Offshore wind lease sale yields $405 million in winning bids

Offshore staff

WASHINGTON, D.C. – US Secretary of the Interior Ryan Zinke and Bureau of Ocean Energy Management (BOEM) Acting Director Walter Cruickshank have completed the nation’s eighth and highest grossing competitive lease sale for renewable energy in federal waters.

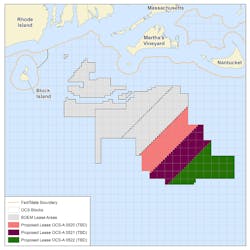

The lease sale offered about 390,000 acresoffshore Massachusetts for potential wind energy development and drew competitive winning bids from three companies totaling about $405 million in winning bids. If fully developed, the areas could support approximately 4.1 gigawatts of commercial wind generation, enough electricity to power nearly 1.5 million homes.

The provisional winners of the lease sale are:

Provisional winner | Lease area | Acres | Winning bid |

Equinor Wind US, LLC | OCS-A 0520 | 128,811 | $135,000,000.00 |

Mayflower Wind Energy, LLC | OCS-A 0521 | 127,388 | $135,000,000.00 |

Vineyard Wind, LLC | OCS-A 0522 | 132,370 | $135,000,000.00 |

The following companies participated in the lease sale: Cobra Industrial Services, Inc.; East Wind, LLC; EC&R Development, LLC; EDF Renewables Development, Inc.; Equinor Wind US, LLC; Innogy US Renewable Projects, LLC; Mayflower Wind Energy, LLC; Northeast Wind Energy, LLC; PNE WIND USA, Inc.; Vineyard Wind, LLC; and wpd offshore Alpha, LLC.

The three lease areas auctioned are located 19.8 nautical miles from Martha’s Vineyard, 16.7 nautical miles from Nantucket, and 44.5 nautical miles from Block Island.

“This auction will further the administration’s comprehensive effort to secure the nation’s energy future,” said BOEM Acting Director Cruickshank. “The Commonwealth of Massachusetts and members of the Massachusetts Renewable Energy Task Force have been great partners throughout this process. We look forward to working with them and the lessees as we move forward with next steps for developing offshore wind energy in a responsible manner.”

Before the lease is executed, the Department of Justice and Federal Trade Commission will conduct an anti-competitiveness review of the auction, and the provisional winner will be required to pay the winning bid and provide financial assurance to BOEM.

The lease will have a preliminary term of one year, during which the lessee may submit a site assessment plan (SAP) to BOEM for approval. The SAP will describe the facilities (e.g., meteorological towers or buoys) a lessee plans to install or deploy for the assessment of the wind resources and ocean conditions of its commercial lease area.

Following approval of an SAP, the lessee will then have four and a half years to submit a construction and operations plan (COP) to BOEM for approval. Once BOEM receives a COP, it will conduct an environmental review of the proposed project and reasonable alternatives. Public input will be an important part of BOEM’s review process. If BOEM approves the COP, the lessee will then have a term of 33 years to construct and operate the project.

Before today’s lease sale, the highest grossingoffshore wind lease sale was held in December 2016 for the lease area offshore New York that received a winning bid of over $42 million, according to BOEM.

After this auction, BOEM has 15 active wind leases. The bureau added that these lease sales have generated more than $473 million in winning bids for nearly 2 million acres in federal waters.

12/14/2018