Slow path to recovery for offshore oilfield services

Offshore staff

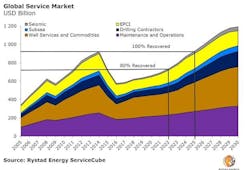

OSLO, Norway – It could take a further six years for global oilfield service market revenues to match the peak of $920 billion last achieved in 2014, according to Rystad Energy.

“This will be the longest slump faced by the oilfield service industry since the 1980s, with about $2.3 trillion in revenues lost along the way,” claimed Audun Martinsen, the company’s head of oilfield service research.

“On the bright side, in only three years’ time, activity levels will be higher than they were in 2014, although the cost cuts achieved in the sector means spending levels will only be 80% of what was seen in that peak year.”

The FPSO leasing sector has recovered quickest, emerging from the downturn relatively intact, and should be operating back at 100% by 2020.

However,offshore drilling and seismic contractors are unlikely to see a full recovery of their markets until 2027 due to a continued supply overhang, higher drilling efficiency, and lingering caution over exploration, Martinsen said.

He pointed out that the offshore market reached its lowest point last year and will take time to fully turn around because new capital investments are ramping up slowly. Also, some cost efficiencies have yet to be realized.

03/19/2019