More than 100 newbuild rigs close to completion, consultant finds

Offshore staff

HOUSTON – Data from Westwood subsidiary RigLogix shows that 19 new offshore drilling rigs were delivered in 2018, comprising 15 jackups and four semisubmersibles.

At year-end, a further 112 rigs were under construction: 75 jackups, nine semis, 21 drillships, and seven tender-assist units. In most cases construction has essentially finished, with the suppliers waiting on acceptance from the rig owners.

During 2018, the number of rigs retired from the fleet reached an all-time high of 57, according to RigLogix head Terry Childs, with 37 jackups, 14 semis, and six drillships withdrawn.

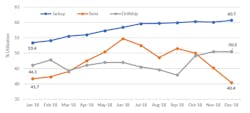

At the same time rig utilization worldwide rose for operational jackups and drillships. However, the gains semi utilization fell from around 54.7% in June to just over 40% in December.

Various rig contractor mergers and acquisitions went through. First,Borr Drilling purchased Paragon Offshore leading to 24 jackups being removed from the fleet.

Borr then acquired nine newbuild jackups from Jurong Shipyard and KeppelFELS and began taking delivery in 2018. Transocean purchased Songa Offshore’s floating rig fleet and acquired Ocean Rig toward year-end.

Ensco and Rowan too announced a merger that looks set to be completed in 2019.

As for day rates, only two regions experienced noticeable gains in 2018, Childs said. Rates for harsh-environment semis in the Norwegian North Sea rose from just under $200,000/d at the start of the year to $290,000-$300,000/d.

In the US Gulf of Mexico, consistent 100% take-up of the 12-strong jackup fleet pushed day rates for some long-legged units up by $20,000 or more to $85,000. Elsewhere, rates remained essentially static as rig supply continued to exceed demand.

As for drillships, Childs cited the recent Chevron hire ofone of Transocean’s new ultra-deepwater drillships for a program in the US Gulf of Mexico. The vessel’s features include what is said to be the world’s first 20,000-psi BOP system.

In this case, the day rate is around $454,000, although had the contract been signed during the peak period of 2011-2013, it likely would have exceeded $700,000, Childs claimed.

With the market still in recovery mode, some rig owners have decided not to bid for work below a certain level. Although that strategy has not yet translated into contract awards things will likely change soon, Childs suggested.

Most rig markets remain oversupplied, so there seems to be little chance of a substantial rate improvement. But in markets where rig supply and demand are tighter, rigs differentiated by key features will likely command higher rates.

01/29/2019