Pressure to consolidate continues

The move by TotalFina and Elf (TFE) to combine operations keeps the French national oil presence ahead of the cluster of national and (now) second-tier integrated majors. However, it does not move them into supermajor status. For TFE to gain that status an additional merger with ENI or Chevron is the best approach. The pressure continues on the smaller players to combine for added size:

- Phillips is the latest company shopping for some form of enhancement. Talks with Chevron and Texaco have not been fruitful, although some form of joint venture seems possible.

- A merger with Chevron would create a company of the same size as TFE and create new synergies to chase the supermajors.

- A three-fold merger of Phillips, Chevron, and Texaco would create a new supermajor to chase BPAmocoArco.

All the smaller integrated companies face the same dilemma: how to maintain their independence, yet attract growth capital to compete against substantially larger players. The only way to remain a viable player may be to sacrifice independence for an entirely new form of operation, one that is larger and more synergistic.

Driving the larger economic picture

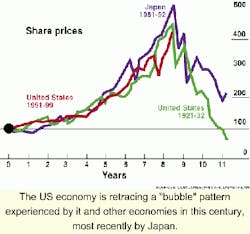

As the industry approaches the beginning of the end of the millennium, there are certain economic patterns that echo the past. The US economy is showing a pattern similar to the one experienced in the 1920's - a long-running rise. The pattern may not repeat the cycle (steep decline), but that is a lingering fear. The US has been the market of last resort during the two-year healing period following the Asian collapse of 1997.

The country has assimilated the world's economic slack, supplied liquidity, and provided markets for the inventory overhang created by the collapse. At this point, there is no other economy that is strong enough to help fill the role of economic shock absorber. It will take at least another year for the Asian economies to return to full steam. Their internal demand is growing again, but they are still vulnerable. Europe is steady and Japan is growing slowly after years of inertia. If something sends the US economy down, a world recession is possible.

Independent links EVA to compensation

Nuevo Energy claims it is the first independent oil and gas producer to adopt economic value added (EVA) as its principal financial targeting system. EVA is the income margin that exceeds the cost of the capital allocated. The company has been working for a year to develop the system. "By using EVA in our capital allocation process and then linking incentive compensation at all levels of the organization to this tool, we'll ensure that every decision we make, large and small, will be evaluated based on its likelihood of creating shareholder value," commented Doug Foshee, Nuevo's Chairman and CEO. EVA has been implemented in dozens of industries, including large integrated energy and power companies. However, the exploration and production sector has been slow to follow due to the wide fluctuations in reserve values associated with volatile commodity prices.

Y2K will test global economy

What does the global economic climate mean for the offshore oil business? The recent oil price recovery is predicated on a diminishing supply overhang ahead of reviving demand for crude. It requires a delicate touch to match slowing supply with rising demand.

At some point, supply will have to increase quickly to match accelerating demand.

If demand recovery falters, the business will suffer another cash flow crisis, as crude supply stays above demand.

In the middle of this "velocity matching" balancing act is the Y2K bug and its undeter mined effect on developing markets. If those economies collapse a second time as a result of computer induced problems, a similar oversupply scenario could unfold.

The problem this time is the US economy; it is at saturation, or near the economically efficient limit. It can absorb no more world production without creating inflation, and would be of limited value in a second world economic collapse. Next to armed conflict, economic collapse is a major fear for both governments and individuals. The coming momentous date rollover will test the global economy as never before.