Subsea processing – the gamechanger

Majors collaborate with suppliers to improve performance

Steve Robertson

Douglas-Westwood

George Trowbridge

OTM

Subsea processing has the potential to massively reduce expenditure on offshore platforms by placing much of the hardware required to separate the well products on the seabed. The logical extension of the concept is that in some situations, subsea processing could remove completely the requirement for the offshore platform. For that reason, subsea processing is a true "game-changer" technology.

Offshore wells rarely produce merely oil and/or gas. The product is most often a cocktail of crude oil, gas, gas condensates, water, and sand. Produced water is a particular problem, especially in the latter years of a field's life, when it can account for up to 90% of the wellstream.

Subsea processing encompasses a number of technologies designed to optimize the production of hydrocarbons from offshore wells. Technolo-gies include techniques such as subsea separation of the various well products, subsea pumping or compression to boost the flow of well products to the surface, and subsea power distribution to drive these processes.

Market drivers

Subsea processing is still in its infancy, and its applicability depends on individual field characteristics, including reservoir depth and pressure, gas-oil ratios, water cut, and distance from host platform facilities. Perceived benefits that have driven market interest include:

- Increased productivity

- Increased recovery

- Improved flow assurance

- Longer tie-back distances

- Reduced topsides processing requirements.

The technology

Increased productivity can be achieved in two main ways: by using single or multi-phase pumping systems to supplement reservoir drive or by separating and disposing of produced water subsea rather than transporting it with the hydrocarbons back to the host facility for treatment and disposal.

In fields with early and significant water production, subsea separation and disposal can be a major benefit because it reduces back pressure on the wells and allows a freer flow of hydrocarbons. It can also play a significant role in the latter years of a field's life in dealing with the problems and associated costs of produced water. Increasing well productivity enables reservoirs to be drained through fewer wells. Since wells account for a major part of project capex, any reduction in their numbers creates considerable positive impact on field economics.

Increased recovery results from the reduced back pressure on the wells consequent on the pressure boosting and/or separation of water from the wellstream. Reservoir drive is maximized, and more reserves can be produced when the hydrostatic head is reduced. This is a particularly important consideration in deepwater, where significant back pressure can be generated by the long risers required.

Improved flow assurance is derived from adding pressure via single or multiphase pumps and/or from the separation of wellstream components, either by removing water or by separating gaseous and liquid fractions. Removing water from the production stream reduces the risk of hydrate formation. Liquid/gas separation eliminates the troublesome phenomenon of liquid "slugging" in flowlines. This problem is particularly severe in multiphase flowlines laid on an undulating seabed because the oil component of the wellstream tends to collect in the dips along the line. When sufficient pressure has built up downstream of oil accumulations, they are driven onward in sporadic surges known as slugs, which complicate the smooth operation of process equipment on the host facility.

Longer tie-back distances can be achieved thanks to improvements in flow assurance and the addition of energy (pumping) to the wellstream, enabling it to flow over longer distances. Subsea systems have produced using reservoir pressure over flowline distances of up to 50 km in length; however, this is most unusual, and in practice, few flowlines exceed 20 km. The attractions of increasing tie-back distance are considerable and could lead to the exploitation of many reservoirs that are currently too small or too isolated for economic development.

Reduced topside processing requirements result from the fact that once partial (two-phase) or total (three- or even four-phase) separation has been completed subsea, there is no need for bulky topside separators, with consequent space, weight, and cost benefits for the host platform.

Of course, gains need to be evaluated against the cost of the processing system and the possible requirement for dual pipelines to transport the separated gas and liquids. Subsea processing could extend the economic life of existing platforms by reducing topsides additions associated with adding satellite development.

Operator survey

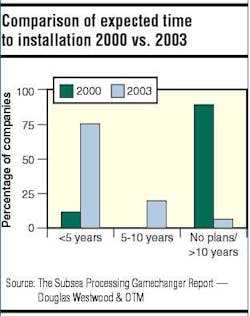

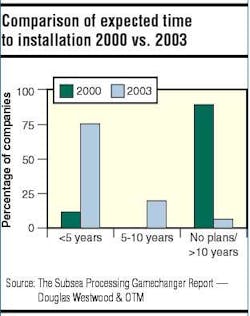

A survey of offshore oil and gas operators constituted a major input into market analysis. Results of this year's survey were compared with those of a similar survey carried out in 2000.

The outcome of the survey indicates that the short-term future for subsea processing is most likely to involve equipment being installed on fields to de-bottleneck topsides facilities. These fields are less likely to be long-distance tie-backs or low-pressure reservoirs and more likely to be deepwater fields or fields with high water content.

This marks a change in the expected role for subsea processing in 2003 and is likely to be due to the reluctance of operators to trust the equipment as a critical part in a development.

The initial benefits originally considered by operators to be possible from subsea processing have been revised over the last three years. Now, while the range of areas where subsea processing is likely to be used has decreased, the likelihood of operators using the technology has increased, with nearly all of them expecting to install some subsea processing equipment within the next five years.

As a result, some of the old benefits of subsea processing, such as reduced field capex, are no longer as great because the equipment will not replace topsides equipment, but will work alongside, making the business case for the technology harder to justify.

Operators, while acknowledging that some pieces of equipment are available for installation, are not purchasing equipment because of its high cost. Operators also have a general aversion to using new technologies because of reliability concerns. Qualifying subsea processing technology will be a major step toward its adoption.

Power supply is perceived as the key enabling technology for subsea processing and is expected by the operators to be developed in the next 10 years. Development of a subsea power and distribution system will play an important role in the uptake of subsea processing because operators are likely to prefer flow boosting to separation, and the former has higher power requirements.

Companies with a structured approach to evaluating and vetting subsea processing are making more rapid progress toward deploying separation or boosting. Unfortunately, survey results do not indicate whether this structured approach has facilitated the progression of subsea processing or if it is the desire within companies to adopt subsea processing that has prompted the development of the structured approach.

The current state of play

The earliest subsea processing came in the form of seabed separators, the first of which was installed in 1970 on BP's Lower Zakum field off the United Arab Emirates. This installation was followed in the 1980s by the Highlander and Argyll fields in the North Sea. More recent applications include the ABB/Framo Troll Pilot subsea separator off Norway on Norsk Hydro's Troll C field and multi-phase pumps on the Ceiba, ETAP, Lufeng, and Topacio fields.

There are fewer than 15 examples of installations worldwide, but res-earch leads to a number of conclusions, the first of which is that a tipping point has been reached. From this point, the number of subsea processing units installed will begin to increase rapidly. This assessment is based on two research findings – the forecasts for installation of subsea processing units derived from the operator survey and the complete change in oper-ators' plans for subsea processing compared to three years ago.

The 2000 survey showed less than 10% of the companies interviewed expected to install any subsea processing technology within a five-year timescale. In 2003, the number had grown to 75%. More than 91% expect installations within 10 years.

Major oil companies are beginning to collaborate seriously with suppliers to develop subsea processing. Examples include the seafloor processing collaboration of BP, ChevronTexaco, ABB and Aker Kværner, the Shell-Alpha Thames cooperation, and the Petrobras initiative.

There is now a narrower interpretation of subsea processing's benefits. Two years ago, it was considered a panacea for problems associated with deepwater, long tie-backs, and restricted topsides. Now, subsea processing is mainly popular for topside support. Operators have developed a realistic approach to where they want to use subsea processing. This means suppliers can begin to more accurately target the resulting markets – the "topsides buster" or "little helper" applications.

Topsides busters replace platforms/FPSOs and can be expensive because they save the cost of an FPSO or platform. Little helpers assist with topsides and might be used closer to a facility. They are not essential for production and operate in addition to the topsides. Suppliers need to identify which sector their systems fall into and market appropriately.

In the last few years there has been a global uptake of subsea processing, and the technology is being considered now for a number of projects, including Ormen Lange, West of Shetlands, and Norne. The installed subsea pumps appear to be performing well and reliably. For the next few years, subsea processing will consist mostly of subsea pumping. While subsea pumping and separation equipment has moved onto the second generation, power systems have yet to do so.

The subsea processing market

Activity forecasts in the subsea processing sector over the 2003-2007 period are driven by currently identified prospects for subsea processing applications. Operators' reports for installation plans are also taken into account in terms of the time lag expected between initial application and follow-up deployments

Under the base-case scenario, the forecast is that global capex in the subsea processing sector over the 10-year period to 2012 will amount to just under $1.6 billion, with the bulk of this ($1.2 billion) occurring over the 2008-2012 period. A total of 86 seabed boosting applications are expected to account for 65% of this 10-year total, with the 28 forecast separation systems accounting for the remaining $560 million.

The overall conclusion to the 1970 Zakum subsea processing project is that it will be some time before subsea separation systems are used, and the introduction will be gradual. This has indeed been the case. But the players are now all in place, and the game is set to change. ;

Douglas-Westwood and OTM published The Subsea Processing Gamechanger Report 2003-2012. The report is the first in a new series that examines the commercial prospects for technologies that show early potential to make a major impact on industries. For further details, visit www.dw-1.com, e-mail [email protected], or call +44 (0) 1227 780999.

Authors

Steve Robertson is market analyst for The Subsea Processing Gamechanger Report 2003-2012. Steve holds a BSc in computing and economics and prior to joining Douglas-Westwood worked in the defense and financial sectors. He is a member of the Institute of Petroleum and the Society for Underwater Technology.

George Trowbridge is the technology analyst for The Subsea Processing Gamechanger Report 2003-2012. George holds an MEng in materials science and engineering and prior to joining OTM worked for a number of well known engineering companies around the world.