Facets, contracts, history of non-exclusive, high-efficiency surveying

PART I: This is the first of a two-part series on the business of non-exclusive seismic data and the licensing contract controversy created by the recent wave of industry mergers. Part II will appear in a subsequent issue.

The advent of the modern non-exclusive data business has had a profound effect on the petroleum and geophysical industries. The process has reduced dramatically the price of seismic data, while at the same time, significantly improved seismic quality. It has changed the scope of detailed, high-resolution seismic surveying from prospect-specific to basin-regional. As a result, it has made possible an unprecedented understanding of basin-wide petroleum systems and diversity of hydrocarbon potential within a basin.

At its heart, non-exclusive seismic data is an exploration tool, but the field development geologist and reservoir engineer have benefited from it as well. As an exploration tool, non-exclusive data has placed the power of billion-dollar cutting-edge technology in the hands of large and small companies alike, and stimulated the exploration process enormously.

In the petroleum industry, there are many types of data licensed under a non-exclusive model, in addition to seismic:

- Gravity and magnetic (G&M) data, both 2D and 3D, are acquired and licensed in the same way as seismic data. G&M data are often acquired in tandem with seismic data in non-exclusive marine surveys.

- Proprietary wellbore data is often acquired by data companies through trade or government release, and made available on a non-exclusive license basis. Such data includes well logs, mud logs, pressure data, checkshots, formation tops, and paleo reports. Data companies add value by digitizing, reformatting, interpreting, or otherwise making the data more accessible and usable.

- Geographic and culture data, aerial photography, and certain types of satellite imagery are also available for license on a non-exclusive basis.

- Leasing, drilling, and production data are maintained on an ongoing basis by several companies and offered under a non-exclusive license. This type of license is often time limited.

- Technical interpretations and integrated studies based on regional geological, geophysical, and engineering data are often created and licensed on a non-exclusive basis.

Use-license perspectives

The rules and restrictions on the use of non-exclusive data are defined by a license contract, which must be executed by the licensee in order to obtain the use of the data. In brief, the license contract establishes that the data is the property of the owner, is protected by copyrights, and constitutes a valuable trade secret. The licensee of the data is granted the right to use the data to conduct internal business, but is prohibited from disclosing, transferring or copying the data to any other parties, including by means of asset sales or corporate mergers. The license contract ensures that the owner has the sole right to sell the data licenses to any and all interested companies, and it is only by this means the data may be used by any company.

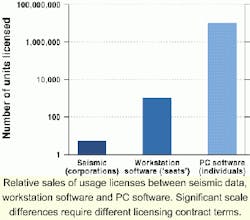

To understand conceptually the licensing terms for non-exclusive seismic data, some have made the comparison to software licenses. There are certainly similarities between seismic and software licenses. However, on closer inspection there are many key differences. To illustrate this, contrast the differences between typical license terms for seismic data, workstation software, and personal computer (PC) software.

- Seismic data: On average, a typical 3D seismic survey will be fully licensed 5-10 times. The recipient of a 3D seismic license is a company. The license fee conveys a license to the entire company and any employee may use it for the benefit of the company, including contract consultants. The data may be loaded on any number of workstations. Along with the license comes access to the raw field data. The licensee can reprocess the data, refresh it, and upgrade it without paying an additional license fee. No annual maintenance fee is required. The license lasts effectively as long as the company does, except in the case of merger or acquisition by another company, in which case it is terminated and must be re-licensed by the acquiring company.

- Workstation software: In contrast, workstation software is licensed according to the number of workstations, or seats, where the software will be installed. For any reasonably successful software package in the industry, several thousand units will be licensed. The source code for the software is not licensed, so the user may not upgrade or improve the software without the payment of additional license fees. An annual maintenance fee is required to receive technical support. The software is made obsolete fairly quickly by improvements in hardware and software. As a result, new software licenses are purchased periodically by most companies. The software may be transferred in the event of a company merger or acquisition, in which case the acquiring company ends up with the combined number of seats licensed in both companies, and must pay the combined annual maintenance fees.

- PC software: PC software is licensed to individuals. Each person wishing to use the software must have a license. Corporate licenses are sold based on the number of downloads rather than individuals. A typical PC application, if successful, can be licensed hundreds of thousands, or even millions of times. No source code is licensed, and the rate of obsolescence can be quite rapid. In the case of individuals, no transfer is allowed. In the case of corporations, transfers are allowed, but again the number of units licensed in the combined company is simply the sum of the units licensed by the each of the companies separately.

Non-exclusive seismic data is sold to an extremely small market in relative terms. Additionally, the client assumes the automatic right to the raw field data - broadly analogous to the source code for software - with the data. The license terms required on a product which is fully licensed typically less than 10 times, must necessarily be quite different from the license terms on a product which can be licensed thousands or even millions of times.

From the beginning, the geophysical industry was built on proprietary 2D seismic reflection and refraction surveying - a single contractor working for a single oil company, acquiring and interpreting data which the oil company then owned exclusively. With the advent of digital recording and common depth point processing, the geophysical industry entered its golden age. Exploration and production (E&P) companies enjoyed remarkable exploration successes with the tool, and the geophysical industry experienced strong growth.

1960-1979 period

During the 1960s and 1970s, it was not uncommon for geophysical contractors to acquire occasional 2D spec seismic lines in frontier areas, or small 2D spec grids over suspected prospects. Group shoots which ended up in contractors libraries were also common. However, spec data acquisition was purely a secondary endeavor for the industry during this period, and it was proprietary work that paid the bills. As such, the spec data libraries of the 1960s and 1970s were haphazard, and often of poor and inconsistent quality. Spec data was acquired as a hedge strategy when weather conditions were outside proprietary contract specifications, or other factors prevented contract work from taking place.

The seismic exploration methodology of the E&P companies during this period was trend and prospect specific. Data was acquired in pursuit of a specific play, and not in a systematic fashion designed to understand an entire basin in detail. Such large-scale regional surveying was beyond the reach of individual oil companies.

1980-1989 period

In the early 1980s, a few pioneering companies envisioned the enormous potential of large scale, high quality non-exclusive 2D surveys in the Gulf Coast Basin and the North Sea, and developed a business model to create them. This early effort proved successful and was very well received by the industry. It marked the beginning of the modern non-exclusive data business. Integrated geophysical companies, new specialized spec data companies, and data brokers ultimately became participants in the new business.

By the middle 1980s, significant quantities

of modern non-exclusive 2D data had been acquired and E&P companies were becoming accustomed to its attractive price, good design, and high quality. Then a series of difficult downturns rocked the industry and began a painful process of downsizing and technical outsourcing, which has continued unabated to the present day. This steadily increasing economic pressure on the industry changed the dynamics of the non-exclusive data business.

The lower cost of non-exclusive data became a means of survival for many exploration companies, and the primary driver for cost effective exploration across much of the industry. As a result, more and more of the geophysical business shifted from the proprietary business model to the non-exclusive model, particularly in the major offshore basins of the Gulf of Mexico, the North Sea, and offshore West Africa. The rate of data collection and capital investment increased.

As non-exclusive data libraries grew, the density of data coverage increased to the point that oil companies could not only use them for regional work but also for prospect specific work as well. For the first time, E&P companies could generate prospects across an entire basin and relate them one to another in detail via a regular, consistent grid of high quality data.

Acquisition technology and performance specifications on non-exclusive surveys were often more aggressive than on proprietary surveys. By spreading the cost of data collection over many sales, to several companies, this high dollar investment in quality was made possible. By the end of the 1980s, the majority of all marine 2D data in the world was being collected on a non-exclusive basis, and the business was fully developed.

At the same time the global 2D data libraries were being built, 3D seismic technology and methodology was rapidly evolving. By the latter part of the decade, the method was reaching full bloom. Major companies were logging an impressive track record of improved drilling success rates using 3D seismic. As technology brought the volume cost of 3D data down, several companies began to experiment with non-exclusive 3D data. Coarse sampling methods, 2-1/2D, were not well received. Small full fidelity 3D surveys, true 3D surveys, were well received by the market. The business took off initially in the Gulf of Mexico, where small block size and rapid acreage turnover proved to provide the correct mix of economy of scale and multiplicity of sales.

1990-1999 period

The shift from the proprietary to non-exclusive business model, and from 2D to 3D, continued into the 1990s. The growth of the 2D libraries began to decline, and the growth of 3D libraries increased dramatically. The industry moved much more rapidly to embrace the non-exclusive business model for 3D data. However, 3D data was much more expensive than 2D data. The capital investments in data being made by the geophysical industry in the 1990s were many times greater than the investments made in the prior decade. The industry-wide rate of investment increased throughout the decade.

By the middle of the 1990s, the non-exclusive business model was dominating 3D data acquisition in the Gulf of Mexico, just as it had 2D in the 1980s. In the North Sea, a fairly reasonable balance was reached between proprietary and non-exclusive models for 3D data. By the late 1990s, non-exclusive 3D surveys were being conducted in Asia, Australia, Africa and Canada.

Today, the geophysical industry is dominated by the non-exclusive data business. The vast majority of all marine 3D surveys acquired around the world, and a large proportion of the land and transition zone 3D data in North America, are being collected on a non-exclusive basis. Large non-exclusive 2D surveys, although less common, are still acquired in frontier marine basins, and onshore western Canada. They will continue to play a very important role in exploration. Proprietary 2D surveys continue at a steady rate.

The authors feel this overwhelming global shift to the non-exclusive model in 3D in the past two years is excessive, and is due more to the highly depressed state of the industry than to good investment fundamentals. This unhealthy trend must correct itself quickly in order to avoid long term damage to the geophysical industry.

Definitions

- Non-exclusive data: Data that is owned by a geophysical or data company, and licensed for a fee to E&P companies under a non-exclusive use-license. The use-licenses are restricted in that the buyer of the data license (licensee) may only use the data subject to important restrictions that protect the value of the asset for the owner.

- Group shoot: This term was used for a type of seismic survey popular in the 1960s, 1970s, and early 1980s. In a group shoot, seismic, and/or gravity and magnetic data were acquired for a group of E&P companies, usually operating under an AMI (area of mutual interest) in a frontier basin. The acquisition contractor was often a participant in the group because he carried a share of the costs, usually an equal share with the other group members. The group shared the cost of the survey at market rates and the contractor was not expected to provide a turnkey price. The contractor usually had the right to market the data to third parties after the group members had evaluated it, and the group members typically received benefit from subsequent sales in proportion to their shares.

- Spec shoot: A spec shoot is a speculative survey in which the seismic contractor carries all or a substantial portion of the cost and risk of the survey, and retains the revenue from license sales of the non-exclusive data to E&P companies.

- Brokerage data: In the 1970s and 1980s, the major oil companies acquired large volumes of 2D seismic data around the world, particularly onshore and offshore North America, which they ultimately allowed to be licensed to third parties on a non-exclusive basis through data brokerage companies. Many of these volumes were later purchased by spec data companies and made a part of their non-exclusive libraries.

- Modern non-exclusive data: The age of modern non-exclusive data began in the early 1980s when several companies decided to make high quality regional spec data the primary focus of their business. Since then the quantity, quality and value of the non-exclusive data libraries of the world has increased dramatically. Today the terms: multi-client, spec, and non-exclusive are synonyms.

- Pre-funding or pre-sales: These are license sales made by the owner before or during the acquisition of the data. By securing some sales commitments in advance, the capital requirements and risk taken by the owner can be managed.

- Late sales: These are license sales made after the risk is taken by the owner and/or after the data is acquired and available for delivery.