Embattled industry goes into crisis management mode

Offshore operators to defer more than $42 billion in EPC contracts due to low oil prices, COVID-19 pandemic

Mark Adeosun, Westwood Global Energy Group

The sudden drop in the oil price together with the Coronavirus pandemic has thrown the global offshore EPC market into a state of flux. 2020 budget cuts so far have been around 25%, but short-cycle US shale players have been the harder hit, announcing average capex cuts of 35% and up to 75%. The offshore market will see a significant slowdown in planned investments. Discretionary E&A budgets have been slashed, rig contracts canceled, and new project sanctioning is being reassessed.

Announcements of delays and deferrals are an almost daily occurrence. As of April 17, major offshore projects that have been deferred include Bay du Nord (Equinor – Canada), Scarborough (Woodside – Australia), Cambo (UK) and North Field South (Qatargas – Qatar). These four projects alone equate to around $8.5 billion of EPC* contracts.

But it is not just oil prices that are slowing down offshore field development activity. The Coronavirus pandemic also poses major logistical challenges for large-scale construction projects that rely on international procurement and significant imported manpower. This could see delays to the roughly $5 billion of already awarded EPC contracts this year such as those associated with Woodside’s Sangomar project off Senegal, and Santos’ Barossa gas project off Australia.

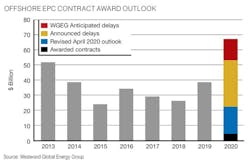

All in all, Westwood now expects up to $30 billion of EPC contracts to be awarded in 2020. This is $43 billion below the $68 billion of possible offshore EPC contracts Westwood had identified for 2020 and 37% less than that awarded in 2019. From an equipment perspective, possible contract awards in 2020 equate to 110 subsea trees, six floating production systems, 1,350 km (839 mi) of line pipe, and 1,400 km (870 mi) of flexibles. Besides the delays announced at the time of writing, others at a high risk of slipping include Western Gas’ Equus LNG off Australia and high-profile African projects such as Shell’s Bonga South-West and BP’s PAJ in the Gulf of Guinea and even Eni’s Mamba gas project off Mozambique. These four projects alone account for $5.3 billion of offshore EPC contract value.

The outlook for oil prices looks bleak for the remainder of the year. Oil consumption fell by an estimated 5 and 10 MMb/d in February and March, respectively, as Europe and the US joined Asia in rolling out social lockdown measures to prevent the spread of COVID-19. April is expected to be the inflection point for demand destruction with analysts estimating a drop anywhere between 15-30 MMb/d. OPEC+ finally agreed to 9.7 MMb/d of production cuts on April 9 starting from May 1 and tapering until April 2022. A few days later, G20 members pledged a further 3.7 MMb/d of cuts and international oil purchases into SPRs amounting to 200 MMbbl. However, despite this unprecedented intervention, oil markets are expected to remain oversupplied for much of 2Q with global consumption only reaching 90 MMb/d in June/July, according to recent analysis released by the EIA and IEA. Westwood has revised its 2020 annual average oil price assumption to $40/bbl, rising to $50/bbl in 2021.

With $5 billion of offshore EPC contracts already awarded year to date, Westwood still anticipates around $25 billion of offshore EPC contracts to still be awarded, assuming prices are around $30 throughout the remainder of 2020. These projects are typically high-priority developments that already have substantial contracts awarded such as ExxonMobil’s Payara off Guyana, Equinor’s Bacalhau off Brazil, and Shell’s Whale in the Gulf of Mexico.

After a turbulent five years, the offshore E&P industry is once again adopting the brace position and operators and contractors are treading a fine line between sustaining cashflow and ensuring the health and safety of their workforce. •

*Offshore EPC contracts include floating production systems, fixed platforms, subsea production systems, subsea umbilicals, risers and flowlines and pipelines.