Chevron set for surging production growth following Hess acquisition

By Jeremy Beckman, London Editor

NEW YORK/SAN RAMON, CA — Chevron has agreed to acquire Hess Corp. in an all-stock transaction valued at $53 billion.

Chevron chairman and CEO Mike Wirth said, “Our two companies have similar values and cultures, with a focus on operating safely and with integrity, attracting and developing the best people, making positive contributions to our communities and delivering higher returns and lower carbon.”

Hess CEO John Hess, who will join Chevron’s board of directors, added, “This strategic combination brings together two strong companies to create a premier integrated energy company. I am proud of our people and what we have achieved as a company, which has one of the industry’s best growth portfolios including Guyana, the world’s largest oil discovery in the last 10 years…”

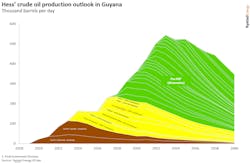

In Guyana, the Exxon Mobil-led joint venture has to date discovered more than 11 Bboe of recoverable resources with high cash margins per barrel, a strong production growth outlook and potential exploration upside, Chevron said.

It anticipates budgeted expenditure for the combined company in the range $19 billion to $22 billion, and following closure of the deal, it expects to increase its asset sales and generate $10 billion to $15 billion in before-tax proceeds through 2028.

Analysis of the deal

According to Matthew Wilks, senior upstream analyst at Rystad Energy, Chevron is “betting big” on the future output of Guyana and Hess’ stake in the offshore Stabroek Block, which gives the company access to 3.4 Bboe of the discovered volumes.

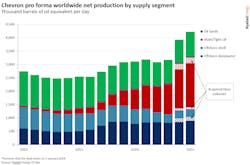

Rystad estimates the overall cost of the Hess transaction at $60 billion, inclusive of debt. In return, Chevron gains 400,000 boe/d in net production in 2024, of which almost 33% will come from Hess’ offshore deepwater interests in Guyana and the GoM, and a further 18% from the offshore shelf in southeast Asia.

These additions will help lift the company’s total global output next year by about 25% to 3.9 MMboe/d.

Stabroek, which extends more than 26,800 sq km, delivered its first discovery, Liza-1, in 2015. The partners have since added 30 more finds.

So far, they have sanctioned five projects for development on the block, are set to approve a sixth FPSO in the next few months and are reportedly working on a seventh FPSO with FID possible next year.

To date they have approved investments totaling more than $40 billion in developments, which will push Guyana’s installed oil production capacity beyond 1 MMbbl/d.

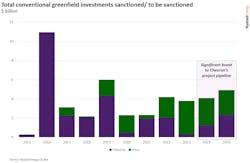

For Chevron, Wilks continued, the Guyana portfolio could lift its greenfield capex sanctioning budget from nearly $3.6 billion to over $9 billion. The company’s annual greenfield capex would also rise from the previously projected average of $2 billion/year between 2024 and 2030 to $4 billion/year.

Those investments do not include the FPSO capitalization costs, which would arise once the Stabroek partners buy the FPSOs from the supplier(s). And as these new FPSOs start producing, Chevron’s share of gross crude oil volumes in Guyana (via Hess) could rise to grow from the current 120,000 bbl/d to more than 360,000 bbl/d in 2030 and to over 550,000 bbl/d in 2035.

Elsewhere, the deal gives Chevron about 380 MMcf/d of net gas production offshore Malaysia, including the Malaysia/Thailand joint development area (JDA), and about 160,000 bbl/d of liquids in the US GoM. Most of the Malaysian production is from the North Malay integrated development fields.

The Malaysia/Thailand JDA production on the offshore A-18 Block includes the Cakerawala, Bulan, Bumi and Suriya fields. In the US GoM, Hess’ main source of production is its operated interests in the Conger, Stampede and Tubular Bells developments.

Since the start of 2019, Chevron has been involved in three company acquisitions, including Noble Energy in 2020 for $13 billion and PDC Energy earlier this year for $7.6 billion. Over the same period, Wilks noted, it has completed divestments totaling about $11 billion.

10.24.2023

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.