Pandemic, falling prices take steam out of floating production market

Sanctioned projects expected to proceed, but with delays

David Boggs, Energy Maritime Associates

Prior to the Covid-19 pandemic and concurrent crash in oil prices, 2020 was on track to be a strong year for new project awards and ongoing construction in the floating production sector.

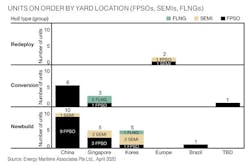

There are currently 23 FPSOs, seven production semisubmersibles and three FLNG units on order. These 33 units are being built or integrated in over 15 main facilities worldwide.

Almost 90% of these units are being fabricated in Asia (China, Singapore, Korea). Confidence among contractors, yards and operators was high, but this has changed as the realities of the global pandemic have set in.

In our latest models, we are anticipating that few new projects will be sanctioned this year, and that our previous five-year forecast for new orders should be reduced by approximately 20%.

Construction activity

China has become the dominant location for all types of FPSOs, accounting for two-thirds of FPSOs on order. This includes nine newbuilt hulls as well as six conversions from oil tankers. CSIC-Dalian leads the way with five FPSOs for Modec – two newbuilds (Bachalau and Barossa) and three conversions for Petrobras (Marlim I, Buzios V, and Mero I). CSSC-SWS and China Merchants Heavy Industry are each building two FPSO hulls for SBM Offshore (Mero 2, Payara, and two speculative order for future projects). The speculative orders are most likely for expected awards in Brazil and Guyana. The Cosco group has four FPSOs under way in four different yards. The Shanghai and Dalian yards are converting vessels for Modec, while Qidong began conversion for Yinson’s Marlim II in 2020. A newbuild for TechnipFMC (BP’s Tortue) is under way in Zhoushan. COOEC is working on four newbuilt units (three FPSOs and one Semi).

After taking a pause for a few years, Korean yards have resumed offshore production projects, especially production semis. Currently on order are three production semis, one FLNG, and one FPSO. Daweoo was awarded the hull for Chevron’s Anchor semisubmersible and Hyundai received an order for the King’s Quay production semisubmersible. This is its first large FPS order since the Jangkrik FPU in 2014. Samsung has remained the most active, with orders for the Coral South FLNG, the Mad Dog 2 semi, and a $1.1-billion FPSO award from Reliance India.

In Singapore, activity is under way for eight units: four FPSOs, two Semis, and two FLNGs. SBM is carrying out topsides work for some of its hulls built in China that are destined for Guyana. For the Liza 2 FPSO, SBM awarded 22,000 tons of topsides to Dyna-Mac followed by integration by Keppel. The Payara FPSO will likely follow the same model. Bumi Armada had previously done its conversions in Keppel, but selected Sembcorp to convert the Cluster II FPSO for ONGC. The hull for the Karish FPSO is scheduled to arrive in Sembcorp in 2Q 2020 for topsides integration. Sembcorp is also executing two production semis for Shell. In 2019, an LOI was placed for the Whale semi, which is an 80% copy of Vito, which was ordered in 2017. Keppel is executing FLNG projects for Golar. After completing the Hilli Episeyo FLNG, Keppel began work on conversion of the 1976-built Gimi to a 2.5 mtpa FLNG unit for BP’s Greater Tortue field offshore Mauritania and Senegal. Golar and Keppel also have an agreement to convert the 1977-built Gandria, but no physical work has yet begun.

Fabrication activity in Norway is under way to upgrade two existing units. In August 2019, Rosenberg Worley was awarded an EPCI contract to upgrade the 1999-built Jotun A FPSO. The unit will be taken to Worley’s Stavanger yard for 15 months to enable 25 years of additional production on the Balder field. The 1997-built Njord A production semi is being upgraded by Kvaerner in its Stord yard.

Cost pressures have resulted in reduced local content requirements for many new projects. Some tenders for Petrobras FPSOs have been revised with lower levels of local content. As a result, yard activity in Brazil has been declining as orders placed in 2010-2013 are completed. SBM mothballed its Brasa yard until at least 2020. The main project currently under way in Brazil is integration of the P-71 topsides by Jurong Aracruz.

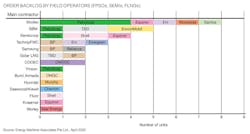

Leading contractors

The 33 production units are being executed by 14 different contractors. Half of these are juggling multiple projects, with the other half are working on a single project.

Modec is the busiest by far with eight FPSOs on order, including four for Petrobras. Of the eight units, six are conversions and two are newbuilds. Modec will lease and operate the FPSOs for Petrobras and Eni (Amoca), while the FPSOs for Woodside (Sangomar), Santos (Barossa), and Equinor (Bacalhau) to be completed under EPC contracts. SBM has five FPSOs under way, with two for ExxonMobil in Guyana, Mero 2 for Petrobras, and two speculative hulls earmarked for future requirements. SBM will lease these FPSOs, with ExxonMobil expected to take ownership after two years of operation.

Sembcorp is building three new units (Vito and Whale production semis for Shell and the FPSO hull for Equinor’s Johan Castberg) in addition to integrating the P-71 FPSO in its Brazilian yard. TechnipFMC is the EPCI contractor for three developments (Energean’s Karish FPSO, Eni’s Coral South FLNG, and BP’s Tortue FPSO) and has engaged different yards for each project. Samsung, Golar, and COOEC have two units each.

COVID-19 and the oil price crash

With oil companies slashing capex across the board, only the financially strongest companies will proceed with new projects. Those that do move forward will only select the biggest and best fields to be developed. We believe that Petrobras and ExxonMobil will continue with plans for multiple, large deepwater FPSOs. However, smaller companies that are not as financially sound are revisiting plans and commitments.

Most companies are looking to cancel uncommitted capital and reduce or delay capital that had been committed. One FPSO project has been cancelled to date. In February 2020, Aker Energy issued an LOI for a leased FPSO on its deepwater Pecan field offshore Ghana. However, this was cancelled by Aker Energy on March 31. We anticipate that the development will be revised to reduce costs, and that the project could be re-sanctioned in 2021/22. The tender process had begun under Hess, which sold its stake in the field to Aker Energy in 2018. The unit will be spread moored in 2,400 m of water and is designed to produce 110,000 b/d of oil and 100 MMscf/d of gas. The FPSO was to be leased for 10 years firm, with options for another five years.

Going forward, we expect sanctioned developments to proceed, with delays of three to 12 months due to supply chain disruptions and efforts to delay capex. Projects that are still in the engineering phase may experience larger delays, as there is a smaller penalty for delaying a development at that stage. Once construction is under way, delaying the project could prove more costly than keeping to the plan. However, given the need to preserve cash, it is certainly possible that some EPC projects could be stopped mid-way. This is especially true if financing has not been secured for the complete development.

Five-year forecast

The following is our low to mid-case 2020-2024 forecast, which was created pre-COVID 19 and the oil price crash of March 2020. As mentioned earlier, we expect very few projects to be sanctioned for the rest of the year. Therefore, the following forecast should be reduced by approximately 20%.

FPSOs. Orders for 40 to 60 FPSOs are expected over the next five years with a total capital cost between $50.3 and $76.3 billion. Some 60% of orders will be leased, 40% owned. Redeployment of existing units will satisfy around 25% of future FPSO requirements. Newbuilt hulls will be used for approximately 40% of all orders.

The currently installed FPSO fleet is comprised of around one-third newbuilt units. Over 80% of these newbuilt units are owned by the field operator (mainly MOCs and Petrobras). These units are primarily for locations in Brazil, North Sea, and West Africa. Over the next five years, we foresee that Petrobras and other large operators resume ownership of FPSOs rather than sign 15- to 20-year leases. Leased units tend to be conversions, but there has been a recent trend toward newbuilt hulls used by leasing contractors. SBM has placed five orders for its newbuilt Fast4Ward FPSO hulls while Modec has two orders for its M350 FPSO. Both of these concepts are designed to reduce costs through standardization and repeatability. Over the next five years, we forecast that newbuilt FPSOs will account for almost half of all orders.

Most of these new hulls will be constructed in China with a few in Korea and Singapore. Conversion work will continue to be dominated by yards in Singapore, Malaysia and China, although European and Middle Eastern yards will also compete, particularly for upgrading existing units.

Historically, redeployed units have accounted for around 15% of FPSO orders, but we expect this number to increase to 25% in the next five years. This is due to the large number of available units (30 as of April 2020), as well as the drive for cost effective and fit for purpose solutions. The majority of redeployments will be small to mid-size FPSOs that can be modified and given a life extension for another five to 10 years. In addition, the owners of idle FPSOs are often willing to accept more flexible commercial terms, such as a lower fixed rate with an additional tariff linked to production and/or oil price.

FLNG. Orders for one to four FLNGs are possible over the next five years with a total capital cost between $3.5 and $9.0 billion. The orders will range from small liquefaction-only barges to turret-moored gas processing and liquefaction units with capacities up to 3.5 mtpa. The Petronas FLNG 2 was delivered in February 2020. Golar’s second FLNG unit, Gimi, is scheduled to start operations on BP’s Tortue field in 2022.

Production semis. Orders for three to six production semis are expected over the next five years with a total capital cost between $2.7 and $4.3 billion. Almost all will be purpose-built hulls ordered by field operators, although some may be financed through leasing or tolling agreements. The required production semis will likely be installed in the Gulf of Mexico, Australia, and West Africa.

Looking forward

We believe that active projects in the floating production sector will be challenged this year as companies try to preserve cash, deal with supply chain interruptions and push schedules to defer spending. Projects that are under way with secure financing will most likely be completed, although not on the original schedule. Early stage projects may be delayed substantially or cancelled.

There had been fears of looming capacity constraints in the supply chain, which should now disappear. When oil prices re-stabilize, we strongly believe that orders for floating production systems will resume, particularly offshore South America and in the Gulf of Mexico. •