Rystad downgrades E&P revenue, cashflow estimates

Offshore staff

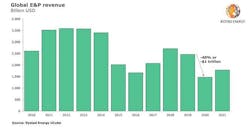

OSLO, Norway – Global E&P revenues could fall by around $1 trillion this year to $1.47 trillion, compared with $2.47 trillion in 2019, according to Rystad Energy.

Prior to the spread of COVID-19, the consultant anticipated revenues of $2.35 trillion in 2020.

It has now lowered its estimated for 2021 from $2.52 trillion to $1.79 trillion.

In addition, Rystad estimated that free cash flow across the E&P sector will shrink to $141 billion, one-third of the level in 2019, based on a base-case scenario of $34/bbl in 2020 and $44/bbl.

But there is a substantial downside risk if currently lower oil prices persist.

Rystad upstream analyst Olga Savenkova said: “This drop not only undermines the companies’ solidity and reduces money available for investments and dividends, but also significantly cuts government tax revenue.

“It will be challenging for petro-states such as Russia and many Middle Eastern countries to sustain their budgets.”

Globally, upstream spending looks set to plunge by 25% to $410 billion this year, with cuts in the range of 12% for offshore deepwater assets.

Capex cuts will also impact companies’ ability to proceed with final investment decisions (FIDs) on new projects. So, 2020 could deliver the lowest project sanctioning activity since the 1950s in terms of total sanctioned investments, falling to $110 billion, with most planned projects being deferred.

Operators may then have to wait years to bring a deferred project back on track as stricter economic terms are applied to new FIDs.

The situation is complicated by the imperilled position of many service companies. Operators cannot rely on the oilfield service sector to repeat the cost reductions it pushed through in 2015-2016, Rystad claimed.

At the same time, the consultant sees a growing de-carbonization sentiment among E&P players and investment banks, so the restraint on new project sanctioning could mean “peak oil” will arrive sooner than predicted.

04/29/2020