Industry executives offer sustainable development strategies at second Offshore Leadership Forum

Geoff Emeigh

IPA Inc.

Speakers and attendees at the recent Offshore Leadership Forum had a cautious but unmistakable air of optimism about the outlook for offshore business and new asset developments.

Sponsored byOffshore and Independent Project Analysis (IPA), the second annual meeting featured presentations by executives from IPA, Inc., Talos Energy LLC, LLOG Exploration Co., Chevron, and Mexico’s National Hydrocarbons Commission (Comisión Nacional de Hidrocarburos-CNH).

At the same event a year earlier, oil and gas companies were bracing themselves for another difficult year of lower oil prices, project cancellations, and workforce reductions. Although some companies in the oil and gas sector fared better than others during the downturn, the feeling among offshore leaders attending the Dec. 5, 2017, event in Houston was that the offshore industry is entering a period of relative stability, if not growth, in 2018.

Speakers at the Offshore Leadership Forum urged attendees to think hard about the direction the industry is headed in delivering scope and cost-efficient and value-generating assets. To survive the lower oil price environment in recent years, most owners downsized and restructured their project organizations to better reflect smaller portfolios. Their aim was to reduce the cost of offshore developments. However, most of the cost reductions they achieved came from the high-grading of project portfolios, as a means of dropping costly opportunities. Other reductions resulted from the supply chain giving back rents and suppliers operating on lower cost curves. But these lower costs may be temporary and should be expected to change as the industry gets back on its feet.

IPA President Edward Merrow offered the opening presentation. He said that now is a good time to assess whether the industry can deliver cost-efficient, schedule-advantaged, and better producing offshore assets in a sustainable manner. Data drawn from IPA’s upstream database show the industry has done little to fundamentally improve asset outcomes. “Where is there improvement to be had? Almost everywhere,” Merrow said. One way E&P companies can attain sustainable asset development costs reductions is by “going where the money is.” The industry has had a difficult time getting to where the money is, though.

During the 1990s and through the mid-2000s, the industry emphasized schedule-driven projects. Companies rushed projects through the Front-End Loading (FEL) process to meet aggressive schedule targets. As a consequence, the capital effectiveness and performance of these assets suffered. Beginning around 2006, however, the pendulum had begun to swing in the opposite direction. Asset development durations started getting longer.

Unfortunately, as data in IPA’s upstream database show, some companies are now spending an entire decade going from reserve discovery to selecting a project. The earning capacity of sanctioned capital diminishes significantly in that time. The solution to this problem is not once again setting aggressive schedule-driven targets for developments, IPA has concluded. The solution is to deliver smart fast projects. For a project to go fast, a comprehensive and holistic assessment of the development process must be conducted. The standard aggressive schedule or lean playbook strategy will not suffice. Efficiencies are gained by fully understanding and correcting process workflows.

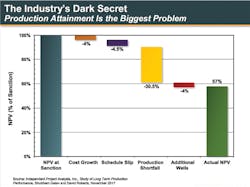

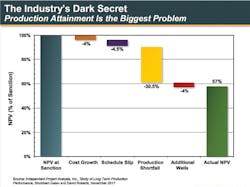

Production attainment is another problem the oil and gas sector must address head on. “The elephant standing in the corner is that we are not getting the barrels we say we’ll deliver,” Merrow said. “The money has got to be in the barrels,” he added. “The economics of our production is killing projects.”

According to data in IPA’s upstream database, companies are failing to deliver their production plans for as much as six to 10 years after startup. The average field only achieves about 70% of planned plateau capacity. Making matters worse is inefficient scoping resulting in extra capacity; this is often twice as much as needed. Industry leaders must ask themselves why reservoir predictability is systematically exaggerated, Merrow observed.

The state of the industry remains fragile as owners, contractors, and vendors figure out how to survive in a much lower oil price environment for the long term. Some companies have made meaningful changes that IPA believes should secure their long-term future. But the industry as a whole has not made significant inroads to addressing stubborn planning and execution inefficiencies. IPA evaluations continue to identify critical weaknesses in project controls, construction management, and contracting functions. These functions are critical to developing sustainable low-cost developments.

At the same time, owners are transferring more responsibility and risk to contractors and vendors even as the industry’s supply chain is in a weakened state. Do company leaders recognize the importance of right-sizing their company’s project organization? Vendor cost pullbacks are reflective of giving back available rent in some cases, but further cost decreases should not be anticipated. Engineering firms are taking on work, but quality issues remain and slip in delivery of designs is not uncommon. Meanwhile, fabricators are not performing well for reasons not entirely known, although weaknesses in construction management and worker retention may be to blame. Given these weaknesses in the supply chain, owners need to assess how much risk they are willing to transfer to contractors and vendors.

IPA Oil and Gas Business Director Neeraj Nandurdikar also addressed forum attendees. “The industry’s entire approach to asset development must evolve,” he observed. The industry’s focus on the optimization of E&P systems has delivered some short-term gains, Nandurdikar noted, but it is unclear how these efforts – from “restructurings” to using digital tools – can drive sustainable low-cost developments. He observed that several recent projects IPA assessed suggest that many companies are estimating their project costs as if it is 2013 (when market conditions were different), because they have lost critical competencies and often rely on internal databases that have not kept up with market reality. Meanwhile, offshore asset developments are struggling to remain competitive against unconventionals. “We don’t take any long-term risks,” Nandurdikar observed. “We follow the traditional playbook with the same remedies, but we still do not transform enough to compete with shale operators.”

Industry leaders also should not turn their backs on the benefits of standardization, including reduced offshore asset development cost and schedule advantages. “We have been working on standardization for more than 20 years,” Merrow noted. The failure to embrace standardization may harken back to the overarching issue standing in the way of needed changes. “Industry needs to place more emphasis on the project leadership and functional competencies that drive performance outcomes,” Merrow observed. “In this way, the industry can implement the needed changes in behavior that can make offshore asset developments more competitive and profitable.”