, mud pumps, anchor winches, drill strings, and mud storage facilities.

Operating environment. Rigs capable of operating in harsh environments are heavier and more expensive than moderate environment rigs. Harsh environment jackups have longer legs to increase the airgap, and as leg length increases, the distance between the legs and the size of the hull must also increase. Similarly, semisubmersibles built for harsh environments must have longer and thicker columns than moderate environment units, which in turn increases costs. Drillships are not typically designed for harsh environments, but interest in Arctic exploration has led to harsh environment designs, and can cost over $1 billion to build, several hundred million more than moderate environment designs.

Equipment specifications.As the drilling depth capability of a rig increases, more robust pumping units and safety systems are required to handle the higher formation pressures and temperatures, increasing costs. The power, storage and VDL capacities determine the maximum drilling equipment that may be installed on the rig. Drilling depth may be used to proxy equipment specification, but it is the actual specifications that determine rig cost. Important specifications include the hook load, riser pressure, rated pressure and diameter of the blow-out preventer, degree of offline capability, storage capabilities, number and power of mud pumps, mud tank capacity, number and flowrate of shale shakers, desilters, desanders, cementing unit operating pressure, and capacity of the BOP handling system.

Contract type and options

Rigs may be built by drilling contractors with or without a firm contract commitment from an E&P company. When building a rig speculatively, drilling contractors may approach negotiation more aggressively and be less willing to pay than when building a rig with a contract commitment. Building a rig on speculation increases risk and the firm may only be willing to accept this risk when market conditions (e.g. recession) put downward pressure on costs, making the investment more likely to be profitable over the life of the rig.

For example, in 2011, Maersk Drilling ordered two MSC CJ70 jackups on speculation for $500 million each; two months later, Seadrill ordered the same rig for $530 million after receiving an initial contract. Similarly, in June 2008, Seadrill ordered a Pacific Class 375 rig on speculation from PPL shipyard for $215 million; the next month Egyptian Drilling received a contract and ordered the same rig from the same shipyard for $220 million. These data are anecdotal and the differences small, but the general synopsis is clear.

Rigs ordered on option allow a contractor to purchase one or more additional rigs at a fixed price simultaneously with their initial order. Typically, options must be exercised within a year of contract signing, and the cost of optioned rigs is frequently higher to account for the risk of inflation, and because the option has inherent value for the contractor by locking in future newbuilding capacity.

Shipyard characteristics

Shipyards vary in their rig building experience, labor costs, supply chain management, tax structure and government subsidies, construction methods, reputation and degree of integration. Many of the major rig shipyards maintain their specialization with proprietary designs. Keppel-FELS and LeTourneau each have their own line of jackup rigs, and while these yards can and do build other designs, they have gained significant experience by building specific rigs and may be able to do so at lower costs than other yards. Similarly, many yards have long-term contractual relationships with rig operators; these operators often prefer a particular design class or company and they may order several identically designed rigs to be delivered from the same yard which will likely lead to cost reductions through learning.

Source: Bureau of Labor Statistics; Wong and Chang 2011.

Large rig shipyards exist in Singapore, China, India, South Korea, Russia, the United States, and the United Arab Emirates. These countries differ markedly in their labor practices and costs, tax structures, the importance of rig/shipbuilding to the overall economy, and the degree of government intervention, all of which influences construction cost differences across countries. Competition works in the opposite direction, however, and forces high-cost shipyards to offer similar prices and accept lower returns to win work, reducing price differences.

Shipyards differ in the methods in which they construct rigs based on their level of automation, subcontracting, and the degree of serial production line usage. The particular method of fabrication and assembly is unique for each yard and rig, and depends upon space and equipment availability. Singaporean shipyards are particularly space limited. South Korean yards are less space limited and use a sophisticated "mega-block" method of ship construction in which very large ship sections are fabricated separately and then assembled in a floating dock. A high degree of specialization will likely lead to reduced costs and enhanced quality control standards, but this is only feasible for yards with a constant supply of orders.

Backlogs

The amount of time between when the rig is ordered and delivered is important in determining costs and risks to both parties. The time to construct a rig depends on a number of factors but is typically 18 to 36 months; however, the time between contract finalization and rig delivery can significantly exceed the construction time due to shipyard backlogs. During construction, the buyer is required to make payments on the rig but does not receive income which can create cash flow problems for buyers. Additionally, as the time between ordering and delivery increases, market conditions may change, creating risk for the buyer and seller. For the buyer, rig utilization and day rates may decline while for the seller, steel, labor or material costs may increase. When there is a particularly long delay between contract finalization and the start of construction, a cost escalation clause may be included.

Editor's note: This article is the first of a five-part series authored by Mark Kaiser and Brian Snyder on rig construction costs, weight specifications, and market day rates.

Offshore Articles Archives

View Oil and Gas Articles on PennEnergy.com