Offshore Europe

Siccar Point pursuing more oil west of Shetland

One drilling campaign attracting special scrutiny is Siccar Point Energy’s five-month program on its licenses west of Shetland, using the Diamond Offshore semisub Ocean GreatWhite. This started in March with a well on the Blackrock prospect 140 km (87 mi) northwest of Shetland which was targeting multiple reservoirs similar to those underlying the nearby deepwater Rosebank field. Siccar Point CEO Jonathan Roger, speaking at the Business Outlook launch in London, said Blackrock had been identified by drilling analysts as one of 20 wells to watch worldwide in 2019.

The location is on a geological feature known as the Corona Ridge, south of Rosebank and north of the Cambo oilfield: Siccar Point is a partner to Equinor in Rosebank and operates Cambo in partnership with Shell. “We see this as the most exciting area in UK waters,” he said. Whatever the result on Blackrock, the rig will next drill the Lyon gas prospect 150 km (93 mi) north of Shetland: a major success here could lead to the establishment of a new gas hub for the area, tying in resources from currently stranded discoveries such as Tobermory and potentially from the yet-to-be-drilled Eden prospect, north of Lyon.

Appraisal drilling last year on Cambo, which was originally discovered by Hess, increased the in-place resource estimate to over 800 MMbbl of oil, and the partners are targeting 30% recovery from a development, Roger said. They aim to submit a first-phase plan at the end of this year, based on an FPSO operating for 20 years or more. Oil would be offloaded to shuttle tankers, but the project will also lead to the creation of new gas infrastructure, which Roger described as “critical to unlock reserves in that area.” These include the 500 bcf proven in the undeveloped Tornado and Suilven fields to the south.

Analysis suggests one-third of the UK’s remaining productive resources could be west of Shetland, Roger said, rising to 50% if future drilling delivers from the ultra-frontier Rockall Trough off northwest Scotland. The far northern area as a whole has been less explored than other parts of the UK shelf, he added, and the west of Shetland could still be considered as in the early stages of drilling. “At the same time, activity is being supported by much more cost-effective drilling. Our wells have been drilled at one-third of the cost of what was being achieved three years ago.”

Lundin coordinates Solveig tieback with Rolvsnes test

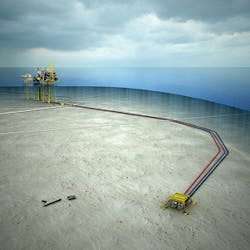

Lundin Norway has submitted its plan of development and operation for the Solveig (ex-Luno II) project in license PL359 in the central Norwegian North Sea, 15 km (9.3 mi) south of the Edvard Grieg field complex. For the first-phase of the $810-million program, targeting resources of 57 MMboe, the company proposes a five-well subsea tieback to the Grieg platform (three horizontal producers, two water injectors), with production ascending to 30 MMboe/d following start-up in early 2021. Northern Drilling’s high-spec semisub West Bollsta will drill the wells with TechnipFMC supplying the subsea facilities.

Simultaneous with the development Lundin plans an extended well test on the Rolvsnes oil discovery in PL338C, south of Grieg. Rolvsnes is a fractured and weathered granite basement reservoir which was successfully tested last year by a horizontal appraisal well. But the company is seeking clarity both on the resource range (currently 14-78 MMboe) and the reservoir’s longer-term performance, as the basement play is new to Norway. To further assess the potential basement trend in this area, Lundin will also drill the Goddo exploration prospect later this year. It assesses the combined Rolvsnes/Goddo resource at over 250 MMboe.Spirit Energy and Hurricane Energy may have spudded their first well as partners in the Greater Warwick Area (GWA) west of Shetland. This is another basement campaign, with the initial focus being a horizontal producer well on the Warwick Deep structure, with a test of productivity from the deeper fracture network. Hurricane’s view is that the seismically mapped faults that subdivide the Lincoln and Warwick oil accumulations could be high-permeability features rather than reservoir barriers. In that case, the GWA could be a single giant oilfield.

In the southern Norwegian North Sea, Spirit has delivered first oil from its Oda field subsea tieback to the Aker BP-operated Ula platform, five months ahead of schedule and almost $100 million below budget at $539 million. The company attributed the savings to efficient drilling of production wells and a new type of “strategic partner alliance” with four main suppliers that was designed to foster collaboration and predictability of deliveries. For the subsea connection, the company re-used processing equipment manufactured for the Oselvar satellite to the same platform – Oselvar ceased production early due to disappointing reservoir performance.