Mexico progressing oil and gas reforms, licensing rounds

President Commissioner of CNH offers insights, updates

Bruce Beaubouef

Managing Editor

Jessica Tippee

Assistant Editor

Mexico has come a long way since it initiated its energy reform in 2013. A new regulatory and institutional framework has brought an end to long-standing monopolies, opening competition as well as private and international investment in all aspects of the nation’s oil and gas industry value chain.

Late last year the country held its first deepwater bid round that attracted major industry interest from around the world. Earlier this year, Eni drilled the first well by an international major in Mexican waters since the reform began. The well, designed to appraise the shallow-water Amoca discovery, intersected 110 m (361 ft) of net oil pay from Pliocene sandstones, some from a deeper, previously undrilled horizon.

Juan Carlos Zepeda Molina has seen first-hand the fundamental changes of Mexico’s oil and gas industry. He has worked for the Ministry of Finance (Secretaría de Hacienda y Crédito Público, or SHCP) and the Ministry of Energy (Secretaría de Energía, or SENER). His duties at SHCP included evaluating PEMEX’s investment projects; designing the PEMEX tax system; evaluating and providing follow-up on the company’s budget and its finances; and designing and setting pricing policies in the oil industry. As general director of exploration and exploitation of hydrocarbons at SENER, he was in charge of the technical evaluation of exploration and exploitation projects.

In May 2009, he was appointed as President Commissioner of the National Hydrocarbons Commission (Comisión Nacional de Hidrocarburos-CNH) for a five-year period. On April 30, 2014, Congress appointed him for a second five-year period.

Recently,Offshore spoke to Zepeda about the country’s energy reforms, CNH’s role and responsibilities, and ongoing and upcoming offshore bid rounds and awards.

Offshore: Can you give us an update on Mexico’s efforts to open up its offshore oil and gas regions and also for upcoming bid rounds for offshore oil and gas leases?

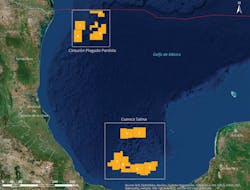

Zepeda: The first round was completed last December. In Mexico a round means a set of different biddings. In the first round, there were four biddings. Two were shallow water, one was onshore, and the last was deepwater. The first round was very successful. In total 39 bids were submitted. There are now 45 new oil companies working in Mexico.

We are now in the second round with three biddings. The first is for shallow water. Twenty-seven companies are in the pre-qualification process. For example, Chevron, ConocoPhillips, Shell, Total, Murphy, Hunt, Petronas, Repsol, and China National Co. There are also two onshore biddings.

In June, we will release the bidding guidelines, the process for the second deepwater bidding process and the country’s first non-conventional bidding.

Mexico has two main non-conventional areas. The first is the Eagle Ford formation that crosses boundaries from the US to Mexico. However, the most important non-conventional area, the most prospective is in the center of Mexico called the Tampico-Misantla basin. It is mainly shale oil and the estimated prospective resources are 35 Bboe.

Offshore: What is CNH’s role in the bidding and contract award process and in Mexico’s oil and gas marketplace?

Zepeda: CNH is the federal upstream regulatory authority in Mexico. CNH is part of the executive branch but it is a technically an autonomous agency. It is in charge of running the bidding process, awarding and signing the contracts, and administering the contracts through the whole life of the projects. This federal agency is the authority in charge of the bidding process, the regulation, and the administration, but it is not the policy maker. CNH advises the Ministry of Energy with technical support and analysis. The Ministry of Energy decides which blocks to open for bidding and the number of bid rounds.

The top authority within CNH is the board of commissioners of which there are seven. Commissioners are proposed by the executive and appointed by the Senate. The main purpose of the agency is to provide certainty, to provide accountability and transparency in the whole process of regulation and administration of contracts.

Offshore: Are there any updates from the deepwater bid round held last December? What are the next steps from that bid round?

Zepeda: The winners of the bid round held on Dec. 5, 2016, have signed the contracts and are in the process of preparing an exploration plan. After signing the contracts the companies have 120 days to present their exploration plans to CNH for approval. In the coming weeks, the winners from the bid round will present their plans. Different exploration wells will be drilled on the Mexican side of the Gulf of Mexico.

Offshore: What impact do you think that the oil prices have had on the bid rounds to date, particularly the offshore ones?

Zepeda: Despite the fact that prices are around $50/bbl, there has been a lot of interest from the oil industry in the bid rounds. Why is that? First of all, the Gulf of Mexico is very prolific and attractive macro-basin on both the US side and Mexican side. Also, keep in mind that these are long-term projects. When companies assess their projects they don’t asses the projects at $50. They consider a long-term forecast of the oil price that we believe is around $70.

One of the important lessons learned from the first round is to reduce the minimum work program. Instead of increasing minimum number of wells to be drilled in the bidding process, we’re allowing the industry to tell us how many wells to be drilled. The bidding is very efficient in terms of allocating the correct number of exploration wells as part of the minimum investment program.

The biddings were adjusted and they’re more flexible and more responsive to the market conditions. The other important factor that is making our bidding very attractive is the geophysical and geological information. All the exploration and seismic information that was acquired by PEMEX in the last eight decades is now managed by CNH and is available to the industry.

The availability of information, a bidding process that is more flexible and more responsive to the market, and together with the fact that the Gulf of Mexico is a very prolific area, these elements have proved to be very competitive when it comes to attracting investors to Mexico.

Offshore: Will Mexico continue to use license contract structures and production-sharing mechanisms?

Zepeda: License contracts will always be used for deepwater. This is a contract where oil companies pay a royalty on gross revenue to the government. Also, we will always use license contracts for onshore. Shallow water is the only area where we will use production-sharing contracts.

Offshore: What is the national content requirement for international operating companies that are wishing to invest in Mexico?

Zepeda: In the Hydrocarbons Law in Mexico, it is established that these upstream contracts have a minimum percentage of national content. For every contract, the Ministry of Energy establishes a percentage of national content depending on the type of the project. For instance, in deepwater national content starts with 3%. It increases in the exploration phase to 8%, then in the development phase it’s 4%. Toward the production phase, it reaches a maximum level of 10%. The national content approach is very sensible to the type of project.

The highest amount of national content is for onshore projects. During the exploration phase it is 13% and in the development phase it gets to the highest amount, the highest percentage of 35%.

Offshore: Obviously, the Mexican shallow water has been under development for years, but the deepwater perhaps less so. There have been some reports about the Trion field building the export infrastructure for the deepwater. What are your thoughts about possible export infrastructure for the deepwater?

Zepeda: The decision on which transportation system to use is going to be on every company. Under the license contract, companies will pay royalties on the gross revenue and once they pay the royalty they keep, manage, and can do with the production as they wish. Oil companies have the option to use the transportation infrastructure on the US side. For example, the Great White project, which is close to the Mexican border, has an infrastructure transportation system of two pipelines, one for oil and one for natural gas. Both pipelines have a spare capacity of about 50%.

I want to stress that this is a decision that has to be made by all companies. They’re free to decide how they want to manage their oil once they pay the royalty to Mexico. One possibility is to ask this transportation company or others to make a short extension of these pipelines to cross the border on the Mexican side.

Offshore: One piece of news that came out not too long ago was the announcement that Chevron, PEMEX, and INPEX have signed a contract with CNH for block 3 in the deepwater Gulf. Can you talk about the importance of that contract and the next steps?

Zepeda: Regarding PEMEX, what happened on Dec. 5, 2016, was very important. Not only did BHP Billiton win the first farm-out of PEMEX but also for the first time PEMEX competed for a block in Mexico. PEMEX together with Chevron and INPEX competed for and won block 3. This is the first block awarded to PEMEX through a competitive process.

Offshore: Can you provide an update on the bidding process for Mexico’s shallow-water areas?

Zepeda: The first bidding for our second round is for shallow water. There are 15 blocks being offered. The original bid day was supposed to be in March, but the industry requested that CNH extend the process and move the bid day from March to June. Companies that were just finishing the processes for signing the deepwater contracts are many of the companies that are also bidding for shallow water. The bid day is now June 19. Twenty-seven companies are going through the pre-qualification process right now.

CNH runs the bid day. In one day, companies submit envelopes with their biddings, we open the envelopes, and show the biddings to the camera. In a single event, we appoint the winners and broadcast the event on the internet.

Offshore: Looking long-term, how many bid rounds do you foresee for this process?

Zepeda: By law, there is a five-year plan for bidding. In addition, by law CNH has to provide the Ministry of Energy with a proposal for this five-year-plan, which will run from 2015 to 2019. On the basis of our proposal, the Ministry of Energy makes adjustments and finally they approve the five-year plan. We have already announced the five-year plan of the coming biddings in Mexico so that companies can know the different areas and the different blocks that the ministry is considering to be opened for bids.

On top of that, there are certain very important rules that were recently introduced by the Ministry of Energy. Perhaps the most notable among these is a new nomination system. Different countries around the world already have a nomination procedure which involves a process by which companies can make a proposal to the ministry on which blocks should be opened for bidding.

We have a five-year plan and these plans could be adjusted depending on the nominations. Right now, we are open for nominations. We have areas in deepwater, we have lots of areas in shallow water, non-conventional, onshore, different areas. Companies can nominate, make their recommendations on which blocks to be included on top of the ones that we have in the five-year plan. That’s the way we announce in advance to the industry how we are planning to move in the following years in terms of these bidding rounds.

Offshore: Overall, how would you characterize Mexico’s oil and gas reform efforts today particularly with regards to offshore oil and gas development?

Zepeda: We were very happy and grateful to have had a first successful round. But now as we finish this first successful round, in the Mexican government we want to standardize, to make it more efficient, and to speed up the process. I have heard often that Mexico offers too few blocks. In terms of our potential, in terms of our prospective resources, yes, we can speed up, we can offer more blocks, we can open more areas for bidding. How many more? Well, that would depend precisely on the nominations. This is one of the reasons why the Ministry of Energy opened this nomination system. We want the industry to tell us, how many more, how fast. We want to adjust the pace of the biddings and the number of blocks to increase the industry’s interest to invest in Mexico.

Offshore: Any other thoughts?

Zepeda: As part of this standardization process, CNH is working to make the pre-qualification process faster, more efficient. The pre-qualification process in Mexico is very thorough. We check for financial strengths, for technical experience and experience regarding safety and environmental standards. We want in Mexico a very thorough process for being able to bid for any block.

What we’re going to do in the upcoming bids is that we’re going to pre-qualify companies once for five years. For instance, if a company pre-qualifies for deepwater, CNH will provide that company with a certificate that will allow it to bid in all the deepwater processes in the next five years. Once you’re certified to work in deepwater then you’ll have a certificate that will allow you to bid for the next five years in all of our biddings in deepwater.

As I’ve mentioned, we had a successful first round, now we want to standardize, to reduce costs, to make it more efficient for the industry, and at the same time to speed up and to have more blocks for bidding.