Africa Oil changes its name to Meren Energy

Africa Oil is renaming itself Meren Energy Inc., based on an old nautical term for mooring of a vessel as it docks.

The company has also issued updates on development planning for various projects offshore Namibia and Nigeria in which it is a partner.

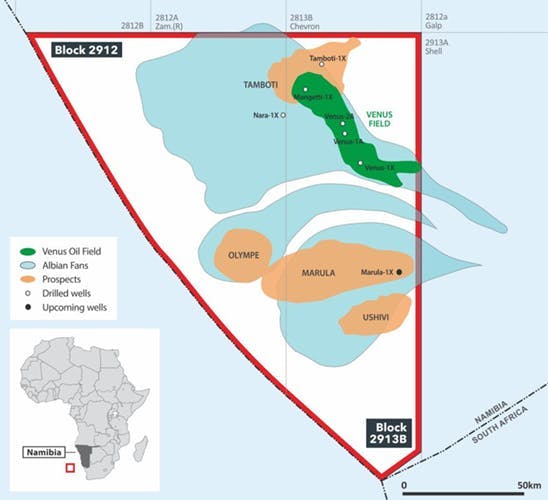

In Block 2913B in the Orange Basin offshore Namibia, the current plan for the TotalEnergies-operated Venus discovery is to drill up to 40 subsea wells tied back to a 160,000-bbl/d FPSO.

At current rate of progress, FEED should go forward between the second and fourth quarters of this year, with submission to the authorities of the Environmental Statement in the fall. A final investment decision (FID) could follow in the first half of 2026.

The partners next exploration drilling campaign on the basin offshore Namibia should start during the fourth quarter, with TotalEnergies identifying the Olympe-1X prospect on Block 2912 as one possible target.

In the South Africa Orange Basin at Block 3B/4B, the operator currently plans to drill the first exploration well next year, with the Nayla prospect in the northwest of the license area as the potential drilling target.

Offshore Nigeria, TotalEnergies has drilled two new producers this year at the deepwater Egina Field, both of which should go onstream shortly. At the Akpo Field, a well intervention and drilling of one development well are planned by mid-year.

Later this year, the rig campaign will likely be paused to allow for interpretation of 4D seismic data and results from the drilled wells in order to mature future infill drilling candidates.

Among the infrastructure-led exploration prospects is Akpo Far East, which could contain up to 143.6 MMboe of light, high gas-oil ratio hydrocarbons, similar to those produced from Akpo. If drilling here is successful, the prospect could be developed initially using existing production manifolds.

At Agbami, 4D seismic interpretation continues in support of a planned infill drilling campaign in 2027.

Finally, Meren Energy is in talks with various parties on farm-ins to blocks EG-18 and EG-31 offshore Equatorial Guinea, and it hopes to complete the process by the end of September. If successful, the newly formed joint ventures could plan for exploration drilling in late 2026 or during 2027.

President and CEO Roger Tucker said, “The recent completion of the Prime consolidation felt like the natural catalyst to rebrand the company given the transformational impact of that transaction. Over the last couple of years, we have worked diligently to enhance our investment proposition by simplifying the structure of the business and gaining more direct interests in our large-scale and high-netback assets in deepwater Nigeria. The business model has also evolved considerably over the past few years; moving away from being exploration led to being a full-cycle E&P underpinned by strong cash flow generation that supports our commitment to meaningful shareholder returns.”

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.