Analyst assesses frontier, emerging plays in the deepwater Gulf of Mexico

Offshore staff

LONDON– A new Westwood report reviews exploration potential across both the US and Mexican sides of the deepwater Gulf of Mexico.

The industry and government are hoping for numerous oil discoveries in Mexican waters of the southern Gulf of Mexico but could be frustrated by the complex and variable geology which is quite different from the prolific US waters to the north, according to Vikesh Mistry, analyst, Global Exploration Research.

In the last 10 years, exploration activity in the deepwater (>500 m/1,640 ft) Gulf of Mexico (GoM) has been focused in the region’s northern waters. Big discoveries have been plentiful but the geology in new plays has been challenging with lower commercial success rates and developments taking more than 10 years to first oil.

In the US northern GoM, high impact drilling remains focused on the Paleogene (Wilcox) and Jurassic (Norphlet) plays.

Since 2008, the deepwater GoM delivered an average of two high impact discoveries per year in frontier and emerging plays, accounting for more than 75% of the discovered volume.

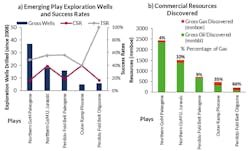

The focus has been on the Paleogene Wilcox plays of the northern GoM and Perdido Fold Belt, which both emerged during the early 2000s, with 3.2 Bboe of commercial discovered since 2008. Two new plays were also opened in the last decade; the Upper Jurassic Norphlet play and the Pliocene ‘Outer Ramp’ subsalt turbidite play of the northern GoM.

The emerging plays in the US northern GoM can still deliver commercial discoveries despite development technology challenges.

According to the report, challenging reservoirs and extreme high-pressure/high-temperature (HP/HT) conditions have limited commercial success rates to only 16% in the northern GoM Paleogene Wilcox play. On average, more than 10 years has been needed to bring Paleogene Wilcox discoveries on production and all but one of the discoveries made since 2008 are currently stranded.

The Paleogene play needs discoveries with in-place volumes of more than 2 Bboe to be commercial with current technology. The limited number of remaining prospects of this size casts a shadow over the play.

High temperatures have also challenged development of the Upper Jurassic Norphlet play. The new high-temperature technologies developed to produce theAppomattox field, discovered in 2010, will soon be tested, with first oil expected in 2020.

The two-high impact Norphlet discoveries (Dover and Ballymore) made in early 2018 and the high impact Whale discovery in the Paleogene Perdido Fold Belt made in 2017 are a reminder, however, that emerging plays in the northern GoM can still deliver.

The deepwater southern GoM remains largely frontier. Exploration drilling in Mexico had been exclusively operated by Pemex until acreage was opened to international oil companies in 2013. In deepwater license rounds held in 2017 and 2018, 27 blocks were awarded to 17 different companies who committed to drill 31 wells.

Each Mexican block is equivalent in size to approximately 100 US GoM blocks (Figure 2). The Miocene turbidite play of the Campeche Salt basin was the most sought after, and the potential scale of this fairway should make it the focus of future exploration drilling campaigns.

The southern GoM is not a direct analogue to its conjugate in the north. Tectonic processes related to Pacific plate motions contribute to making this part of the GoM structurally more complex. Reservoir systems are more confined and are fed by less extensive river systems that bring sediments from highly variable provenance areas into the GoM.

Despite the lack of exploration to date there are large numbers of potential traps and plays to explore. The challenge for explorers is finding commercial sized accumulations with a bonanza of new high impact discoveries in the south, far from guaranteed.

08/29/2018