Explorers increasingly focused on high-impact wells to replenish resources

Offshore staff

LONDON – Exploration drilling recovered last year but portfolio renewal has become a critical issue for the industry following a performance decline, according to Westwood’s 10th annual ‘State of Exploration’ report.

During the downturn of 2014-17, success rates increased as companies focused on drilling their best prospects. In 2018, however, discovered volumes, average discovery size and success rates all fell, the consultant claimed.

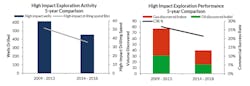

Volumes proven via high-impact drilling during 2014-18 declined by 50% compared to the previous five years. Only a little over half of this drop was due to fewer wells (-28%) being drilled.

Larger oil companies have responded by striving to open new plays through increased frontier drilling.

However, over the last five years only nine potentially commercial new plays have been opened with a success rate of just 6%, and three of those plays are in one block, the ExxonMobil-operated Stabroek offshore Guyana.

Across frontier plays there are an increasing proportion of stratigraphic traps which appear to be smaller in scale than previously, with only the Upper Cretaceous clastic play of the Guyana-Suriname basin potentially delivering more than 5 Bboe.

The other plays are levelling off at around 1 Bboe, with material success concentrated in a small number of companies, Westwood said.

Although the industry plans to step up exploratory drilling in 2019, the question remains as to whether the global near-field and high-impact prospects portfolio is strong enough to sustain an increase in activity without sacrificing exploration performance.

Westwood’s based its review of exploration performance trends on results achieved by 36 international E&P companies that participated in 756 conventional wildcat wells between 2014 and 2018, drilled at a total cost of $28.3 billion, leading to total discovered resources of 22.4 Bboe of oil and gas.

In 2019, the consultant expects high-impact drilling to increase by 20% to around 80 wells, with more high-impact wells planned in maturing and mature plays, especially off northwest Europe and Mexico.

Total is leading the way with at least 20 high-impact wells in its line-up for 2019. Globally, high impact exploration delivered 2.4 Bboe by the end of 1Q 2019 and the total risked drill-out for 2019 is potentially 40% higher than the volume discovered in 2018.

05/08/2019