Digitalization could open development of ‘sub-commercial’ reserves

Offshore staff

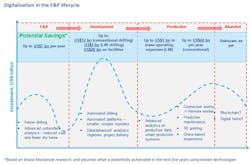

EDINBURGH, UK – A new report from Wood Mackenzie suggests that digitalization could save the upstream sector $75 billion annually by 2023.

Greig Aitken, principal analyst in the consultant’s corporate analysis team, said: “Digitalization offers multiple prizes in exploration. The biggest would be to uncover new resources.

“This may be from better processing of seismic or new understanding of well logs and chemical analysis. Not only would this offer E&P companies the bonanza of finding new resources in existing acreage, but anyone with a competitive advantage in exploration would have a material advantage in licensing or M&A [mergers and acquisitions].”

According to the report,Digitalisation in upstream: show me the money, the industry’s ultimate aim is for machine learning and artificial intelligence (AI) to process data and identify hydrocarbon-bearing reservoirs with a near-perfect success rate.

Secondary benefits include better, faster decisions on where and how to drill, or whether to drill at all.

“By accessing effectively unlimited computing power via the cloud, Cairn Energy, which began its digital transformation in 2015, now has the ability to shave months off its 3D seismic processing,” Aitken said.

“For an exploration-focused company such as Cairn, the improved speed at which it can make drill-or-drop decisions is transformational.”

Since 2014, Wood Mackenzie says upstream operators have spent on average $50 billion/yr on exploration.

Analysis based on 2014-2017 average activity and spend levels suggests that over the next five years, cost savings of $5-7 billion (10-15%) per year could be achieved in exploration, with similar results attainable indrilling and completion.

However, digitalization’s biggest benefits appear to be infield development.

Mhairidh Evans, principal analyst, upstream supply chain, said: “The primary financial impact will be to substantially reduce capital costs. Equinor believes its ‘field of the future’ concept will reduce offshore facility capex by around 30%.

“Such a dramatic reduction could have a top-line impact, enabling the monetization of currently sub-commercial reserves. Equinor sees most of the headline-grabbing cost cuts being enabled by automated platforms, such asOseberg H, the first unmanned platform in the Norwegian sector.”

Evans added: “Worker-free environments mean smaller topsides with no accommodation modules and no supply vessels. Of course, this can only be achieved if every process can be automated or managed remotely – a point that underscores the potentially transformational impact of the digital twin.”

A digital twin – a virtual copy of a physical asset – is designed to replicate the dynamics of each valve, pipe and cable, and the structural integrity of the facilities, allowing simulation of outcomes on an unprecedented scale.

Benefits are said to be across the E&P lifecycle, from planning and development to production and decommissioning.

“Even without automated platforms, digitalization will lead to cost savings in the pre-FEED [pre-front-end engineering design] and FEED stages of traditional developments,” Evans said.

“Automated modeling can generate economic outcomes for a field under a range of development concepts and a continuum of variables. This isn't new. But big data analytics infuses these models with real-world experience, allowing data-driven decisions to be made faster, with more confidence.”

Wood Mackenzie’s research found that over the past decade, the average upstream project was delivered six months late, with costs up 14% from the forecast at final investment decision.

However, applying digitalization through the development phase should improve project delivery.

Existing fields too should benefit from digitalization, with potentially a 5% reduction in annual field opex and a 1% increase in annual field production.

According to the consultant, Total is aiming for an opex reduction of almost 10% at its Culzean field development in the UK central North Sea through application of a digital package.

Increased uptime is another potentially major benefit. A 1% increase from each conventional producing asset onstream globally in 2018 would deliver an additional 1.3 MMb/d to the market, the report suggests.

According to Aitken: “BP claims to have added 30,000 bbl of production last year due to its use of the APEX system and cites an example in the Gulf of Mexico of system optimization being reduced from 24-30 hours to just 20 minutes.”

11/12/2018