Israel’s liberalized natural gas sector slowly attracting foreign investors

Major projects under way, momentum growing for exports

Simon Weintraub

Yigal Arnon & Co

In December 2015, after years of deliberation and regulatory uncertainty, the Israeli government finally approved the Natural Gas Framework. This provided a comprehensive regulatory scheme for the Israeli natural gas industry through an agreement with the dominant players, namely, affiliated entities of Noble Energy and Delek Group.

However, the breakthrough was short-lived as the Framework was subsequently challenged before the Supreme Court of Israel. In a landmark decision, the court determined that the Framework was invalidly adopted, primarily on account of the legal status of a key provision known as the “stability clause,” which obligated the government to guarantee statutory and regulatory stability for a 10-year period. On May 22, 2016, the Israeli government addressed the court’s concerns by amending the Framework with a more lenient stability clause. To date, this revised Framework has remained unchallenged and has revitalized the local natural gas industry.

Construction in progress of the Leviathan platform.

(Courtesy Noble Energy)

Among other objectives, it was intended to bring stability and increased competition to Israel’s natural gas industry. There was also hope that this agreement would kindle an interest in wider offshore natural gas exploration and encourage foreign energy giants to consider investment and operations in Israel. So far it appears that the Framework has succeeded in laying the requisite foundation for significant foreign investment in the industry, although further progress is still needed to better exploit the export potential of existing reservoirs and to open up exploration of additional natural gas resources.

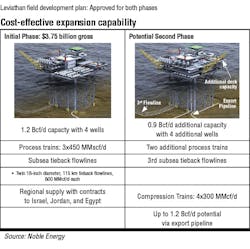

Lately, the central focus of development activities in the local natural gas market has been the deepwater Leviathan field in the Mediterranean Sea, 100 km (62 mi) west of the northern port city of Haifa. Leviathan was discovered in December 2010, although its development was initially halted due to the regulatory uncertainty that preceded implementation of the Framework. In June 2016, the Israeli Petroleum Commission approved the development plan based on an estimate of 17.6 tcf recoverable. The following December the Leviathan partners also approved the plan for the project, Phase 1 of which targeted first gas by the end of 2019. This is the largest energy scheme in Israel’s history with an investment tag of around $3.75 billion. Each of the Leviathan partners has since entered into individual finance arrangements to raise external financing to support the project, raising funds via a broad syndication of leading domestic and foreign banks and various institutional investors.

A crucial component of the Framework was Noble and Delek’s requirement to divest from their rights in the smaller Tanin and Karish offshore fields. This sale was finally completed in 2016 to Greek independent Energean Oil & Gas. In March 2018, Energean and its partner sanctioned the $1.6-billion development of these reservoirs, with Energean raising £330 million ($425 million) through an IPO on the London Stock Exchange and closing a $1.275-billion credit facility underwritten by a consortium of domestic and foreign banks. The hope is that the gas from Tanin and Karish will provide real competition in the Israeli market: Energean has reportedly signed gas purchase agreements with Israeli companies at around $4/BTU, 33% less than the price currently paid by the Israeli Electric Corporation to the offshore Tamar field partners.

Field farm-downs

The Framework also mandated that by the end of 2021, Delek would relinquish all of its rights and Noble at least 11% of its rights in the Tamar field. In July 2016, Noble sold 3.5% of its stake in the field to Israeli-based institutional investors, and a year later, Delek divested a 9.25% stake in the Tamar and Dalit fields through an IPO and bond offering on the TASE valued at $1.2 billion, via Tamar Petroleum, a special purpose company established for this purpose. Earlier this year, Noble sold an additional 7.5% of its stake in the field to Tamar Petroleum for combined proceeds of a reported $800 million. The result here is positive for the Israeli natural gas market as new players are slowly entering the market and this trend is expected to continue as Delek and Noble fulfill their legal requirements.

Under the Framework, among other limitations, gas exports are restricted to a predetermined quantity of natural gas calculated as a pro rata percentage of all natural gas resources available for the domestic market and in order to ensure an aggregate minimum quantity of at least 540 bcm for local consumption. Further restrictions provide that set percentages of natural gas derived from individual reservoirs are reserved for the local market as well (50% for reservoirs of 200 bcm or greater, 40% for reservoirs of 100 bcm or above, and 25% for reservoirs in the range 25-100 bcm). With that said and obviously with the needs of the local market in mind, there is acknowledgment within the industry that there is sufficient available gas for export to other countries as well, and the current players are exploring every possible route to make this happen. However, Italian energy company Edison, one of the oldest players in the Israeli natural gas market, has reportedly decided to close down its Israel-related activity, primarily on account of the export restrictions currently in place.

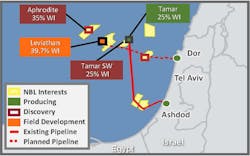

Noble Energy has interests in four major gas discoveries in the Eastern Mediterranean Sea. (Map courtesy Noble Energy)

Two deals have already gone through. One was the signing in September 2016 of an agreement between the Leviathan partners and the National Electric Power Company of Jordan, under which the partners will supply around 45 bcm to the State of Jordan. In February 2018, the partners also signed a $15-billion export agreement with Dolphinus Holdings to supply a total of 64 bcm to the Egyptian domestic market. In June, Delek was reported as being is in advanced talks to acquire usage rights in the existing East Mediterranean Gas (EMG) pipeline between Israel and Egypt for the fulfillment of this agreement.

One further development with the potential to transform the region into a regional energy hub is the proposed EastMed pipeline, which would link natural gas from fields offshore Israel and Cyprus (Eni’s Aphrodite) to Greece and Italy. In December 2017, Israel, Greece, Cyprus and Italy signed a memorandum of understanding setting out their commitment to the project. This project has also received the support of the European Commission, which has allocated EUR34.5 million ($40 million) to complete planning of the pipeline. A final investment decision for the pipeline, with an estimated cost of $7 billion, should be taken in early 2019.

As mentioned earlier, one of the main objectives of the Framework is to encourage new foreign players to enter the market. In this context, in November 2016, the Ministry of Energy published a tender for oil and gas exploration in Israel’s offshore exclusive economic zone. Unfortunately, demand for these licenses was somewhat underwhelming. Out of the 24 blocks offered, only six licenses were awarded, five to Energean and a sixth to a consortium of four Indian companies. At this stage it is too early to assess what impact these awards will have on the future of the industry.

There have also been reports recently of plans to develop the Gaza Marine reservoir, situated off the coast of the Gaza Strip, which could potentially add an interesting dimension to the regional market. According to the reports, the rights holders in the reservoir are negotiating with Energean for development and operation of the reservoir, which contains an estimated 32 bcm. Over the coming years as some of the proposed projects in the Eastern Mediterranean basin develop and become operational, it will be interesting to see what kind of joint co-operation might transpire, with the infrastructure crossing very sensitive geopolitical boundaries. A further issue is the potential environmental implications of these projects and the increasing power of environmental groups in Israel, some of which are in the process of petitioning the applicable regulatory bodies in Israel regarding the location of the Leviathan offshore platform, in a bid to move this farther offshore. In addition, these groups have been petitioning authorities regarding greater disclosure requirements concerning information provided to the public on emission levels.

In conclusion, the approval of the Framework in December 2015 allowed the local natural gas industry to overcome a major regulatory hurdle in its development. Recent events following adoption of the Framework have been promising although in reality, one would be very hard pressed to argue that the market has significantly widened the competition base, which was the main goal. There have been significant foreign investments in existing reservoirs coupled with significant support from the local investment community showing great confidence in the future of the industry. And the export agreements with Jordan and Egypt, and potential others with Turkey or even the Palestinian Authority, hold great geopolitical consequences and might ultimately serve to strengthen stability in the region. Finally, despite the lackluster results of the exploratory permits tender, the anticipated progress in the potential development of the EastMed pipeline might generate substantial activity in the local market and could help establish Israel as a global energy provider. •

The author

Simon Weintraub, partner at Israeli law firm, Yigal Arnon & Co. Simon is co-head of the company’s Oil and Gas Practice. Most recently, he represented HSBC and JP Morgan as the Lead Mandated Arrangers in a $1.75-billion credit facility to the Delek Group and represented HSBC and BNP Paribas as the Lead Mandated Arrangers in a $450-million credit facility to Ratio Oil Exploration. Both loans will be used for the development of the Leviathan field.