Smaller, stronger, faster

Rig equipment technology changes to meet deepwater challenges

Judy Maksoud, International Editor

Deepwater environments pose significant technical challenges. As demands on equipment increase, the companies that supply critical components are working to meet some of the greatest challenges since the inception of offshore drilling.

One company that falls into this category is American Electric Technologies Inc. (AETI), formerly M&I Electric Industries Inc. The company’s focus over the last seven to 10 years has been on alternating current variable frequency drives (AC VFDs), motors that power vital equipment, including drawworks.

Dale Reeder, vice president of marine marketing, says the technology is finally coming into its own, in great part because of the technology needs in more demanding drilling environments.

“The world changes when you start getting into the deeper water and equipment requirements and operator-imposed requirements really start taking hold,” Reeder says.

For AETI, the way forward is the AC VFD.

The AC VFD is an induction motor, Reeder explains, with everything set into motion by bi-electrical manual current instead of the traditional DC power, which requires current commutation.

“Because the AC VFD is all inductive and magnetic fields, there are no brushes, there’s no wear, and there’s no maintenance of brushes,” Reeder says. “There’s a lot of benefit to this, because the motor is capable of running at more than what is called synchronous speed (usually 1,200 rpm). That’s the maximum speed at which the motor is designed to run. An AC VFD motor can run from 0 up to 1,200 rpm and more because of the VFD characteristics,” Reeder explains.

With AC VFD, frequency is what controls the speed instead of voltage. “You can ‘overspeed’ the motor,” Reeder says, “to take advantage of a block that is not heavily loaded to reduce trip time. Taken over a normal drilling year, it’ll make an enormous difference in drilling time. Years ago, when the top drive was introduced to the industry, that was its main attribute.”

Being able to “overspeed” the motor has obvious attributes, Reeder says. That means the driller can exercise more precise control over the bit. “The other finite point,” he says, “is that these motors can be used to brake the drawworks. AC VFD motors can be used to hold the weight on the drillstring even when operating at zero speed. We can use the motor and the controls and have them in turn be controlled by an automatic driller.” This takes the place of the old conventional automatic driller and moves personnel into a safer working environment.

Because the AC VFD design eliminates the gear box, it is not only significantly lighter, it is easier to operate, which means that it saves wear on the motor, drawworks, and bits. But the cost savings goes well beyond capex investment, Reeder says.

“There is no doubt the AC VFD saves money on bits, but what the operator is interested in is what saves time. Bits are expensive, but they’re nothing compared to the cost of downtime when the operator has to trip out of a deep hole,” Reeder explains.

The AC VFD offers better functionality with less weight and at a lower initial cost. “Combining this with the safety enhancement, mainly in the drawworks, makes this technology very valuable to drilling contractors,” Reeder says.

Safety first

Bill Stroshein, vice president, technical development, of Calgary-based Iron Derrickman Ltd. agrees with Reeder’s views on safety and the application of the AC VFDs.

Iron Derrickman builds a robotic arm that takes the derrickman out of the derrick and puts him in the control room with the driller, Stroshein explains. The arm can also be run using radio controls from the rig floor.

“The point is that we’re using technology to get people out of harm’s way,” Stroshein explains. “We put workers in an environment they are familiar with, behind a console controlling operations using joysticks and touch screens. Obviously, the safety is better, and significant efficiencies improve because the AC motor allows more precise control of the bit.”

Stroshein refers to both the pipe arm and the AC drawworks as somewhat “disruptive” technologies because they completely change the traditional way of doing things. “There is still some resistance in areas of the industry to making these changes,” he says. Despite industry resistance to change, these technologies are moving into the mainstream.

Part of the reason for this, Stroshein says, is that AC VFDs are an enabling technology for minimizing risk. “The abilities for remote communications are much greater with the PC-controlled systems typically associated with AC drives,” he explains.

“Remote troubleshooting is the big thing,” Stroshein says, “not just because it is safer, but because there is a tremendous scarcity of qualified people. You can use less-experienced people to carry out troubleshooting onsite because they can get direction from experienced people remotely.”

Reliable systems

LeTourneau Technologies Inc. is using its own brand of AC motors for many of the same reasons AETI adopted them. In fact, the company’s unique top drive system is based on AC motor technology.

Dan Eckermann, president of LTI, explains how the company came to develop its new top drive. “When we decided to move into drilling systems a little less than a decade ago, we focused on AC drive technology to build our unique top drives because it provides built-in reliability. The AC drive is reliable, powerful, and simple, and it has a tremendously long life.”

Reliability is everything, Eckermann says. “Like the heart in your body, if the top drive fails, everything fails.”

When determining what to focus on in developing its new product, LTI homed in on the fact that the gear box and associated components are the cause of 40% of the failures. It became obvious that eliminating the gear box would eliminate significant potential for failure.

“Moving parts are problematic because they require seals, bearings, and lubricants. And they wear.” Eckermann says. “Ours is a very simple design approach. It has fewer moving parts because they are normally the first things to fail.”

LTI also designed in controls and monitors to allow diagnostics that isolate problems in real time and allow preventive maintenance, Eckermann says.

“Today, rigs are extremely expensive, and day rates are sky high; so reliability is becoming critically important,” Eckermann says.

Cutting down the time needed to service the top drive was another of LTI’s design objectives. As a result, the main stem assembly of these top drives can be replaced without having to remove the motor, which reduces the amount of downtime required while the equipment is being serviced.

LTI manufactures a family of top drives. At the low end is the 250-ton (226.8 metric ton) top drive that is used primarily onshore. LTI offers a 500-ton (453.6 metric ton) top drive as well, and the company’s 750-ton (680.4 metric ton) unit is being used in offshore applications. A 1,000-ton (907.2 metric ton) unit is under development, Eckermann says.

“We’re coming out of the chute now. The general reception has been extremely favorable. There has been a huge amount of interest.”

Eckermann expects the 1,000-ton top drive to be on the market early next year in a semisubmersible application.

Aker Kværner is also investing in top drive technology.

Trond Robstad, vice president of business development, says the company’s new AC-powered top drives are being installed on newbuild drillships being constructed at Daewoo Shipbuilding & Heavy Machinery in Korea.

The 1,250-metric-ton (1,378-ton) top drive incorporates many of the technologies that are in demand in the industry, Robstad says, including remote monitoring. “The industry is getting more ‘hands-off’ and more remote diagnostics,” he explains.

“Remote monitoring allows you to track operating efficiencies from an onshore location,” Robstad says. “Many companies are now providing this capability because it helps to avoid downtime. Remote monitoring also means you can be proactive in preventive maintenance.”

The Aker Kværner system uses vibration measurement to determine how the equipment is performing. The data is transmitted offsite to a technician who can monitor performance. “This technology can be introduced to most of our product line,” Robstad says.

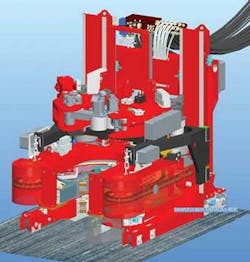

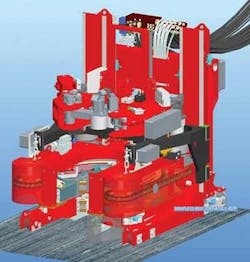

In addition to its top drive technology, Aker Kværner has been working on streamlining the drilling process. The upshot of that research is the TorqueMaster, a patented machine for making up and breaking out drill pipe, drill collars, and casing.

Developed in conjunction with Statoil, the TorqueMaster not only quickly makes up and breaks out pipe, it provides documentation on all the connections, a must for Gulf of Mexico operations, Robstad says.

The robot controlled TorqueMaster is a product Aker Kværner believes has great potential, according to Robstad. The machine makes and breaks connections using continuous rotation. It provides very high torque, which saves on drilling time, Robstad says. The equipment has been used in a number of applications over the past year.

Aker Kværner ’s objective is to look at what the market needs so that the needs can be met, Robstad says. “We are working on giving the customer a complete system, not just delivering what they’re asking for. We try to understand their needs, where the bottlenecks are. With our engineering resources and experience in different markets, we understand what the oil companies and drilling contractors need. That’s where we think we have the edge.”

Moving forward, the company is carrying out a lot of upgrades on its existing product line, Robstad says, including software that provides a new way of measuring performance details.

There also are technologies Aker Kværner is not pursing at present, but that have the potential to significantly impact the industry, Robstad says. One of those is the use of permanent magnets to increase motor capacity.

National Oilwell Varco, meanwhile, is investing heavily in permanent magnet technology.

David Reid, vice president of product management for rig solutions at NOV, believes permanent magnet technology is not only viable, but needed in the industry. “Permanent magnets, magnets that hold their magnetism over time, provide the most efficient motor technology to date. The horsepower put into the system gives you more output from a torque and speed combination standpoint in a smaller package than AC induction motors,” he explains.

The potential advantages this creates for drilling are obvious, Reid says, particularly for extended reach drilling, where higher torque and speed are required at the same time over long horizontal wells.

“Traditionally, on the AC and DC machines we had, we’ve worked within a torque/speed curve. We have achieved either an extreme of torque or speed, but not both. We are achieving high torque and high speed at the same time with permanent magnet applications.”

NOV’s new technologies are being applied to increase productive rig time. The modular components, redundancy, and increased capacity of the new machines have the potential to decrease downtime considerably. The new technology also impacts equipment size. “Package size is a key differentiator for NOV in all of the product lines,” Reid says. “Permanent magnet technology fits well into that design philosophy.”

The new technology also marks an important change within the company, Reid says. In the past, NOV relied on mechanical innovation to improve its products. Permanent magnet technology goes beyond mechanical innovation and introduces a technical change. “It changes the game on quite a few pieces of equipment as well,” Reid says.

NOV has been investing in R&D that will allow the technology to go from concept to reality. “For the most part, we’re still in the early development stage,” Reid explains. “We do have a number of permanent magnet machines on rigs and in top drives as well as on manrider winches in Norway,” Reid says. Many more applications are on the drawing board.

Before the technology can gain industry acceptance, NOV will have to prove its viability in the field. The company already has produced seven permanent magnet top drives that are installed on land rigs, and rig crane systems are being sent on their first operational applications. So far, the drawworks is performing to expectations, Reid says.

NOV introduced a permanent magnet top drive for offshore application at the Offshore Technology Conference (OTC) in Houston in May, but the first offshore installation has yet to take place, Reid says. The recently introduced permanent magnet crane also is awaiting its first real-world installation.

While R&D efforts continue with permanent magnet technology, NOV is capitalizing on innovations to its iron roughneck, a piece of equipment that makes up and breaks out stands of pipe. “We’re shipping more than one a day,” Reid says.

The newest iron roughneck design has a number of advantages, including the speed of connection. The innovative design integrates the spinner and the torque and eliminates the tracks required by conventional iron roughnecks. NOV has supplied numerous multi-purpose tongs with a three-point bite that allow it to more efficiently make up and break out modern thin-wall drill pipe connections.

One of the keys to staying in the vanguard of technology development, Reid says, is focusing on continual evolution.

Evolution

At Cameron, “evolution” is not just a mantra for the company’s R&D group, it is the name of a new product line. Cameron’s EVO product line is being touted as the next evolution for drilling systems.

Mike Mikulenka, director of marketing services drilling production systems, says, “Cameron has been making BOPs (blowout preventers) for 80 years, and we’ve developed several models and technologies over that time. We have come up with solutions to the challenges presented by new drilling areas, and we’re continuing that effort with the EVO line of products.”

Cameron advertises its EVO line as smarter, less complex, powerful, and reliable. According to Irving Schneider, director of marketing for the drilling division, the products are all that and more.

The two components that have made the biggest impact on the company’s EVO BOP are the locking mechanism and bidirectional ram, Schneider says. “The locking mechanism is the big step change in our latest BOP.”

Cameron focused on the lock because the industry is demanding a less complex, more reliable locking mechanism. One of the design objectives was to reduce the number of parts to create a simple, low-maintentance lock. The new design has 60% fewer parts than the previous model.

Deeper water was a major impetus for the design change. “In 10,000 ft (3,048 m) of water, you can’t afford to pull the stack to fix a problem,” Schneider says.

Cameron introduced the EVO BOP with the EVO-Loc at OTC. The lock is a motor-driven lock screw that contains a locking mechanism that Cameron says is the only ROV-operable lock in the industry.

The new design has met with a warm reception, Schneider says, noting that the company expects to sign the order for the first EVO-Loc that will go into the field by the end of July. If the award comes through, Cameron will deliver one within the following 12 months, Schneider says.

The recently introduced bi-directional ram is another of Cameron’s major innovation. The ram creates a seal above and below the ram cavity; so the drillstring doesn’t have to be retrieved before the stack can be tested, which saves a lot of trip time. By eliminating one cavity, Cameron also was able to decrease the height and weight of the stack.

Another component of the BOP stack is the wellhead connector. The EVO-Con connector latches not only onto Cameron wellheads, but those of its competitors, Cameron says. The fingers in the connector can be changed out to match the wellhead profile. Cameron has already placed these in the field.

“The next step for us is deepwater MUX (multiplex) hydraulic controls,” says Schneider. Cameron is developing controls that will be reliable at 12,000 ft (3,658 m) water depth and greater. R&D work is already underway for MUX controls to reach 15,00 ft (4,572 m) and deeper, he says.

“When we develop new products, we get feedback from our customers before we modify our design. We don’t design our equipment in the dark, which makes acceptance a whole lot easier. There is great room for improvement in the industry,” Schneider says, “and drilling contractors are always looking for a better mousetrap.” •

Aker Kværner’s TorqueMaster makes and breaks connections using continuous rotation.

NOV’s manrider winch is powered by permanent magnet motors.

Cameron has invested in the EVO BOP, which features reduced height and weight, fewer accumulator bottles, and low-profile bonnets.