Collective effort drives down cost of shelved Andrew development

First oil emerges six months ahead of schedule and £80 million under budget

Jeremy Backman

European Editor

(Left) Sailway of Andrew jacket from the Barmac yard at Nigg Bay. (Right) S7000 crane barge installing Andrew's integrated deck.

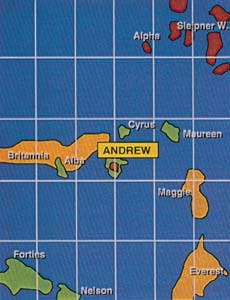

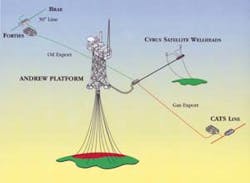

(Left) Location of Andrew and Cyrus. (Right) Andrew/Cyrus development schematic.

Andrew gainshare arrangements.Peace, love, and understanding really works - it's official. BP's UK Andrew Field has just delivered first oil, £80 million under budget and six months ahead of schedule. Teamwork and trust among the contractors was allegedly the main driver.

Andrew is one of a host of marginal fields now veering towards production in the North Sea. Most of these are small accumulations where technology advances or leased FPSOs have minimized the risk to the field licensees.

Horizontal drilling has aided Andrew's cause, but on its own would not have triggered the development. The reservoir was first identified in 1974, within the Paleocene: for a long time difficulties caused by a thin oil leg on top overlaying lower Cretaceous gas and water looked insurmountable.

Nevertheless, BP and its field partners could not ignore 121 million bbl of oil and NGLs and 131 bcf of associated gas. Their estimate of £450 million for the development in the early 1990s was sub-economic, but that was based on a traditional BP/individual contractor way of working.

In 1993 a figure of £370 million was put forward, based on an alliance approach: the selected team needed six months to accede. "We were all concerned about how to reach that figure, based on previous experiences," says Alex Dawson of fabricator Trafalgar John Brown (TJB) which was responsible for the integrated deck. "It was not an easy total."

Unusually, the contractor alliance was involved in the cost estimate which was approved by BP's board in February 1994, and formally sanctioned by the UK government the following August.

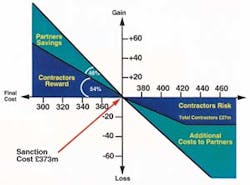

At a recent presentation in London, BP admitted that £373 million was a tight target, with a real risk to the contractors of exposure to additional costs. Under the gainshare agreement, a £27 million cap on cost overruns was laid on the contractors, with BP faced with bearing the rest.

Any gains (under-spending) were to be split, with 46% going to BP and its field partners Lasmo, Clyde, Mitsubishi, and Talisman. The remaining 54% would be allocated to the seven alliance contractors, headed by Brown & Root (22%) and TJB (12%).

Each contractor could independently identify spending curbs within their own working methods. But it helped that at the end of each Andrew team meeting, there was clear accountability over who would do what. As one team member pointed out: "Traditional arguments - `this is my scope, this isn't' - were off the table."

Only 14 BP individuals worked on the project, all integrated with the team members. "This was different from the way we and most others had worked in the North Sea previously," said a BP spokesman. "We spent a lot of time on team-building, and our doors were always open to other project managers."

The happiness factor reflects in the fact that by the end of the construction phase, there had been no claim for extra charges. "There have been changes to the fabrication work plan," said the spokesman, "but no related claims, because everyone is fairly reimbursed."

Andrew hardware

Andrew is in fact a two-field project. The main installation is a fixed platform in 116 meters of water in UK blocks 16/27a and 16/28b. This comprises a 10,300-ton integrated deck with production, drilling, and LQ facilities, supported by a piled, 7,500-ton steel jacket. Cyrus, a 23 million bbl oilfield 10 km to the north is also being developed through two new horizontal wells tied back to the platform via a flowline.

Combined output from the two fields will peak at 70,000 b/d, with an expected production life of 17 years. Processed oil feeds into the Brae-Forties system through a new 16 km, 10-in. diameter pipeline. Treated gas is destined for the CATS transmission system through a new 44 km, 8-in. dia. line.

Saipem's crane vessel S7000 installed the jackets and deck in May. The deck lift was claimed to be a world record for a vessel in DP mode: at one point the S7000 was stationed just two meters from the jacket.

As well as building and commissioning the deck, TJB was responsible for installing the modules: the aim was 100% completion onshore. Traditionally in the North Sea large decks are only 97% complete when they leave their yard for hook-up, but the Andrew target was fulfilled, without the added cost of a conventional offshore hook-up contractor.

Prior to sail-out from Teesside in northern England, the platform staff were already working within the deck testing process equipment. The hook-up was then completed in seven days - in fabrication terms, 45 man minutes/ton as against the project sanction limit of 10 manhours/ton. That meant a saving of £20 million from the original £27 million budget.

The certificate of fitness was also secured onshore before sailaway: this would normally be awarded by Lloyds offshore. And within one day of the deck being installed on the field, a certificate was received for personnel to live there. A few days later, the certificate for drilling completions was rubber stamped.

As for the jacket, piles and template - built by Barmac in Scotland - the budgeted figure was £33 million, but this was eventually sliced to £24.2 million. Innovative engineering from parent company Brown & Root led to a reduction in pile numbers; however, Barmac also fostered ideas for savings right down to the shop floor. The end result was a productivity figure of 63 manhours/ton, the yard's best ever performance on a jacket.

Close contact with suppliers yielded savings on materials. Barmac also had the idea of using its aluminum spray facility for the area of the jacket above the waterline. This proved to be more robust than paint and less expensive.

At no time was a BP person resident on site. "Normally they would have jacket and inspection engineers," said a Barmac spokesman," but Brown & Root said we were mature enough now not to need them."

The search for savings continues now into the operational phase, with BP forming a separate alliance for the development drilling and well management. Contractors include Santa Fe, Baker Hughes Inteq, and Schlumberger for drilling support and ASCo for logistics support.

Four pre-drilled wells should allow plateau production to be reached by October. In time there will be ten horizontal producers: this number helped ease the cost estimate at the project sanction stage. At one time 18 conventional wells were deemed necessary.

Further gains

BP's oil coffers were further boosted when the 20 million bbl South Magnus Field came onstream recently in the UK northern North Sea. This is a subsea development from the main Magnus platform seven km to the north. It was only discovered by semisub Ocean Guardian in February 1995.

Later this year, a water injector well will be drilled to maintain reservoir pressure over the expected 10-year field life. Further producer wells may be added.

Another new water injector should yield a further 5.3 million bbl from BP's Don South West Field which has been in production since 1993 as part of a phased subsea development from the Thistle platform. BP is now examining options for producing further oil accumulations in the Greater Don area: current reserves estimate is 300 million bbl.

Copyright 1996 Offshore. All Rights Reserved.