Tough times continue for offshore supply vessel market in the US Gulf

Excess capacity, labor constrains hinder recovery

Richard Sanchez

IHS Markit

Last year this author wrote about the US Gulf of Mexico’s offshore supply vessel (OSV) market suggesting that 2017 was expected be the bottom of the trough. His forecasts suggested that rising oil prices would stimulate more offshore exploration and production; however, 2018 is already proving to be worse, despite high oil prices. Deepwater day rates have sunk as low as $7,000, and OSV term utilization has continued to hover around 24-26%. Most of the OSV industry has been operating in the red for well over a year. The largest platform supply vessels (PSV) have operating costs in the range of $6,000-$10,000/day; boat owners have been bleeding cash just to stay in business; and the situation seems likely to persist. The success of North American onshore production has been devastating to gulf coast oil service providers in offshore environments.

Edison Chouest Offshore has the largest fleet and has managed to hold on to the most term charters throughout the downturn.

(Image courtesy Edison Chouest Offshore)

Offshore focus leaves the US Gulf

The first barb came in mid-2014 with a dramatic fall in global oil prices. The OSV industry was in the midst of a robust newbuild construction cycle, and most were caught almost completely off guard. Offshore oil and gas investment severely diminished in 2015, and offshore sectors felt it most acutely as drilling rig programs were slowed, postponed, or canceled. As oil prices climbed in 2017, many thought offshore investment would resume, but short cycle barrels from onshore plays were looking more attractive to investors. Offshore demand has suffered, and as it slowly returns with higher oil prices, the oil companies have been very careful about where to spend those offshore investment dollars.

While the US Gulf is far from done, new oil investment has been focusing E&P spending on the burgeoning regions of Mexico, Guyana, and Brazil. While Brazil certainly is not new, oil companies have shown renewed interest after the large presalt fields were unshackled from Petrobras and became more open to international investment.

The OSV industry in the US Gulf continues to languish under the pressure of excess capacity which has kept day rates at or below operating costs. Despite multiple bankruptcies, very little consolidation has occurred. Hornbeck Offshore Services’ purchase of Aries Marine’s four deepwater PSVs effectively eliminated one of the 12 deepwater competitors, but it is not enough to move day rates. Now that Tidewater, GulfMark, and Harvey Gulf International Marine have emerged from bankruptcy, the stalemate seems more likely to continue. Hornbeck Offshore Services is the next major OSV company which many market watchers expect will submit a prepackaged bankruptcy before the end of 2018.

Bifurcation of shallow and deepwater demand

The long-term OSV and rig forecasts for the US Gulf are mostly flat, and that is more about deepwater maintaining activity levels, while shallow water activity is at a historic low. Where once we had seen hundreds of jackups in operation, this year we consider it extraordinary to have 10 jackups working simultaneously. The deepwater market would not look so bad if not for the massive oversupply of vessels driving down profitability. In June 2018, IHS Markit reported 60 term charters for PSVs greater than 3,000 dwt, unfortunately, 150 PSVs managed by 12 different companies are chasing those jobs. That is more than two deepwater supply vessels for each term charter.

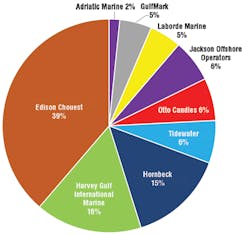

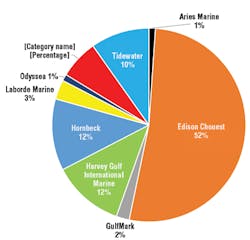

Several of the CEOs speaking at a recent Marine Money Offshore Forum in Houston said that 2018 will be another difficult year, and two of them called the first quarter of 2018 the bottom of the OSV market. One voice absent at the Marine Money Forum was the single largest OSV company in the US Gulf, Edison Chouest Offshore. Some in the industry also suspect Edison Chouest Offshore may also be in some distress, but these concerns have been overblown. Before the downturn in January 2014, Edison Chouest held 52% of the term charters for Jones Act PSVs greater than 3,000 dwt in the US Gulf. Today it continues to hold onto 39% of that deepwater market which has become even more fragmented. New players joined the market with deepwater vessels right before the downturn began. Jackson Offshore Operators, Adriatic Marine, and Odyssea Marine have managed to carve out niches for themselves in an already crowded market.

The US Gulf’s most powerful competitor

Edison Chouest Offshore has long been the leading provider of offshore supply vessels in the US Gulf of Mexico. It easily has the largest fleet and has managed to hold on to the most term charters throughout the downturn. Going into the downturn the company was in a very strong position with term utilization above 91%. Edison Chouest Offshore is a unique example of a highly integrated OSV company. It owns extensive shipbuilding capacity, ship repair yards, shore bases, and a myriad of subsidiary companies that help it maintain unparalleled control of capital costs and operating costs on its operations in the US Gulf and Brazil. If you are repairing an OSV in the Gulf of Mexico, chances are high that your maintenance costs end up in Edison Chouest’s coffers. Back in late 2014, in partnership with Ben Bordelon, Edison Chouest Offshore strengthened its shipyard holdings by acquiring Bollinger, the largest vessel repair company in the region with more than 30 dry-docks in Louisiana and Texas. Besides helping to control costs, the Chouest empire of offshore service companies also contributes revenue not available to an average OSV company. Edison Chouest Offshore is a very private company, but there is little doubt that it has negotiated more favorable terms with its 50+ lenders to account for lower day rates fleet wide.

Current state of the US Gulf OSV market

The US Gulf OSV market is still oversupplied in both shallow and deepwater sectors, with not much relief in sight for vessel owners. Low day rates are expected to continue until the supply of immediately available vessels is forced down by high-priced docking surveys or labor constrains. The offshore industry has been losing skilled mariners and vessel owners currently lack the budgets to attract replacement mariners. Constrained labor could be the lever that ratchets down the oversupply and forces operators to offer long-term contracts which could cover the prices of labor and docking surveys. Vessel owners need term contracts on order of six months at sustainable day rates to justify $2-million regulatory docking surveys.

For the moment, oil companies continue to enjoy offshore logistics costs which are being subsidized by the vessel owners and their banks.

Looking to the past to find a way forward

Next year’s spending budgets will offer the next important clues to potential recovery scenarios. However, if we look to the last time the bottom fell out of the market, 1985, to see what a “recovery” looks like, we could be in for a very long wait. How long did that last historic downturn last? Eight years, 10 years, 15 years, 20 years. It somewhat depends on who you asked. Looking back to the OSV survey published in the Offshore International Newsletters (1991-2008), OSV day rates remained severely depressed for at least eight years. Back then 210-ft (64-m) PSVs were the workhorses of the US Gulf. In early 1993, with operating costs (opex) in the range of $2,500-3,000/day, rates began creeping up above opex in May 1993 when rates reached $3,250/d, from a low of $1,300/d. But they fell below opex again in 1994. Late 1995 saw rates rally again above opex and had vessel owners enjoy a few years of better fortunes. In late 1998, day rates tanked again and were below opex for until 2000. The 2000-2005 period saw rates bounce in and out of profitability. By 2005 the OSV fleet had changed. Many of the old players had been weeded out and vessel owners stayed out of the spot market and demanded long-term contracts. This period also overlapped with the rise of deepwater demand which required new boats and started the cycle all over again, with shallow and deepwater gradually going in opposite directions. •