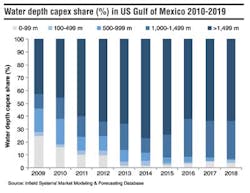

GLOBAL DATA

This month Infield Systems looks at offshore capex distribution in the US Gulf of Mexico (GoM) up to 2019. Despite the challenges of low global oil prices, deepwater projects are expected to continue to drive capex demand in the US GoM over the next five years. Key operators include Shell, BP and Anadarko, with their combined spend expected to account for 51% of US GoM capex demand over the forecast. The majority of projected capex by these three companies is likely to be focused on projects that are situated in water depths of more than 1,000 m (3,280 ft). Noteworthy deepwater developments include Anadarko's Heidelberg oil field which will use a spar platform, Shell's Appomattox field which could require a semisubmersible platform and possibly BP's Mad Dog Phase 2 oil field which could also use semisubmersible platform.

With operators continuing to invest in the development of deep and ultra-deepwater reserves, the subsea sector is expected to account for the largest share of capex in the US GoM, with Infield Systems projecting this market to account for 49% of the region's offshore spend over the next five years. Key projects driving subsea capex demand include Shell's Stones, ExxonMobil's Hadrian North, and BP's Mad Dog Phase 2 oil field developments. The pipeline market is also anticipated to continue to require large levels of investment over the forecast, with 98% of projected pipeline capex associated with SURF lines, which corresponds to the large demand for subsea infrastructure. The floating platform market (FPS) is also expected to see increasing levels of investment over the forecast with semisubmersible platforms projected to account for 45% of FPS capex. The FPS market is likely to be supported by the possible development of a number of proposed FLNG projects over the next five years, which include Excelerate's Port Lavaca FLSO and Cambridge Energy's two FLNG units.

− George Griffiths, Research Analyst, Infield Systems