Data Briefs

Editor's note: This Data section first appeared in the March-April 2024 issue of Offshore magazine. Click here to view the full issue.

Cost inflation set to derail FPS contracting opportunities

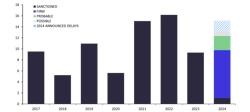

The floating production system (FPS) EPC contract award value in 2024 is forecast to close at about $13 billion. However, about 25% ($3.3bn) of the award value is susceptible to delays, in addition to $2 billion of contract award value already postponed in Q1 2024. While FPS tendering activities remain robust, E&Ps continue to battle supply chain cost inflation, which has been at its highest since 2014 and has experienced a 35-40% cost increase since 2020. While firm EPC award value for the remainder of 2024 is valued at $8.7 billion, uncertainties remain on the contracting timeline for FPSO demand from Petrobras, as the Brazilian NOC has failed to agree to commercial terms on some of its matured FPSO tenders, and it has also postponed the bid submission deadline for units such as the SEAP I and SEAP II FPSOs and the Barracuda/Caratinga replacement FPSO.—Westwood Global Energy Group

Majors dive into deeper waters

Exxon Mobil, Shell, Chevron, bp, TotalEnergies and Eni will continue to exercise caution in exploration spending this year, with drilling activity poised for a busy year ahead. These producers will have spent on average a combined $7 billion each year between 2020 and 2024. Frontier drilling is fueling optimism for a productive year, particularly deepwater projects in the Atlantic Margin, Eastern Mediterranean and Asia. There was a significant increase in 2023 in awarded offshore acreage to major players, totaling 112,000 sq km. The trend suggests a significant push toward deeper waters, with more than half of the awarded blocks targeting deepwater or ultradeepwater reserves. About 50 more deepwater and ultradeepwater exploratory wells are predicted this year compared to 2023. About 27% of all offshore exploration wells drilled last year were deepwater/ultradeepwater, while this year the share of such wells is expected to rise to about 35%.—Rystad Energy

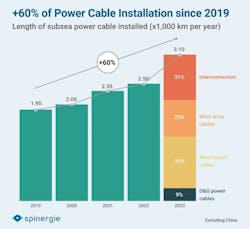

Subsea power cable installation is booming

The number of installed submarine cables increased by 60% between 2019 and 2023, with a new record for cable installations met each year. Cable manufacturers LS Cable & System, NKT and Nexans each show record EBITDA margins in their recently published 2023 annual reports. The demand for array and export cables has followed the growth of offshore wind, showing a 30% increase in installed annual capacity since 2019. For interconnectors, growth is explained by their ability to allow electricity to flow across territories according to supply and demand patterns.—Spinergie