Data Briefs

Offshore rig sector faces flat demand and uncertainty ahead

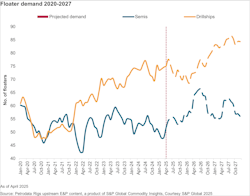

The offshore rig sector is navigating a challenging landscape, with demand for floaters projected to remain flat through 2025. While the forecast for drillships indicates a small decline this year, the semi forecast suggests a balanced outlook with a slight increase, remaining relatively stable over the next two years. For 2025, demand is expected to average 73 drillships, 52 semis and 357 jackups, reflecting a dip in overall rig contracts. Hesitation has been added to the situation as a series of tariffs have been introduced by the new US administration, which have interfered with global trade and increased operational costs. While some rig contractors remain hopeful for a demand recovery by late 2026, the current environment of uncertainty and rising costs could push projects further into the future, particularly impacting smaller players in the industry. The geopolitical landscape is evolving, and the long-term implications of these trade policies remain to be seen.—Petrodata Rigs by S&P Global

FLNG projects ramping up offshore Nigeria, Gabon

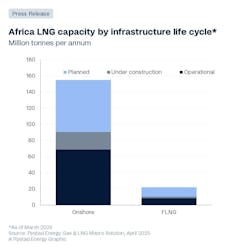

Western Africa, led by Nigeria, produces nearly half of the continent's LNG, and Rystad Energy forecasts that the country’s LNG exports will rise 20 million tonnes (Mt) by 2030. Nigeria may need to explore alternative solutions such as FLNG and smaller-scale mini-LNG projects to fully capitalize on its gas resources and meet both export and domestic demand. Africa is home to the highest concentration of FLNG infrastructure in the world. New liquefaction projects are expected to boost the region's capacity to 50.6 Mtpa by 2035 through onshore developments in Nigeria and Gabon, along with various FLNG projects that are set to begin in the next decade. West Africa's gas resources consist of about 65% offshore and 35% onshore. Nearly two-thirds of its offshore gas—about 16 Bboe—remain undeveloped. These resources are ideal for FLNG technology, being less dependent on vulnerable pipeline infrastructure. Currently, West Africa holds about 20% of the world's FLNG capacity, with potential for further growth if more gas resources are tapped for LNG exports.—Rystad Energy