Global Data

Worldwide offshore rig count and utilization rate

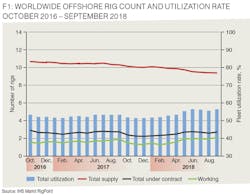

The offshore rig market has improved somewhat in September, erasing most of the decline suffered over the last couple months. The total number of jackups, semis, and drillships under contract grew slightly this month to 434 rigs, which is an increase of five units from last month.

At the same time, a couple more units have been removed from the global fleet, with the total supply falling by three to a total of 769. With these changes, rig utilization climbed by almost a whole point to 56.4%. Meanwhile, the number of rigs working has also had a bump this month, rising by six units to a total of 402.

– Justin Smith, Petrodata by IHS Markit

Middle East to continue driving jackup contracting activity

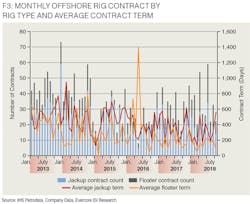

Offshore contracting activity accelerated in September with 33 new contracts announced, up 17 year-over-year, according to analyst Evercore ISI. Of five term contracts confirmed in September four were for jackups including three in the Middle East for ADNOC Offshore.

The analyst expects the UAE’s jackup count will establish new peaks in the coming quarter, as well as the Middle East to continue driving jackup contracting activity. Overall, Evercore counts 25 open tenders for jackups in the Middle East for an average of 2.5 years, up slightly from 24 tenders as of July despite 11 new term contracts awarded over the past three months.

FPSO market making strides again

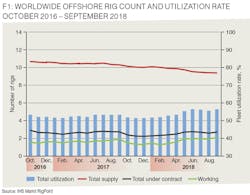

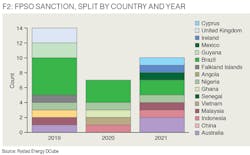

The global floating production market has stirred back to life, according to analyst Rystad Energy. Last year brought some relief to the market, with six new FPSO orders worldwide. With oil prices recovering to around $80/bbl this year, combined with technological advancements and reduced costs, momentum has picked up further.

More than 30 FPSO projects could reach FID between 2019 and 2021. The cost-cutting efforts of the downturn are a major contributor to the projects’ favorable economics. Fourteen projects have a breakeven of less than $50/bbl, 15 projects come in between $50 and $70/bbl. Just three of the expected projects have breakevens more than $70/bbl. The analyst added that FPSO awards are set for a strong comeback driven by Brazil.