Stalling investments hitting Angola’s long-term oil ambitions

Offshore staff

OSLO, Norway – Capital spending cuts brought on by COVID-19 could set back Angola’s oil industry for an extended period, according to Rystad Energy.

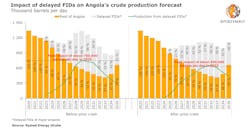

Prior to this year’s events, output from Angolan fields was on track to rise to an average 1.4 MMb/d. And the government, which had introduced a new royalty and tax regime to attract investments from the majors in particular, was hoping to add up to 750,000 new b/d by 2029, the consultant estimated, offsetting the anticipated decline from currently producing fields.

But planned projects that had been deemed profitable with the new incentives have now been delayed and exploration planning halted, not helped by stiff competition from other deepwater sectors such as Brazil and Guyana.

These developments could mean the new cumulative output will shrink to 650,000 b/d, and will only be reached in 2032 - at which time output from currently-producing fields will have continued to fall.

The National Agency for Petroleum, Gas and Biofuels (ANPG), formed as an industry regulator last year, had drawn up a six-year (2019-2025) licensing strategy under which 55 blocks would be offered.

Instead, ANPG has decided to postpone the country’s 2020 licensing round, originally due to be launched by May. According to Rystad, the oil price slide has also caused all majors operating in Angola to either cancel rig contracts or leave their drilling rigs idle.

“Angola desperately needs to accelerate its new developments to reduce its declining production and must undertake more exploration to replace its depleted reserves,” said Siva Prasad, senior upstream analyst at Rystad.

“Despite the government’s efforts to make operations in the country more operator-friendly, investors may quit Angola unless the government acts swiftly.”

Potential options might include further fiscal changes or operational incentives.

07/08/2020